Asian stocks dropped for the seventh week in eight, sending the region’s benchmark index to the lowest level since 2004, on signs profits are declining as the credit crisis worsens.

Sony Corp, maker of the PlayStation game consoles, slumped 19 percent to the lowest in 13 years after slashing its profit forecast on weaker demand for electronics and the surging yen. Samsung Electronics Co led South Korea’s KOSPI Index to its biggest weekly drop in at least two decades after its profit tumbled and as the government stepped up measures to shore up the nation’s financial system. Newcrest Mining Ltd, Australia’s largest gold producer, led a drop by commodities producers as oil, gold and copper all recorded new lows for the year.

The MSCI Asia-Pacific Index lost 7.9 percent to 80.40 this week, bringing the index to its lowest close since May 2004. Measures of commodity and electronics companies posted the steepest declines among the index’s 10 industry groups as only utilities recorded gains.

The MSCI gauge has lost 49 percent this year and is on track for its worst annual performance since it was created in 1987. About half the value of global equities has been erased in the last year, with almost US$30 trillion in value lost.

TAIPEI

Taiwanese share prices are expected to encounter additional volatility over the next week as foreign institutional investors remain at the sell side amid the global financial woes, dealers said.

Many investors remain cautious ahead of a US Federal Reserve policy meeting on Tuesday and Wednesday, waiting for possible rate cuts and comments on the world economy, they said.

The market is expected to move lower to test the 4,200-point support level next week, while a likely technical rebound may lift the index to around 4,600 points, dealers said.

For the week to Friday, the TAIEX closed down 380.78 points, or 7.68 percent, at 4,579.62 after a 3.32 percent fall a week earlier.

Average daily turnover stood at NT$41.38 billion (US$1.25 billion), compared with NT$49.94 billion a week ago. The weighted index fell 150.89 points, or 3.19 percent, from Thursday.

TOKYO

Japan’s Nikkei stock index plunged 9.6 percent.

The Nikkei-225 index lost 811.9 points to end at 7,649.08, near a 20-year low of 7,607.88 struck on April 28, 2003. The broader TOPIX index of all-first section shares fell 65.59 points, or 7.52 percent, to 806.11.

HONG KONG

Hong Kong share prices closed 8.3 percent down.

The Hang Seng Index plunged 1,142.11 points to 12,618.38, its lowest close since it ended at 12,431 points on Aug. 24, 2004.

SYDNEY

Australian share prices fell 2.6 percent. Some A$30 billion (19.9 billion US) was wiped off the market’s value as property, miners and financial institutions tumbled to end the week lower.

The benchmark S&P/ASX200 index fell 105.0 points to close at 3,869.4 while the broader All Ordinaries slipped 107.7 points, or 2.7 percent, to 3,831.6, its weakest close since Nov. 2, 2004.

SHANGHAI

Chinese share prices closed down 1.92 percent. The benchmark Shanghai Composite Index, which covers A and B shares, was down 35.94 points at 1,839.62. The Shanghai A-share index fell 1.91 percent to 1,932.37, while the Shenzhen A-share index lost 8.99 points, or 1.66 percent, to 531.72.

SEOUL

South Korean shares closed 10.6 percent lower.

The KOSPI index ended down 110.96 points at 938.75, the lowest figure since May 2005.

SINGAPORE

Shares plunged 8.33 percent.

The main Straits Times Index fell 145.39 points to 1,600.28.

It was the index’s lowest closing level since September 2003.

KUALA LUMPUR

Malaysian stocks slumped 3.6 percent. The Kuala Lumpur Composite Index shed 32.21 points to 859.11.

JAKARTA

Indonesian shares closed 6.9 percent lower. The Indonesian Stock Exchange’s main index dropped 92.34 points to a 28-month low of 1,244.86 points in thin volume.

BANGKOK

Thai share prices closed 6.96 percent lower.

The Stock Exchange of Thailand composite index lost 32.37 points to close at 432.87 points.

MANILA

Philippine share prices closed 2.1 percent down at a three-year low.

The composite index gave up 42.43 points to 1,953.49, its lowest level since Oct. 27, 2005.

WELLINGTON

New Zealand share prices closed 1.03 percent lower. The NZX-50 index fell 28.79 points to close at 2,778.55.

MUMBAI

Indian shares fell almost 11 percent. The benchmark 30-share SENSEX tumbled by 1,070.63 points or 10.96 percent to close at 8,701.07, its lowest level since Nov. 23, 2005.

ACCOUNTABILITY: The incident, which occured at a Shin Kong Mitsukoshi Department Store in Taichung, was allegedly caused by a gas explosion on the 12th floor Shin Kong Group (新光集團) president Richard Wu (吳昕陽) yesterday said the company would take responsibility for an apparent gas explosion that resulted in four deaths and 26 injuries at Shin Kong Mitsukoshi Zhonggang Store in Taichung yesterday. The Taichung Fire Bureau at 11:33am yesterday received a report saying that people were injured after an explosion at the department store on Section 3 of Taiwan Boulevard in Taichung’s Situn District (西屯). It sent 56 ambulances and 136 paramedics to the site, with the people injured sent to Cheng Ching Hospital’s Chung Kang Branch, Wuri Lin Shin Hospital, Taichung Veterans General Hospital or Chung

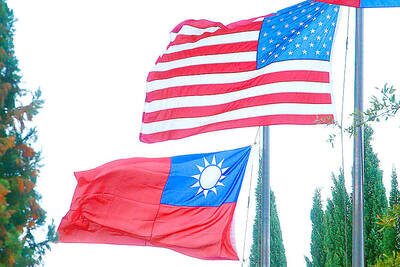

‘TAIWAN-FRIENDLY’: The last time the Web site fact sheet removed the lines on the US not supporting Taiwanese independence was during the Biden administration in 2022 The US Department of State has removed a statement on its Web site that it does not support Taiwanese independence, among changes that the Taiwanese government praised yesterday as supporting Taiwan. The Taiwan-US relations fact sheet, produced by the department’s Bureau of East Asian and Pacific Affairs, previously stated that the US opposes “any unilateral changes to the status quo from either side; we do not support Taiwan independence; and we expect cross-strait differences to be resolved by peaceful means.” In the updated version published on Thursday, the line stating that the US does not support Taiwanese independence had been removed. The updated

‘CORRECT IDENTIFICATION’: Beginning in May, Taiwanese married to Japanese can register their home country as Taiwan in their spouse’s family record, ‘Nikkei Asia’ said The government yesterday thanked Japan for revising rules that would allow Taiwanese nationals married to Japanese citizens to list their home country as “Taiwan” in the official family record database. At present, Taiwanese have to select “China.” Minister of Foreign Affairs Lin Chia-lung (林佳龍) said the new rule, set to be implemented in May, would now “correctly” identify Taiwanese in Japan and help protect their rights, the Ministry of Foreign Affairs said in a statement. The statement was released after Nikkei Asia reported the new policy earlier yesterday. The name and nationality of a non-Japanese person marrying a Japanese national is added to the

There is no need for one country to control the semiconductor industry, which is complex and needs a division of labor, Taiwan’s top technology official said yesterday after US President Donald Trump criticized the nation’s chip dominance. Trump repeated claims on Thursday that Taiwan had taken the industry and he wanted it back in the US, saying he aimed to restore US chip manufacturing. National Science and Technology Council Minister Wu Cheng-wen (吳誠文) did not name Trump in a Facebook post, but referred to President William Lai’s (賴清德) comments on Friday that Taiwan would be a reliable partner in the