US automakers Chrysler LLC and General Motors Corp are pushing for a quick merger deal ahead of the US presidential election as sales continue to plummet and they cannot gain access to credit, a Detroit newspaper reported on Saturday.

According to the Detroit News, senior executives at GM and Cerberu are keen to wrap up talks before both automakers are weakened further by a sluggish US economy.

A Chrysler spokeswoman said the company would not comment on the newspaper report. GM officials did not respond to a request for comment.

Both parties are racing to conclude a deal before the Nov. 4 election.

There has been speculation within the industry and among analysts that if Detroit’s automakers face failure, they may seek a bailout from the US government along the lines of the recent US$700 billion package for the financial sector.

It is unclear whether the government would support such a rescue package, but both presidential candidates — Democratic Senator Barack Obama and Republican Senator John McCain — may be more likely to promise help for the industry before Americans head to the polls.

The US auto industry accounts for thousands of jobs in Michigan and Ohio, and the latter remains a key battleground state in the upcoming election.

The newspaper report said under one possible scenario, GM would absorb Chrysler to get hold of its cash stockpile — US$11.7 billion on June 30 — then shut down some of its brands and car dealerships in order to cut costs dramatically

A person familiar with the negotiations said on Friday that the talks have advanced to the point where top executives of both companies have looked at a deal and asked for refinements. The person spoke on condition of anonymity because the talks are secret.

In August, Chrysler said it had accumulated US$11.7 billion in cash and marketable securities as of June 30. That figure remains around US$11 billion, the person said, despite Chrysler’s US sales being down 25 percent through last month, the largest decline of any major automaker.

Detroit-based GM is burning up more than US$1 billion per month, with several analysts predicting it will reach its minimum operating cash level of US$14 billion sometime next year. GM’s sales are down 18 percent, and the company has lost US$57.5 billion in the past 18 months, although much of that comes from noncash tax accounting changes.

Chrysler’s money pile would help solve GM’s cash problem if credit remains unavailable.

Both automakers have had to deny bankruptcy rumors in recent weeks, saying people won’t buy cars from a company that looks like it could go out of business.

According to the person familiar with the negotiations, the deal being discussed thus far calls for Cerberus to hand over Chrysler in exchange for GM’s 49 percent stake in GMAC Financial Services. GM sold a 51 percent stake in its finance arm to Cerberus in 2006.

Cerberus also would get an equity stake in GM, hoping to get a good return should GM recover when US auto sales bounce back from a serious slump.

Other automakers, including the allied companies of Renault SA and Nissan Motor Co, also are in discussions about Chrysler, the person said. Simultaneously, Cerberus, which bought 80.1 percent of Chrysler from Daimler AG in a US$7.4 billion deal last year, is negotiating to acquire Daimler’s 19.9 percent stake.

GM and Cerberus are still a long way from a deal, according to the person, and GM’s board reportedly is cool to the idea.

All that GM, Chrysler and Cerberus have said about the negotiations is that automakers meet all the time. Chrysler chief executive Bob Nardelli said on Thursday the auto sales drop has created an environment that favors consolidation.

It’s the uncertainty of consolidation that worries many in Michigan, which has lost more than 400,000 jobs since 2000. Its unemployment rate last month was 8.7 percent, the highest in the nation, as GM, Chrysler and Ford Motor Co continued to make cuts.

“Mergers usually represent job loss,” Michigan Governor Jennifer Granholm said Friday on the Public Broadcasting Service’s Nightly Business Report. “We are fearful that a merger would mean more job loss, and that is the last thing we need.”

Among the fearful are Chrysler workers and its roughly 3,600 dealers, who already are under pressure from the company to merge with other dealers and scale back their ranks.

“If you end up going from the Detroit Three to the Detroit Two, you don’t need as many dealers representing those nameplates,” said Dale Early, owner of a Chrysler-Jeep dealership in the Houston suburb of Kingwood, Texas.

The upside of an acquisition, industry analysts say, is that it would almost certainly shrink the US auto industry to where it needs to be so the survivors can thrive. Many analysts are predicting that the US auto market will shrink to sales of about 13 million vehicles this year. That’s a drop of about 3 million from last year, and the decline is more than Toyota Motor Corp’s US sales last year.

GM would almost immediately make cuts to eliminate duplication, save costs and hoard cash, and that means something like the doomsday scenario would occur, said Jeremy Anwyl, CEO of the Edmunds.com automotive Web site.

AIR SUPPORT: The Ministry of National Defense thanked the US for the delivery, adding that it was an indicator of the White House’s commitment to the Taiwan Relations Act Deputy Minister of National Defense Po Horng-huei (柏鴻輝) and Representative to the US Alexander Yui on Friday attended a delivery ceremony for the first of Taiwan’s long-awaited 66 F-16C/D Block 70 jets at a Lockheed Martin Corp factory in Greenville, South Carolina. “We are so proud to be the global home of the F-16 and to support Taiwan’s air defense capabilities,” US Representative William Timmons wrote on X, alongside a photograph of Taiwanese and US officials at the event. The F-16C/D Block 70 jets Taiwan ordered have the same capabilities as aircraft that had been upgraded to F-16Vs. The batch of Lockheed Martin

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

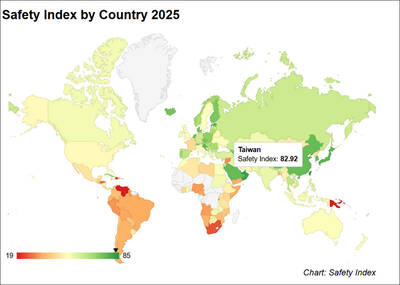

Taiwan was ranked the fourth-safest country in the world with a score of 82.9, trailing only Andorra, the United Arab Emirates and Qatar in Numbeo’s Safety Index by Country report. Taiwan’s score improved by 0.1 points compared with last year’s mid-year report, which had Taiwan fourth with a score of 82.8. However, both scores were lower than in last year’s first review, when Taiwan scored 83.3, and are a long way from when Taiwan was named the second-safest country in the world in 2021, scoring 84.8. Taiwan ranked higher than Singapore in ninth with a score of 77.4 and Japan in 10th with

China's military today said it began joint army, navy and rocket force exercises around Taiwan to "serve as a stern warning and powerful deterrent against Taiwanese independence," calling President William Lai (賴清德) a "parasite." The exercises come after Lai called Beijing a "foreign hostile force" last month. More than 10 Chinese military ships approached close to Taiwan's 24 nautical mile (44.4km) contiguous zone this morning and Taiwan sent its own warships to respond, two senior Taiwanese officials said. Taiwan has not yet detected any live fire by the Chinese military so far, one of the officials said. The drills took place after US Secretary