A strong rally that lifted Wall Street from last week’s multiyear lows has investors pondering whether the worst is now over for the stock market battered by its worst bear market in decades.

Some analysts say the savage selloffs over the past weeks have effectively established a “bottom” for the stock indexes, although others say a rebound will be hard to maintain with confidence weak and recession likely.

The Dow Jones Industrial Average rose 4.74 percent in the week to Friday to end at 8,852.22, coming back from its worst week in history that produced a dizzying 18 percent drop.

The broad-market Standard & Poor’s 500 index gained 4.60 percent to 940.55 after its 18.2 percent slide in the prior week.

The technology-heavy NASDAQ composite posted a 3.74 percent weekly gain to 1,711.29.

Bob Dickey, analyst at RBC Dain Rauscher, said the roller-coaster action in recent sessions has in fact established a floor for the market.

The market’s bounce off its lows “was the most convincing bottoming pattern we have seen during the past six months and has increased our bullish opinion,” Dickey said in a note to clients.

John Hussman of Hussman Funds said those who follow market history see the latest woes as the kind of panic that has occurred before.

“The only thing we have to fear is the fearmongering of Wall Street itself,” he said in a research note.

“Investors will berate themselves for the panic they are now exhibiting. This, from an adviser that has adamantly argued for over a decade [with the exception of 2002 to 2003] that the stock market was strenuously overpriced,” he said.

But others say the stock market has not fully priced in the possibility of a prolonged US economic downturn or global recession, and that the odds for this have risen with data showing exceptionally weak consumer spending and manufacturing activity.

Joachim Fels at Morgan Stanley said the freezing of credit around the world has choked off economic growth and that it will take time to recover even with massive amounts of stimulus from government bailouts.

“While decisive fiscal, monetary and regulatory action is likely to prevent a 1930-style depression, we think that a recession in the industrialized world is still in the cards,” Fels said.

“Most of the damage pushing economies over the brink had already been done before the financial turmoil intensified in recent months, namely by declining house prices, the past tightening in credit conditions and the run-up in oil prices and inflation until the summer,” he said.

Kevin Giddis, analyst at Morgan Keegan, said some of the efforts by governments including the US$700 billion US rescue plan appear to be paying off, and that a recovery could be coming.

“There are a number of good happenings in the market,” Giddis said. He noted that Libor rates for interbank loans, one of the key markets frozen in the credit crisis, are falling, and that commercial paper for corporate funding appears to be coming back.

This means investors are gaining a bit of confidence and moving out of extremely safe assets like US Treasury bills, a positive sign for the market.

“More importantly, as the funds see trades and cash head their way, they in turn will begin to come off their money and invest in short-term instruments with confidence,” he said. “At that point, the circle of credit life will be complete and traders will return their focus back to the fundamentals.”

David Kastner, analyst at Charles Schwab & Co, said stocks appear cheap after the brutal selloffs, even taking into account a sharp slowdown in the economy and profits.

“The market appears to have priced in a fairly deep recession,” Kastner said.

Warren Buffett meanwhile said he is moving out of bonds and into stocks now even though there could be some more turbulence.

Buffett said he was following his advice to “be fearful when others are greedy and be greedy when others are fearful.”

“If you wait for the robins, spring will be over,” he wrote in the New York Times.

Bonds fell as investors turned to stocks. The yield on the 10-year Treasury bond increased to 3.938 percent from 3.861 percent a week earlier, and that on the 30-year bond climbed to 4.312 percent against 4.137 percent.

AIR SUPPORT: The Ministry of National Defense thanked the US for the delivery, adding that it was an indicator of the White House’s commitment to the Taiwan Relations Act Deputy Minister of National Defense Po Horng-huei (柏鴻輝) and Representative to the US Alexander Yui on Friday attended a delivery ceremony for the first of Taiwan’s long-awaited 66 F-16C/D Block 70 jets at a Lockheed Martin Corp factory in Greenville, South Carolina. “We are so proud to be the global home of the F-16 and to support Taiwan’s air defense capabilities,” US Representative William Timmons wrote on X, alongside a photograph of Taiwanese and US officials at the event. The F-16C/D Block 70 jets Taiwan ordered have the same capabilities as aircraft that had been upgraded to F-16Vs. The batch of Lockheed Martin

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

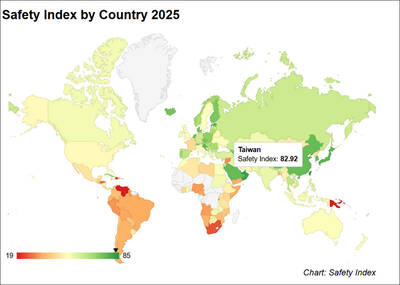

Taiwan was ranked the fourth-safest country in the world with a score of 82.9, trailing only Andorra, the United Arab Emirates and Qatar in Numbeo’s Safety Index by Country report. Taiwan’s score improved by 0.1 points compared with last year’s mid-year report, which had Taiwan fourth with a score of 82.8. However, both scores were lower than in last year’s first review, when Taiwan scored 83.3, and are a long way from when Taiwan was named the second-safest country in the world in 2021, scoring 84.8. Taiwan ranked higher than Singapore in ninth with a score of 77.4 and Japan in 10th with

SECURITY RISK: If there is a conflict between China and Taiwan, ‘there would likely be significant consequences to global economic and security interests,’ it said China remains the top military and cyber threat to the US and continues to make progress on capabilities to seize Taiwan, a report by US intelligence agencies said on Tuesday. The report provides an overview of the “collective insights” of top US intelligence agencies about the security threats to the US posed by foreign nations and criminal organizations. In its Annual Threat Assessment, the agencies divided threats facing the US into two broad categories, “nonstate transnational criminals and terrorists” and “major state actors,” with China, Russia, Iran and North Korea named. Of those countries, “China presents the most comprehensive and robust military threat