The US government’s plan to inject cash into financial institutions, coupled with similar actions by countries around the world, may jump-start the stalled global financial system, Blackstone Group LP chief executive officer Stephen Schwarzman said.

“We’re looking today at an absolute sea change in the global financial system in terms of liquidity,” Schwarzman said yesterday at the Super Return Middle East conference in Dubai. “This could be the time that breaks the back of the credit crisis.”

The US plans to invest about US$125 billion in nine of the country’s biggest banks, including Citigroup Inc and Goldman Sachs Group Inc, in exchange for preferred shares, people briefed on the plan said. The measure follows similar moves by European leaders to unfreeze credit markets and shore up confidence in the financial system.

“There is no reason in the face of this why anyone would have any concerns or fear about putting money into the US financial system,” Schwarzman said. “Before this remarkable initiative, the cost of money for financial institutions was way higher than they could afford to lend it out. The system ground to a close.”

The cost of borrowing in dollars for three months fell from the highest level this year. The London interbank offered rate that banks charge each other for such loans dropped by 7 basis points to 4.75 percent on Monday, the largest drop since March 17.

Restoring liquidity may accelerate the return of private-equity deals that have foundered amid a lack of financing from Wall Street banks struggling to survive.

Announced transactions by leveraged buyout firms have dropped by more than 70 percent so far this year from the same period last year, according to data compiled by Bloomberg.

“What the governments have done will put us back into that world much quicker than we imagined,” said Schwarzman, who founded Blackstone in 1985 with Peter Peterson, his former partner at Lehman Brothers Holdings Inc.

Based in New York, the firm is the world’s biggest leveraged buyout firm.

Schwarzman echoed comments earlier in the day from Thomas H. Lee Partners LP co-president Scott Schoen, who said private equity firms’ returns to their investors would suffer from the high prices and debt loads placed on companies during the two-year buyout boom that ended last year.

Returns from buying investments, fixing them up and selling them again may decline to about 8 percent this year from their historic level of more than 20 percent, Schoen said in a separate speech in Dubai yesterday.

“It’s extremely difficult to achieve returns as in the past when you’re selling into a lower-priced environment,” Schoen said. “We’ve seen what happens when credit dries up and confidence goes away.”

AIR SUPPORT: The Ministry of National Defense thanked the US for the delivery, adding that it was an indicator of the White House’s commitment to the Taiwan Relations Act Deputy Minister of National Defense Po Horng-huei (柏鴻輝) and Representative to the US Alexander Yui on Friday attended a delivery ceremony for the first of Taiwan’s long-awaited 66 F-16C/D Block 70 jets at a Lockheed Martin Corp factory in Greenville, South Carolina. “We are so proud to be the global home of the F-16 and to support Taiwan’s air defense capabilities,” US Representative William Timmons wrote on X, alongside a photograph of Taiwanese and US officials at the event. The F-16C/D Block 70 jets Taiwan ordered have the same capabilities as aircraft that had been upgraded to F-16Vs. The batch of Lockheed Martin

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

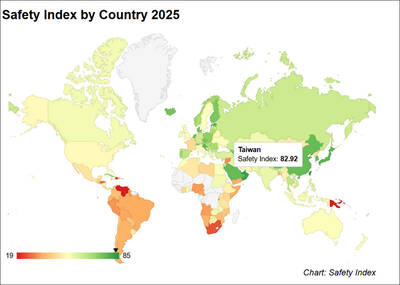

Taiwan was ranked the fourth-safest country in the world with a score of 82.9, trailing only Andorra, the United Arab Emirates and Qatar in Numbeo’s Safety Index by Country report. Taiwan’s score improved by 0.1 points compared with last year’s mid-year report, which had Taiwan fourth with a score of 82.8. However, both scores were lower than in last year’s first review, when Taiwan scored 83.3, and are a long way from when Taiwan was named the second-safest country in the world in 2021, scoring 84.8. Taiwan ranked higher than Singapore in ninth with a score of 77.4 and Japan in 10th with

China's military today said it began joint army, navy and rocket force exercises around Taiwan to "serve as a stern warning and powerful deterrent against Taiwanese independence," calling President William Lai (賴清德) a "parasite." The exercises come after Lai called Beijing a "foreign hostile force" last month. More than 10 Chinese military ships approached close to Taiwan's 24 nautical mile (44.4km) contiguous zone this morning and Taiwan sent its own warships to respond, two senior Taiwanese officials said. Taiwan has not yet detected any live fire by the Chinese military so far, one of the officials said. The drills took place after US Secretary