Iceland’s banks faced a battle for survival yesterday, after the country’s government introduced emergency legislation to give the government sweeping new powers over its collapsing financial sector.

The government’s attempt to wrest control of the increasingly dire situation and restore some confidence in the country’s hard-hit banking sector followed a day of panic on Monday that saw trading in shares of major banks suspended and the Icelandic krona fall a quarter against the euro.

Icelandic Prime Minister Geir Haarde warned late on Monday that the heavy exposure of the tiny country’s banking sector to the global financial turmoil was raising the specter of “national bankruptcy.”

Iceland is paying the price for an economic boom of recent years that saw its newly affluent companies go on an acquisition spree across Europe and its banking sector grow to dwarf the rest of the economy.

Bank assets are nine times annual GDP of 14 billion euros (US$19 billion).

Investors are now punishing the whole country for the banking sector’s heavy exposure to the global credit squeeze — its currency has gone through the floor, imports have fallen and inflation is soaring.

A major fear is that the government will struggle to rescue any other failing banks after last week coming to the rescue of the country’s third-largest bank, Glitnir.

“In the perilous situation which exists now on the world’s financial markets, providing the banks with a secure life line poses a great risk for the Icelandic nation,” Haarde said in a televised address to the nation. “There is a very real danger, fellow citizens, that the Icelandic economy, in the worst case, could be sucked with the banks into the whirlpool and the result could be national bankruptcy.”

The new laws will give the Central Bank of Iceland and the Icelandic Financial Supervisory Authority detailed and vast authority to intervene in the control and operation of Icelandic financial institutions, including the ability to take over or create new institutions, call shareholder meetings and limit the authority of boards.

Haarde told reporters that the government would not be closing banks, but foreshadowed the government taking control of more banks.

“We will not be closing banks but it is conceivable that some of them will not be able to function without our authorities intervening,” he told reporters, declining to name any potential candidates.

Earlier on Monday, the Icelandic Financial Supervisory Authority suspended trading in financial instruments issued by Kaupthing, Landsbanki, Glitnir, Straumur-Burdaras, Exista and Spron, saying that “uncertainties regarding the issuers are likely to disrupt normal price formation, and as such, any trading could be detrimental for investors.”

The government also put 100 percent guarantees on savers’ deposits, following in the footsteps of Ireland, Germany, Austria, Greece and Denmark.

A collapse of the Icelandic financial system could also have ramifications across Europe given the heavy investment by Icelandic banks and companies across the continent.

One of the country’s biggest companies, retailing investment group Baugur, now owns or has stakes in dozens of major European retailers — including enough to make it the largest private company in Britain, where it owns a handful of well-known stores such as the famous toy store Hamley’s.

Kaupthing, Iceland’s largest bank and one of those whose share trading was suspended on Monday, has also invested in European retail groups.

Part of problem is that Iceland’s tiny size has led to a high level of cross-ownership of assets between banks and companies, which creates a house of cards scenario.

In that eventuality, the central bank with its liquid foreign assets of just US$5.5 billion will be hard pressed to make any more bailouts — the big four banks have combined foreign liabilities in excess of US$137 billion.

Those concerns led all the major credit ratings agencies to downgrade Iceland’s sovereign, or government, credit rating last week.

SECURITY: The purpose for giving Hong Kong and Macau residents more lenient paths to permanent residency no longer applies due to China’s policies, a source said The government is considering removing an optional path to citizenship for residents from Hong Kong and Macau, and lengthening the terms for permanent residence eligibility, a source said yesterday. In a bid to prevent the Chinese Communist Party (CCP) from infiltrating Taiwan through immigration from Hong Kong and Macau, the government could amend immigration laws for residents of the territories who currently receive preferential treatment, an official familiar with the matter speaking on condition of anonymity said. The move was part of “national security-related legislative reform,” they added. Under the amendments, arrivals from the Chinese territories would have to reside in Taiwan for

CRITICAL MOVE: TSMC’s plan to invest another US$100 billion in US chipmaking would boost Taiwan’s competitive edge in the global market, the premier said The government would ensure that the most advanced chipmaking technology stays in Taiwan while assisting Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in investing overseas, the Presidential Office said yesterday. The statement follows a joint announcement by the world’s largest contract chipmaker and US President Donald Trump on Monday that TSMC would invest an additional US$100 billion over the next four years to expand its semiconductor manufacturing operations in the US, which would include construction of three new chip fabrication plants, two advanced packaging facilities, and a research and development center. The government knew about the deal in advance and would assist, Presidential

‘DANGEROUS GAME’: Legislative Yuan budget cuts have already become a point of discussion for Democrats and Republicans in Washington, Elbridge Colby said Taiwan’s fall to China “would be a disaster for American interests” and Taipei must raise defense spending to deter Beijing, US President Donald Trump’s pick to lead Pentagon policy, Elbridge Colby, said on Tuesday during his US Senate confirmation hearing. The nominee for US undersecretary of defense for policy told the Armed Services Committee that Washington needs to motivate Taiwan to avoid a conflict with China and that he is “profoundly disturbed” about its perceived reluctance to raise defense spending closer to 10 percent of GDP. Colby, a China hawk who also served in the Pentagon in Trump’s first team,

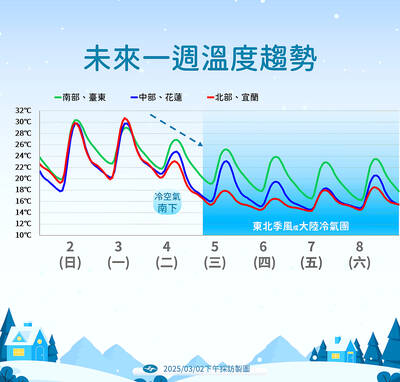

The arrival of a cold front tomorrow could plunge temperatures into the mid-teens, the Central Weather Administration (CWA) said. Temperatures yesterday rose to 28°C to 30°C in northern and eastern Taiwan, and 32°C to 33°C in central and southern Taiwan, CWA data showed. Similar but mostly cloudy weather is expected today, the CWA said. However, the arrival of a cold air mass tomorrow would cause a rapid drop in temperatures to 15°C cooler than the previous day’s highs. The cold front, which is expected to last through the weekend, would bring steady rainfall tomorrow, along with multiple waves of showers