Citigroup announced late on Saturday that it had persuaded a New York judge to temporarily block Wells Fargo from acquiring Wachovia, firing the first shot in what could be a prolonged legal battle.

Citigroup has accused Wells Fargo of wrecking its plan to acquire Wachovia’s banking operations for US$2.2 billion, or US$1 a share, in a deal arranged by the Federal Deposit Insurance Corp. Four days after that deal was struck, it fell apart when Wachovia agreed to Wells Fargo’s offer to pay seven times as much for the entire company.

The underlying battle is over which company will emerge from the economic crisis in a stronger position among a smaller number of financial giants. Citigroup contends that the deal with Wells Fargo violates an agreement that prohibited Wachovia from having any sale or merger discussions with anyone other than Citigroup until today.

PHOTO: BLOOMBERG

The order issued by a judge on Saturday extends the term of that agreement until further court action, Citigroup said. A person briefed on the situation said that Citigroup was seeking US$60 billion in damages from Wells Fargo for interfering with the initial transaction.

Efforts to reach a Wells Fargo representative late on Saturday night were unsuccessful. Christy Phillips-Brown, a Wachovia spokeswoman, said the bank “believes its agreement with Wells is proper, valid, and is in the best interest of shareholders, employees and American taxpayers.”

“Under that agreement, Citigroup is always free to make a superior offer to Wachovia,” Phillips-Brown said.

The litigation could be a blockbuster, pitting some of the nation’s largest surviving financial institutions against one another and giving work to the most expensive legal talent money can buy. Citigroup is represented by the New York lawyer Gregory Joseph; Wachovia by David Boies of Boies, Schiller & Flexner; and Wells Fargo by Paul Rowe of Wachtell, Lipton, Rosen & Katz, people briefed on the matter say.

Until late on Thursday, Citigroup believed it had reached a deal with Wachovia after protracted talks last weekend under intense pressure from federal regulators worried about Wachovia’s financial condition. Regulators agreed to help Citigroup by absorbing losses over US$42 billion.

Wells Fargo, which had walked away from talks with Wachovia, returned late on Thursday with its surprise bid, in which Wells Fargo offered to buy all of Wachovia, not just its banking operations, for about US$15 billion in stock, far more than Citigroup had offered. And Wells Fargo’s deal, which takes advantage of a lucrative tax loophole tied to deferred losses, would be structured without any direct government support.

Federal regulators did not block Wells Fargo’s proposal, and by early Friday morning, its merger with Wachovia was approved by the boards of both companies.

The move left Citigroup officials fuming. On Friday, they put out word to regulators and the public that Wachovia had breached an exclusivity agreement and that Wells Fargo had interfered with their deal. That night and on Saturday morning, Citigroup officials huddled in a makeshift war room at the law offices of Davis Polk & Wardwell in midtown Manhattan.

Federal regulators have been discussing the offers, with senior officials from the Federal Reserve encouraging the parties to reach a swift resolution, a person briefed on the matter said.

Citigroup raised the stakes in the merger battle on Saturday afternoon, asking Justice Charles Ramos of the trial-level state Supreme Court to issue an emergency order blocking the deal between Wachovia and Wells Fargo. Representatives from the banks met at Ramos’ home in Cornwall, Connecticut, late on Saturday afternoon for more than three hours of oral arguments, according to people briefed on the situation.

In the unusual weekend session, Citigroup presented Ramos with a 16-page complaint naming both Wells Fargo and Wachovia, and their boards, as defendants. But it has not yet filed the suit formally because the courts were closed.

Late on Saturday, after several hours of intense legal jockeying, Ramos issued an injunction effectively blocking the Wells Fargo deal, pending a hearing scheduled for Friday.

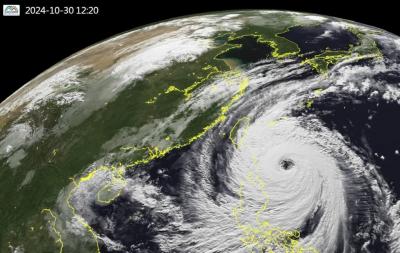

Super Typhoon Kong-rey is the largest cyclone to impact Taiwan in 27 years, the Central Weather Administration (CWA) said today. Kong-rey’s radius of maximum wind (RMW) — the distance between the center of a cyclone and its band of strongest winds — has expanded to 320km, CWA forecaster Chang Chun-yao (張竣堯) said. The last time a typhoon of comparable strength with an RMW larger than 300km made landfall in Taiwan was Typhoon Herb in 1996, he said. Herb made landfall between Keelung and Suao (蘇澳) in Yilan County with an RMW of 350km, Chang said. The weather station in Alishan (阿里山) recorded 1.09m of

NO WORK, CLASS: President William Lai urged people in the eastern, southern and northern parts of the country to be on alert, with Typhoon Kong-rey approaching Typhoon Kong-rey is expected to make landfall on Taiwan’s east coast today, with work and classes canceled nationwide. Packing gusts of nearly 300kph, the storm yesterday intensified into a typhoon and was expected to gain even more strength before hitting Taitung County, the US Navy’s Joint Typhoon Warning Center said. The storm is forecast to cross Taiwan’s south, enter the Taiwan Strait and head toward China, the Central Weather Administration (CWA) said. The CWA labeled the storm a “strong typhoon,” the most powerful on its scale. Up to 1.2m of rainfall was expected in mountainous areas of eastern Taiwan and destructive winds are likely

The Central Weather Administration (CWA) yesterday at 5:30pm issued a sea warning for Typhoon Kong-rey as the storm drew closer to the east coast. As of 8pm yesterday, the storm was 670km southeast of Oluanpi (鵝鑾鼻) and traveling northwest at 12kph to 16kph. It was packing maximum sustained winds of 162kph and gusts of up to 198kph, the CWA said. A land warning might be issued this morning for the storm, which is expected to have the strongest impact on Taiwan from tonight to early Friday morning, the agency said. Orchid Island (Lanyu, 蘭嶼) and Green Island (綠島) canceled classes and work

KONG-REY: A woman was killed in a vehicle hit by a tree, while 205 people were injured as the storm moved across the nation and entered the Taiwan Strait Typhoon Kong-rey slammed into Taiwan yesterday as one of the biggest storms to hit the nation in decades, whipping up 10m waves, triggering floods and claiming at least one life. Kong-rey made landfall in Taitung County’s Chenggong Township (成功) at 1:40pm, the Central Weather Administration (CWA) said. The typhoon — the first in Taiwan’s history to make landfall after mid-October — was moving north-northwest at 21kph when it hit land, CWA data showed. The fast-moving storm was packing maximum sustained winds of 184kph, with gusts of up to 227kph, CWA data showed. It was the same strength as Typhoon Gaemi, which was the most