Financial markets remained on edge on Friday after the Bush administration’s proposal for a US$700 billion banking bailout ran into opposition from Republican lawmakers. Stocks ended mixed, with big financial companies lifting the Dow Jones industrials more than 120 points, but worries about smaller banks and parts of the technology sector taking much of the market lower.

Demand for safe-haven buying in government debt remained high as investors uneasily watched events in Washington, where the Bush administration tried to overcome Republican objections to its rescue package.

Republican lawmakers are concerned about the cost of the proposal, and they balked at the plan after congressional leaders said on Thursday they had reached an agreement in principle. Shortly after Friday’s opening bell on Wall Street, US President George W. Bush said at the White House lawmakers can express doubts but ultimately should “rise to the occasion” and approve a plan to stave off what he sees as an economic calamity.

The Dow rose 121.07, or 1.10 percent, to 11,143.13. Gains by JPMorgan Chase & Co and Bank of America Corp gave support to the 30-stock index. Most of their advance came late in the session as investors placed bets that a deal would emerge from Washington over the weekend.

Broader indicators were mixed. The Standard & Poor’s 500 index rose 3.83, or 0.32 percent, to 1,213.01, and the NASDAQ composite index fell 3.23, or 0.15 percent, to 2,183.34.

Declining issues outnumbered advancers by more than 2 to 1 on the New York Stock Exchange, where volume came to 1.17 billion shares.

The banking rescue is designed to remove billions of dollars of bad mortgages and other now-toxic assets from the books of financial firms in a bid to free up lending. Tight lending conditions make it harder and more expensive for businesses and consumers to borrow money, a headwind for the economy.

In a last-minute shake up, some Republican lawmakers wanted an alternative plan under which the government would provide insurance to companies that agree to hold frozen assets, rather than have the US purchase the assets.

Volume was relatively light on Friday as many investors chose to just wait. That helped skew some of the movements in the major indexes.

“I think the markets are on pause trying to figure out where this is going to go. Congress is still there,” said Mark Coffelt, portfolio manager at Empiric Funds in Austin, Texas. “Right now everyone is a little bit shell-shocked.”

With no deal in place as trading ended Friday, investors were certainly going to be uneasy throughout the weekend. And there was no way to predict whether tomorrow morning would bring calmer markets after weeks of intense volatility, or whether the turbulence would accelerate. Even if a deal is reached over the weekend, its terms will determine how the markets start the week.

Credit markets remained strained on Friday, though they showed improvement. The yield on the three-month Treasury bill, considered the safest short-term investment, rose to 0.84 percent from 0.72 percent late Thursday. The lower the yield on a T-bill, the more desperation there is in the market; investors are at times willing to take the slimmest returns to preserve their principal. The yield on the benchmark 10-year Treasury note, which moves opposite its price, rose to 3.85 percent from 3.84 percent late on Thursday.

For the week, which again saw triple-digit moves in the Dow, the blue chip average lost 2.15 percent and the NASDAQ declined 3.98 percent.

Stocks traded unevenly on Friday, with technology shares falling sharply after Research In Motion Ltd warned late on Thursday that its gross margins would contract in the current quarter because of the costs for producing three new BlackBerry models. The stock fell US$25.45, or 26 percent, to US$72.08.

The market was also uneasy after Washington Mutual Inc became the largest US bank to fail. The Federal Deposit Insurance Corp seized WaMu on Thursday and then sold the thrift’s banking assets to JPMorgan for US$1.9 billion. It was the latest financial firm to collapse under the weight of enormous bad bets on the mortgage market.

Although WaMu’s failure was expected, it nonetheless underscored for investors how widespread the problems are in the financial sector.

Coffelt said the market appeared to take some comfort, however, from the orderly fall of WaMu. Several analysts praised the move as a wise takeover for JPMorgan.

JPMorgan rose US$4.78, or 11 percent, to US$48.24 and was the biggest decliner among the Dow industrials. WaMu fell US$1.53, or 90.3 percent, to US$0.16.

Meanwhile, Bank of America, which last week snapped up Merrill Lynch, rose US$2.33, or 6.8 percent, to US$36.70.

Bank of America and JP Morgan are now the first and second largest banks US banks, respectively, perhaps offering investors some reassurance about the safety provided by their large asset bases in a market short on liquidity.

But worries about some other banks, including regionals, persisted after the failure of WaMu. Wachovia Corp fell US$3.70, or 27 percent, to US$10, while National City Corp fell US$1.28, or 26 percent, to US$3.71.

Concerns about the broader US economy persist. The US Department of Commerce said the spring’s economic rebound was less robust than previously estimated. GDP increased at a 2.8 percent annual rate in the second quarter. That fell short of the 3.3 percent growth estimated a month ago, but was still better than two previous dismal quarters.

SECURITY: As China is ‘reshaping’ Hong Kong’s population, Taiwan must raise the eligibility threshold for applications from Hong Kongers, Chiu Chui-cheng said When Hong Kong and Macau citizens apply for residency in Taiwan, it would be under a new category that includes a “national security observation period,” Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) said yesterday. President William Lai (賴清德) on March 13 announced 17 strategies to counter China’s aggression toward Taiwan, including incorporating national security considerations into the review process for residency applications from Hong Kong and Macau citizens. The situation in Hong Kong is constantly changing, Chiu said to media yesterday on the sidelines of the Taipei Technology Run hosted by the Taipei Neihu Technology Park Development Association. With

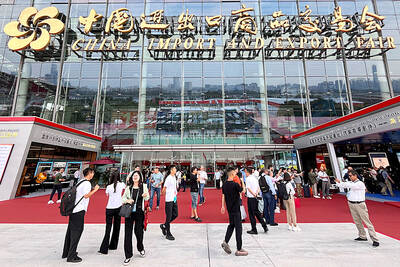

CARROT AND STICK: While unrelenting in its military threats, China attracted nearly 40,000 Taiwanese to over 400 business events last year Nearly 40,000 Taiwanese last year joined industry events in China, such as conferences and trade fairs, supported by the Chinese government, a study showed yesterday, as Beijing ramps up a charm offensive toward Taipei alongside military pressure. China has long taken a carrot-and-stick approach to Taiwan, threatening it with the prospect of military action while reaching out to those it believes are amenable to Beijing’s point of view. Taiwanese security officials are wary of what they see as Beijing’s influence campaigns to sway public opinion after Taipei and Beijing gradually resumed travel links halted by the COVID-19 pandemic, but the scale of

A US Marine Corps regiment equipped with Naval Strike Missiles (NSM) is set to participate in the upcoming Balikatan 25 exercise in the Luzon Strait, marking the system’s first-ever deployment in the Philippines. US and Philippine officials have separately confirmed that the Navy Marine Expeditionary Ship Interdiction System (NMESIS) — the mobile launch platform for the Naval Strike Missile — would take part in the joint exercise. The missiles are being deployed to “a strategic first island chain chokepoint” in the waters between Taiwan proper and the Philippines, US-based Naval News reported. “The Luzon Strait and Bashi Channel represent a critical access

Pope Francis is be laid to rest on Saturday after lying in state for three days in St Peter’s Basilica, where the faithful are expected to flock to pay their respects to history’s first Latin American pontiff. The cardinals met yesterday in the Vatican’s synod hall to chart the next steps before a conclave begins to choose Francis’ successor, as condolences poured in from around the world. According to current norms, the conclave must begin between May 5 and 10. The cardinals set the funeral for Saturday at 10am in St Peter’s Square, to be celebrated by the dean of the College