British bank HSBC Holdings PLC said yesterday it had canceled an agreement to purchase a controlling stake in a South Korean bank from US private equity group Lone Star Funds amid world financial turmoil.

HSBC said in a statement that it “exercised its right to terminate the acquisition agreement with immediate effect.”

The London-based bank cited “all relevant factors including current asset values in world financial markets” for the decision.

It gave Thursday as the date of the cancelation.

The bank agreed last September to purchase Korea Exchange Bank from Dallas, Texas-based Lone Star, which has faced regulatory and legal obstacles in efforts to sell its 51 percent stake in the local lender it purchased in 2003.

South Korea’s financial regulator, which was reviewing the proposed purchase by HSBC, had recently suggested it was likely to be approved. Global financial turmoil this week, however, appears to have played a major role in scuttling the deal.

“In the light of developments around the world, not least changes in asset values in world markets, we do not believe that it would be in the best interests of shareholders to continue to pursue this acquisition on the terms negotiated last year,” said Sandy Flockhart, chief executive officer of HSBC Asia and an executive director of HSBC.

HSBC had contracted to buy Lone Star’s controlling stake in Korea Exchange Bank, the country’s sixth-largest lender, for about US$6 billion.

The Financial Services Commission, the regulator, expressed disappointment.

“It is regrettable that HSBC unilaterally canceled the contract during the review process despite active efforts by the FSC,” the regulator said in a statement.

Lone Star chair John Grayken confirmed HSBC’s decision.

“We are disappointed that HSBC terminated the agreement and that the transaction will not be completed,” he said in a statement.

Lone Star has battled suspicions that it was able to purchase the bank at a bargain price after allegedly colluding with government officials to understate the bank’s financial health.

The fund has denied any wrongdoing and argued its rehabilitation of the once-financially strapped bank has been good for South Korea’s economy.

Lone Star’s efforts to sell Korea Exchange Bank have also run up against public opinion in South Korea seen as hostile to foreign buyout firms.

In June, a South Korean appeals court overturned a guilty verdict against Lone Star in a stock manipulation case, causing speculation that its fortunes were turning.

HSBC signed the deal with Lone Star after a previous effort to sell the stake to Kookmin Bank, South Korea’s largest bank, collapsed.

KEB CEO Richard Wacker lamented the cancelation in a statement, calling it “a lost opportunity for KEB and Korea.”

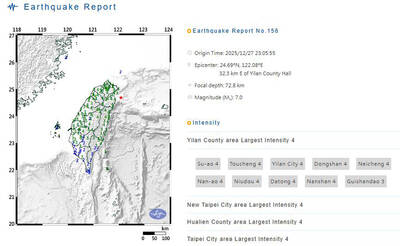

A magnitude 7.0 earthquake struck off Yilan at 11:05pm yesterday, the Central Weather Administration (CWA) said. The epicenter was located at sea, about 32.3km east of Yilan County Hall, at a depth of 72.8km, CWA data showed There were no immediate reports of damage. The intensity of the quake, which gauges the actual effect of a seismic event, measured 4 in Yilan County area on Taiwan’s seven-tier intensity scale, the data showed. It measured 4 in other parts of eastern, northern and central Taiwan as well as Tainan, and 3 in Kaohsiung and Pingtung County, and 2 in Lienchiang and Penghu counties and 1

FOREIGN INTERFERENCE: Beijing would likely intensify public opinion warfare in next year’s local elections to prevent Lai from getting re-elected, the ‘Yomiuri Shimbun’ said Internal documents from a Chinese artificial intelligence (AI) company indicated that China has been using the technology to intervene in foreign elections, including propaganda targeting Taiwan’s local elections next year and presidential elections in 2028, a Japanese newspaper reported yesterday. The Institute of National Security of Vanderbilt University obtained nearly 400 pages of documents from GoLaxy, a company with ties to the Chinese government, and found evidence that it had apparently deployed sophisticated, AI-driven propaganda campaigns in Hong Kong and Taiwan to shape public opinion, the Yomiuri Shimbun reported. GoLaxy provides insights, situation analysis and public opinion-shaping technology by conducting network surveillance

‘POLITICAL GAME’: DPP lawmakers said the motion would not meet the legislative threshold needed, and accused the KMT and the TPP of trivializing the Constitution The Legislative Yuan yesterday approved a motion to initiate impeachment proceedings against President William Lai (賴清德), saying he had undermined Taiwan’s constitutional order and democracy. The motion was approved 61-50 by lawmakers from the main opposition Chinese Nationalist Party (KMT) and the smaller Taiwan People’s Party (TPP), who together hold a legislative majority. Under the motion, a roll call vote for impeachment would be held on May 19 next year, after various hearings are held and Lai is given the chance to defend himself. The move came after Lai on Monday last week did not promulgate an amendment passed by the legislature that

Taiwan is gearing up to celebrate the New Year at events across the country, headlined by the annual countdown and Taipei 101 fireworks display at midnight. Many of the events are to be livesteamed online. See below for lineups and links: Taipei Taipei’s New Year’s Party 2026 is to begin at 7pm and run until 1am, with the theme “Sailing to the Future.” South Korean girl group KARA is headlining the concert at Taipei City Hall Plaza, with additional performances by Amber An (安心亞), Nick Chou (周湯豪), hip-hop trio Nine One One (玖壹壹), Bii (畢書盡), girl group Genblue (幻藍小熊) and more. The festivities are to