Asian stocks fell, driving the region’s benchmark index to its largest weekly drop in 13 months, on concern that slowing global economic growth will dent demand for raw materials and other goods.

BHP Billiton Ltd and CNOOC Ltd (中國海洋石油) plunged more than 10 percent this week after metal and crude oil prices tumbled. LG Electronics Inc, the world’s No. 3 television maker, dropped 7.4 percent after a slump in South Korea’s overseas shipments sparked fears of an economic slowdown.

Taiwan’s Hon Hai Precision Industry Co (鴻海精密) lost 11 percent, leading technology companies lower, following its first earnings decrease in seven years and as US consumer spending waned and jobless claims increased.

The MSCI Asia-Pacific Index dropped 6.7 percent to 116.85, the biggest slump since the five days ended Aug. 17 last year. All 10 industry groups retreated, with measures tracking energy and mining companies posting the biggest losses.

The regional gauge has dropped 26 percent this year to the lowest since June 13, 2006, as soaring fuel prices damped consumer spending and eroded corporate profits, while writedowns and credit losses at the world’s largest financial companies topped US$500 billion.

“There’s no place to hide within Asia right now,” said Beat Lenherr, who oversees more than US$20 billion in assets as Singapore-based chief global strategist at LGT Capital Management. “We’re cautious on the commodities sector given there is an intermediate peak in oil prices, which will put a lid on energy-related stocks.”

■TAIPEI

Taiwanese share prices are expected to stage a technical rebound next week after recent heavy losses, but the upside may be limited amid concerns over a global economic slowdown, dealers said on Friday.

Bargain hunters are likely to trade actively, targeting electronic heavyweights on hopes that the current peak season will boost their profitability, they said.

However, investors were advised to keep their hands off old-economy stocks for now amid pessimism that weak consumption will hurt sales in the domestic market, they added.

Technical factors are expected to lift the market to around 6,500 points next week, but lingering economic growth worries may send the index down to 6,000 points, dealers said.

For the week to Friday, the TAIEX lost 738.83 points or 10.49 percent to 6,307.28 after a 1.95 percent increase a week earlier.

■TOKYO

Japanese shares lost 2.75 percent, dealers said.

The Tokyo Stock Exchange’s benchmark Nikkei-225 index lost 345.43 points to close at 12,212.23, the lowest close since mid-March.

The broader TOPIX index of all first-section shares dropped 30.81 points or 2.56 percent to 1,170.84.

The Nikkei briefly fell more than 3 percent in early trading due to concerns that speculators may place big sell orders in Nikkei futures.

■HONG KONG

Share prices closed down 2.2 percent, dealers said. The benchmark Hang Seng Index closed down 456.2 points at 19,933.28, the first time it dived below the key 20,000 point level since early last year.

■SYDNEY

Australian shares plunged 2.1 percent, dealers said.

The benchmark S&P/ASX 200 closed down 102.4 points at 4,877.1, while the broader All Ordinaries shed 101.4 points to 4,949.5.

■SHANGHAI

Chinese share prices closed down 3.29 percent, dealers said. The benchmark Shanghai Composite Index, which covers both A and B shares, was down 74.97 points to end at a near 21-month low of 2,202.45.

The Shanghai A-share index shed 78.75 points, or 3.29 percent, to close at 2,311.63, while the Shenzhen A-share index fell 24.84 points, or 3.76 percent, to 636.67.

Property developers and banks led the broad-based decline.

The Shanghai B-share Index was down 4.03 points, or 2.67 percent, to 147.11, while the Shenzhen B-share Index fell 11.16 points, or 2.98 percent, to 363.46.

■SEOUL

South Korean shares closed 1.55 percent lower, analysts said.

The KOSPI ended down 22.05 points at 1,404.38 after falling as low as 1,393.33 in early trade.

■SINGAPORE

Shares closed at their lowest level in almost two years, down 1.97 percent, dealers said. The blue-chip Straits Times Index closed down 51.84 points at 2,574.21. The index closed at its lowest level since Oct. 5, 2006.

■KUALA LUMPUR

Malaysian share prices ended 1.3 percent lower, dealers said. The Kuala Lumpur Composite Index lost 14.84 points to close at 1,070.54.

■BANGKOK

Thai share prices closed 1.38 percent lower, dealers said. The Stock Exchange of Thailand composite index lost 9.05 points to close at 645.80 points, while the blue-chip SET-50 index fell 7.99 points to 453.18.

■JAKARTA

Indonesian shares tumbled 2.5 percent to close at a 12-month low, dealers said. The Jakarta Composite Index fell 42.44 points to 2,022.56.

■MANILA

Philippine shares closed 1.1 percent lower, dealers said. The composite index shed 29.33 points to 2,724.72, while the all-share index lost 0.9 percent to 1,676.99.

■WELLINGTON

New Zealand shares closed 0.36 percent lower, dealers said. The benchmark NZX-50 index fell 11.96 points to 3,336.18.

■MUMBAI

Indian shares tumbled 2.79 percent, dealers said. The benchmark 30-share SENSEX index fell 415.27 points to 14,483.83.

DEFENDING DEMOCRACY: Taiwan shares the same values as those that fought in WWII, and nations must unite to halt the expansion of a new authoritarian bloc, Lai said The government yesterday held a commemoration ceremony for Victory in Europe (V-E) Day, joining the rest of the world for the first time to mark the anniversary of the end of World War II in Europe. Taiwan honoring V-E Day signifies “our growing connections with the international community,” President William Lai (賴清德) said at a reception in Taipei on the 80th anniversary of V-E Day. One of the major lessons of World War II is that “authoritarianism and aggression lead only to slaughter, tragedy and greater inequality,” Lai said. Even more importantly, the war also taught people that “those who cherish peace cannot

STEADFAST FRIEND: The bills encourage increased Taiwan-US engagement and address China’s distortion of UN Resolution 2758 to isolate Taiwan internationally The Presidential Office yesterday thanked the US House of Representatives for unanimously passing two Taiwan-related bills highlighting its solid support for Taiwan’s democracy and global participation, and for deepening bilateral relations. One of the bills, the Taiwan Assurance Implementation Act, requires the US Department of State to periodically review its guidelines for engagement with Taiwan, and report to the US Congress on the guidelines and plans to lift self-imposed limitations on US-Taiwan engagement. The other bill is the Taiwan International Solidarity Act, which clarifies that UN Resolution 2758 does not address the issue of the representation of Taiwan or its people in

US Indo-Pacific Commander Admiral Samuel Paparo on Friday expressed concern over the rate at which China is diversifying its military exercises, the Financial Times (FT) reported on Saturday. “The rates of change on the depth and breadth of their exercises is the one non-linear effect that I’ve seen in the last year that wakes me up at night or keeps me up at night,” Paparo was quoted by FT as saying while attending the annual Sedona Forum at the McCain Institute in Arizona. Paparo also expressed concern over the speed with which China was expanding its military. While the US

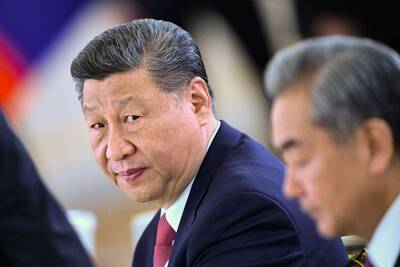

‘FALLACY’: Xi’s assertions that Taiwan was given to the PRC after WWII confused right and wrong, and were contrary to the facts, the Ministry of Foreign Affairs said The Ministry of Foreign Affairs yesterday called Chinese President Xi Jinping’s (習近平) claim that China historically has sovereignty over Taiwan “deceptive” and “contrary to the facts.” In an article published on Wednesday in the Russian state-run Rossiyskaya Gazeta, Xi said that this year not only marks 80 years since the end of World War II and the founding of the UN, but also “Taiwan’s restoration to China.” “A series of instruments with legal effect under international law, including the Cairo Declaration and the Potsdam Declaration have affirmed China’s sovereignty over Taiwan,” Xi wrote. “The historical and legal fact” of these documents, as well