Singaporean sovereign wealth fund Temasek Holdings, which invested billions in investment bank Merrill Lynch, yesterday reported a record profit of S$18.2 billion (US$12.8 billion).

But the state-linked investment firm in control of some of Asia’s best-known companies warned that slowing global economic growth following the US financial crisis could limit future opportunities.

“The fallout of the credit crisis will continue to dampen the global economy over the next 24 months, with sharply escalated oil and food prices beginning to test inflation expectations,” company chairman S. Dhanabalan said.

The record annual profit for the year to March covered a period during which Temasek invested US$4.9 billion in Merrill Lynch.

That deal followed the financial crisis and global credit crunch sparked by the meltdown in the US subprime mortgage sector. Sovereign wealth funds like Temasek have stirred controversy after rescuing big banks hit by the crisis.

The funds, government-created investment vehicles, have emerged as a potent force in global markets, sparking concerns that their investment policies are too opaque and could threaten national security.

Temasek, which has claimed a record of transparency, said strong operating performance by its portfolio companies “and healthy realized gains from its direct investment activities” contributed to its record profit.

It said in a statement that its portfolio rose in value to S$185 billion, up 13 percent from S$164 billion the previous year.

But Dhanabalan said Temasek was worried about risks from an environment of high inflation and slowing growth, sometimes referred to as “stagflation.”

Dhanabalan said: “This presents huge socio-political as well as economic risks in the next three to five years. Opportunities may be limited in such a scenario.”

Temasek is the largest shareholder in Merrill, which announced last month that it was dumping billions of dollars of mortgage debt at a steep loss and raising US$8.5 billion in new capital, including US$3.4 billion from Temasek.

The Singaporean fund first invested in the US bank Merrill Lynch in December, with a requirement that if Merrill raised more capital within 12 months at a lower share price, Temasek would be compensated for the difference.

The proviso kicked in for the most recent Temasek investment into Merrill, with the fund putting that US$2.5 billion compensation back into the US bank along with another US$900 million.

Temasek said for the first time net investments outside Asia were S$10 billion, exceeding net investments within Asia of S$5 billion.

Its exposure to economies outside Asia increased from 22 percent of its portfolio to 26 percent, due to the Merrill Lynch stake and investments in Latin America and Russia, the company said.

For the financial year, Temasek reported total shareholder return of seven percent by market value. That compares with the 27 percent in the previous year.

Temasek controls Singapore Airlines, Neptune Orient Lines and Singapore Telecommunications as well as other major regional firms.

It is one of two Singapore government investment vehicles along with the Government of Singapore Investment Corp.

SECURITY: As China is ‘reshaping’ Hong Kong’s population, Taiwan must raise the eligibility threshold for applications from Hong Kongers, Chiu Chui-cheng said When Hong Kong and Macau citizens apply for residency in Taiwan, it would be under a new category that includes a “national security observation period,” Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) said yesterday. President William Lai (賴清德) on March 13 announced 17 strategies to counter China’s aggression toward Taiwan, including incorporating national security considerations into the review process for residency applications from Hong Kong and Macau citizens. The situation in Hong Kong is constantly changing, Chiu said to media yesterday on the sidelines of the Taipei Technology Run hosted by the Taipei Neihu Technology Park Development Association. With

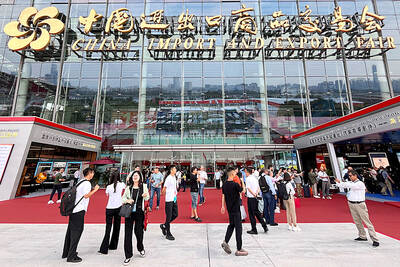

CARROT AND STICK: While unrelenting in its military threats, China attracted nearly 40,000 Taiwanese to over 400 business events last year Nearly 40,000 Taiwanese last year joined industry events in China, such as conferences and trade fairs, supported by the Chinese government, a study showed yesterday, as Beijing ramps up a charm offensive toward Taipei alongside military pressure. China has long taken a carrot-and-stick approach to Taiwan, threatening it with the prospect of military action while reaching out to those it believes are amenable to Beijing’s point of view. Taiwanese security officials are wary of what they see as Beijing’s influence campaigns to sway public opinion after Taipei and Beijing gradually resumed travel links halted by the COVID-19 pandemic, but the scale of

A US Marine Corps regiment equipped with Naval Strike Missiles (NSM) is set to participate in the upcoming Balikatan 25 exercise in the Luzon Strait, marking the system’s first-ever deployment in the Philippines. US and Philippine officials have separately confirmed that the Navy Marine Expeditionary Ship Interdiction System (NMESIS) — the mobile launch platform for the Naval Strike Missile — would take part in the joint exercise. The missiles are being deployed to “a strategic first island chain chokepoint” in the waters between Taiwan proper and the Philippines, US-based Naval News reported. “The Luzon Strait and Bashi Channel represent a critical access

Pope Francis is be laid to rest on Saturday after lying in state for three days in St Peter’s Basilica, where the faithful are expected to flock to pay their respects to history’s first Latin American pontiff. The cardinals met yesterday in the Vatican’s synod hall to chart the next steps before a conclave begins to choose Francis’ successor, as condolences poured in from around the world. According to current norms, the conclave must begin between May 5 and 10. The cardinals set the funeral for Saturday at 10am in St Peter’s Square, to be celebrated by the dean of the College