Asian stocks fell for a third week, ending the regional benchmark’s worst first half in 16 years, as record oil prices dimmed earnings prospects and concern grew that credit market losses haven’t reached an end.

The MSCI Asia-Pacific Index lost 2.2 percent to 136.96 this week. It has fallen about 13 percent in the first six months of this year, its worst performance since a 23 percent drop in 1992. A gauge tracking consumer stocks led losses among 10 industry groups on the index.

TAIPEI

PHOTO: AFP

Taiwanese share prices are expected to extend losses next week with market sentiment dampened by recent steep declines, high oil prices and volatility on Wall Street, dealers said.

In the week to Friday, the TAIEX closed down 353.68 points or 4.48 percent at 7,548.76 after a 2.51 percent fall the previous week.

“The market is dominated by a bearish mood, with few able to be sure when Wall Street will stablise,” Concord Securities (康和證券) analyst Allen Lin said.

TOKYO

Japanese share prices slid on worries about weak US markets, high oil prices and a stronger yen which is bad for exporters, dealers said.

The Tokyo Stock Exchange’s benchmark Nikkei-225 index ended down 277.96 points or 2.01 percent at 13,544.36. The broader TOPIX index of all first-section shares declined 24.11 points or 1.79 percent to 1,320.68.

HONG KONG

Shares closed down 1.84 percent, dealers said.

The benchmark Hang Seng Index lost 413.32 points to 22,042.35. For the week, the index fell 3.3 percent, while it is down 21 percent since the start of the year.

SYDNEY

Australian shares dropped 1.3 percent, dealers said.

The benchmark S&P/ASX 200 shed 70 points to end the day at 5,237.0 while the broader All Ordinaries was down 72.1 points at 5,349.4.

The Australian market tumbled 160.6 points, or 3.1 percent, on opening but clawed back much of the lost ground amid bargain-hunting.

SHANGHAI

Chinese share prices closed down 5.29 percent, dealers said.

The benchmark Shanghai Composite Index, which covers A and B shares, closed down 153.42 points at 2,748.43.

The Shanghai A-share Index lost 5.29 percent to 2,882.95, while the Shenzhen A-share Index was down 6.06 percent at 833.21.

The Shanghai B-share Index was down 4.05 percent to 209.12 and the Shenzhen B-share Index lost 4.58 percent to 471.21.

SEOUL

Shares closed 1.9 percent lower, dealers said.

The KOSPI index closed down 33.21 points at 1,684.45, after diving as much as 2.2 percent in the earlier session. The index fell about 3 percent this week.

SINGAPORE

Shares closed 0.84 percent lower, dealers said.

The blue-chip Straits Times Index fell 25.04 points to 2,955.91.

The benchmark index fell to an intraday low of 2,922.87.

MUMBAI

Indian shares plunged 4.3 percent, dealers said.

The benchmark Mumbai 30 share SENSEX index fell 619.6 points to 13,802.22, a 13-month low.

Also See: Jim Rogers tells investors not to 'give up' on China

SECURITY: The purpose for giving Hong Kong and Macau residents more lenient paths to permanent residency no longer applies due to China’s policies, a source said The government is considering removing an optional path to citizenship for residents from Hong Kong and Macau, and lengthening the terms for permanent residence eligibility, a source said yesterday. In a bid to prevent the Chinese Communist Party (CCP) from infiltrating Taiwan through immigration from Hong Kong and Macau, the government could amend immigration laws for residents of the territories who currently receive preferential treatment, an official familiar with the matter speaking on condition of anonymity said. The move was part of “national security-related legislative reform,” they added. Under the amendments, arrivals from the Chinese territories would have to reside in Taiwan for

CRITICAL MOVE: TSMC’s plan to invest another US$100 billion in US chipmaking would boost Taiwan’s competitive edge in the global market, the premier said The government would ensure that the most advanced chipmaking technology stays in Taiwan while assisting Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in investing overseas, the Presidential Office said yesterday. The statement follows a joint announcement by the world’s largest contract chipmaker and US President Donald Trump on Monday that TSMC would invest an additional US$100 billion over the next four years to expand its semiconductor manufacturing operations in the US, which would include construction of three new chip fabrication plants, two advanced packaging facilities, and a research and development center. The government knew about the deal in advance and would assist, Presidential

‘DANGEROUS GAME’: Legislative Yuan budget cuts have already become a point of discussion for Democrats and Republicans in Washington, Elbridge Colby said Taiwan’s fall to China “would be a disaster for American interests” and Taipei must raise defense spending to deter Beijing, US President Donald Trump’s pick to lead Pentagon policy, Elbridge Colby, said on Tuesday during his US Senate confirmation hearing. The nominee for US undersecretary of defense for policy told the Armed Services Committee that Washington needs to motivate Taiwan to avoid a conflict with China and that he is “profoundly disturbed” about its perceived reluctance to raise defense spending closer to 10 percent of GDP. Colby, a China hawk who also served in the Pentagon in Trump’s first team,

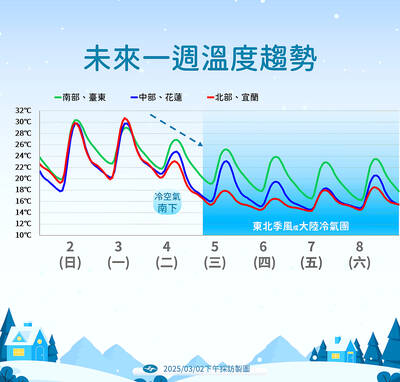

The arrival of a cold front tomorrow could plunge temperatures into the mid-teens, the Central Weather Administration (CWA) said. Temperatures yesterday rose to 28°C to 30°C in northern and eastern Taiwan, and 32°C to 33°C in central and southern Taiwan, CWA data showed. Similar but mostly cloudy weather is expected today, the CWA said. However, the arrival of a cold air mass tomorrow would cause a rapid drop in temperatures to 15°C cooler than the previous day’s highs. The cold front, which is expected to last through the weekend, would bring steady rainfall tomorrow, along with multiple waves of showers