Vietnam’s economy, until recently a darling of foreign investors, has overheated and may be sliding into a boom-and-bust cycle that could require IMF-style assistance, analysts say.

The economy widely hailed last year as Asia’s next tiger has been battered by double-digit inflation, a ballooning trade gap, a tanked stock market and worries about the currency and banking sector.

Credit rating agencies Standard & Poor’s, Fitch and Moody’s and several investment banks have revised downward their outlooks for Vietnam at a time when the specter of a US recession could spell global trouble.

PHOTO: AFP

Aseambankers Research said: “The worst-case scenario would be for Vietnam to suffer massive capital flight, triggering a balance of payment crisis and forcing the country to go to the International Monetary Fund for help.”

Analyst Adam Le Mesurier wrote for consultancy DSG Asia that “an ‘IMF-program- style’ policy response will be needed within six months,” including monetary and fiscal tightening and a dong currency devaluation.”

Many investors and donors in Vietnam remain upbeat about the market of 86 million, pointing to strong exports — including food and oil — investment inflows, growing tourism and the potential of its young workforce.

“It’s too easy to get excited and claim that Vietnam has gone from poster child to problem child,” EU chief country representative Sean Doyle said. “But I’m not sure it’s very wise and very balanced ... Vietnam, if it can keep steady, stick with the right policies, will be attractive.”

Nonetheless, the turnaround in investor perception has been stunning.

Communist Vietnam’s entry into the WTO last year fuelled enthusiasm for the low-wage “mini-China,” bringing an influx of foreign cash.

Domestic investors gambled on a sky-rocketing stock exchange, the government went on a spending spree and banks lent freely, fuelling rapid credit growth.

The wheels started to come off about half a year ago, when inflation hit double digits as the economy tried to digest US$6 billion in foreign direct investment (FDI) disbursed last year, or 8.4 percent of GDP.

Since the start of the year, prices have galloped, driven by global food and energy costs, to 25 percent year-on-year inflation last month. Wage demands sparked 300 labor strikes in the first quarter alone.

“The wage-price spiral that appears to be beginning, if it becomes embedded, could make matters much worse,” said an HSBC report that predicted a rise to 30 percent inflation amid hoarding of commodities.

Another alarm bell sounded when surging imports drove the trade deficit to US$14.4 billion last month, compared to US$12 billion for all of last year.

The stock market has tumbled amid tighter credit and falling investor confidence, turning from the world’s best to worst performing bourse. Last week it crashed below 400 points, from its high of over 1,100 last March.

Many investors have bought gold or offloaded value-losing dong for greenbacks, briefly sending the black market rate in Vietnam to 18,500 to the dollar last week, against the official rate of around 16,000.

Standard Chartered Bank said recently that the “Vietnamese dong has come under downward pressure, and such pressure is likely to persist until solid improvement is seen in the trade balance.”

Some observers now fear a banking crisis amid tighter liquidity, depositor-flight and non-performing loans.

“Urgent action is required in the financial sector,” said Michael Pease, chairman of the Vietnam Business Forum. “Vulnerability of some financial institutions threatens not just the domestic financial sector but also the confidence of foreign investors.”

Vietnam’s government — which has adopted a fight-inflation-first strategy and pledged other economic fixes — has lowered its economic growth target for this year to 7 percent from last year’s blistering 8.5 percent.

IMF country chief Benedict Bingham has suggested Vietnam cool its “overheated” economy with higher interest rates and public spending cuts, freeing up of the exchange rate and accelerated reforms of its state-owned enterprises.

While Bingham said the IMF was “encouraged” by government plans to fix the economy, he called for “a concrete and convincing policy package that will bolster investor confidence and restore macroeconomic stability.”

SECURITY: As China is ‘reshaping’ Hong Kong’s population, Taiwan must raise the eligibility threshold for applications from Hong Kongers, Chiu Chui-cheng said When Hong Kong and Macau citizens apply for residency in Taiwan, it would be under a new category that includes a “national security observation period,” Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) said yesterday. President William Lai (賴清德) on March 13 announced 17 strategies to counter China’s aggression toward Taiwan, including incorporating national security considerations into the review process for residency applications from Hong Kong and Macau citizens. The situation in Hong Kong is constantly changing, Chiu said to media yesterday on the sidelines of the Taipei Technology Run hosted by the Taipei Neihu Technology Park Development Association. With

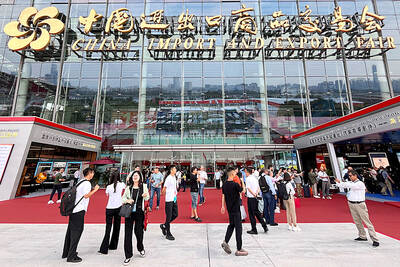

CARROT AND STICK: While unrelenting in its military threats, China attracted nearly 40,000 Taiwanese to over 400 business events last year Nearly 40,000 Taiwanese last year joined industry events in China, such as conferences and trade fairs, supported by the Chinese government, a study showed yesterday, as Beijing ramps up a charm offensive toward Taipei alongside military pressure. China has long taken a carrot-and-stick approach to Taiwan, threatening it with the prospect of military action while reaching out to those it believes are amenable to Beijing’s point of view. Taiwanese security officials are wary of what they see as Beijing’s influence campaigns to sway public opinion after Taipei and Beijing gradually resumed travel links halted by the COVID-19 pandemic, but the scale of

A US Marine Corps regiment equipped with Naval Strike Missiles (NSM) is set to participate in the upcoming Balikatan 25 exercise in the Luzon Strait, marking the system’s first-ever deployment in the Philippines. US and Philippine officials have separately confirmed that the Navy Marine Expeditionary Ship Interdiction System (NMESIS) — the mobile launch platform for the Naval Strike Missile — would take part in the joint exercise. The missiles are being deployed to “a strategic first island chain chokepoint” in the waters between Taiwan proper and the Philippines, US-based Naval News reported. “The Luzon Strait and Bashi Channel represent a critical access

Pope Francis is be laid to rest on Saturday after lying in state for three days in St Peter’s Basilica, where the faithful are expected to flock to pay their respects to history’s first Latin American pontiff. The cardinals met yesterday in the Vatican’s synod hall to chart the next steps before a conclave begins to choose Francis’ successor, as condolences poured in from around the world. According to current norms, the conclave must begin between May 5 and 10. The cardinals set the funeral for Saturday at 10am in St Peter’s Square, to be celebrated by the dean of the College