Wachovia Corp, the fourth-largest US bank, brought forward its earnings announcement, prompting speculation that soured home loans triggered the firm’s first quarterly loss in more than six years.

First-quarter results would be announced yesterday instead of April 18, the Charlotte, North Carolina-based bank said in a statement late on Sunday. Wachovia may receive as much as US$7 billion from investors to shore up capital, the Wall Street Journal reported earlier that evening.

“I’m assuming they’re going to have a meaningful loss,” Gerard Cassidy, an analyst at RBC Capital Markets, said in an interview, after hearing of the date change and possible cash infusion. He had expected Wachovia to earn about US$0.40 a share.

Chief executive officer Kennedy Thompson may report the bank’s first loss since the third quarter of 2001 because of California’s weak housing market, and depressed prices for commercial mortgage-backed securities and loans for leveraged buyouts. Thompson has told shareholders the US$24 billion purchase of home lender Golden West Financial Corp in 2006 was mistimed, and that Wachovia now faces “a moment of truth.”

Wachovia will disclose results no later than 6am New York time, the statement said. Voice and e-mail messages left for spokeswoman Christy Phillips-Brown weren’t immediately returned.

The world’s biggest banks and securities firms have raised more than US$140 billion to replenish capital after US$245 billion in writedowns and credit losses since the beginning of last year.

A loss may pressure Wachovia to cut its dividend, a move predicted on March 25 by Merrill Lynch & Co analyst Edward Najarian. The current yield is 9.2 percent, compared with 2.26 percent for the Standard & Poor’s 500 Stock Index.

“The prudent management decision would be to cut their dividend and start rebuilding it over time,” Cassidy said.

New investors may give Wachovia US$6 billion to US$7 billion in return for shares priced at about US$23 or US$24 each, the Journal report said, citing people familiar with the situation. The stock closed at US$27.81 last week after falling by almost half in 12 months, leaving the company with a market value of US$55.1 billion.

The investors may include New York-based buyout firm Warburg Pincus LLC, the Journal said. Warburg Pincus spokeswoman Sarah Gestetner didn’t immediately return an e-mail.

Wachovia wrote off US$2.9 billion in the second half of last year mainly because of loans related to housing, and collateralized debt obligations backed by mortgages to borrowers with poor credit records.

Wachovia’s capital raising would be the second this year following a US$3.5 billion offering of preferred stock in February. It would also mirror the US$7 billion investment last week in Washington Mutual Inc, the largest US savings and loan, by a group led by David Bonderman’s TPG Inc. Washington Mutual cut its dividend to a penny a share from US$0.15 and announced 3,000 job cuts.

Thompson, 57, who became CEO of Wachovia predecessor First Union Corp in April 2000, made his biggest acquisition with Golden West, the Oakland, California-based home lender, at the height of the housing boom. Thompson got board approval for the transaction 11 days after the initial contact between the two companies in April 2006, a regulatory filing showed.

Golden West specialized in so-called option adjustable-rate mortgages, which allow borrowers to decide to skip some or all of the monthly payments and add the amount to their principal. About 60 percent of Wachovia’s US$120 billion in adjustable-rate mortgages are in California, among the states hardest hit as housing prices tumbled.

About US$2.8 billion in option-ARMs were more than 90 days late at Wachovia on Dec. 31, up from US$675 million a year earlier. Washington Mutual, Countrywide Financial Corp and other large option-ARM lenders have reported rising levels of delinquencies this year, sparking concern that Wachovia’s late payments would also escalate.

Wachovia’s late payments and losses from the loans have been lower than industry averages through the end of last year, prompting chief risk officer Donald Truslow to say in February that the bank’s mortgage business might remain profitable even if loans losses quadrupled this year.

Wachovia also faces higher losses on its mortgage-backed securities and leveraged loans, along with mounting problems in its commercial real estate, home equity and construction loan businesses, Cassidy said.

“These investors in Wachovia, if the reports are true, are making assumptions about what the losses are going to be, but no one really knows what they will be,” Cassidy said.

A dividend cut is likely because the payout is costing Wachovia about US$5 billion annually, Najarian and other analysts have said.

The US$2.56-a-share annual dividend is 9.8 percent lower than the US$2.84 per share that the bank is expected to earn this year, the average estimate of 21 analysts compiled by Bloomberg showed.

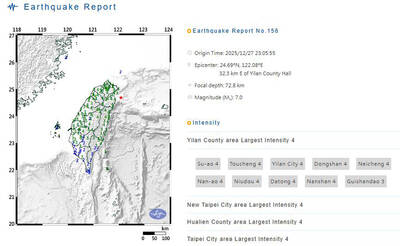

A magnitude 7.0 earthquake struck off Yilan at 11:05pm yesterday, the Central Weather Administration (CWA) said. The epicenter was located at sea, about 32.3km east of Yilan County Hall, at a depth of 72.8km, CWA data showed There were no immediate reports of damage. The intensity of the quake, which gauges the actual effect of a seismic event, measured 4 in Yilan County area on Taiwan’s seven-tier intensity scale, the data showed. It measured 4 in other parts of eastern, northern and central Taiwan as well as Tainan, and 3 in Kaohsiung and Pingtung County, and 2 in Lienchiang and Penghu counties and 1

FOREIGN INTERFERENCE: Beijing would likely intensify public opinion warfare in next year’s local elections to prevent Lai from getting re-elected, the ‘Yomiuri Shimbun’ said Internal documents from a Chinese artificial intelligence (AI) company indicated that China has been using the technology to intervene in foreign elections, including propaganda targeting Taiwan’s local elections next year and presidential elections in 2028, a Japanese newspaper reported yesterday. The Institute of National Security of Vanderbilt University obtained nearly 400 pages of documents from GoLaxy, a company with ties to the Chinese government, and found evidence that it had apparently deployed sophisticated, AI-driven propaganda campaigns in Hong Kong and Taiwan to shape public opinion, the Yomiuri Shimbun reported. GoLaxy provides insights, situation analysis and public opinion-shaping technology by conducting network surveillance

‘POLITICAL GAME’: DPP lawmakers said the motion would not meet the legislative threshold needed, and accused the KMT and the TPP of trivializing the Constitution The Legislative Yuan yesterday approved a motion to initiate impeachment proceedings against President William Lai (賴清德), saying he had undermined Taiwan’s constitutional order and democracy. The motion was approved 61-50 by lawmakers from the main opposition Chinese Nationalist Party (KMT) and the smaller Taiwan People’s Party (TPP), who together hold a legislative majority. Under the motion, a roll call vote for impeachment would be held on May 19 next year, after various hearings are held and Lai is given the chance to defend himself. The move came after Lai on Monday last week did not promulgate an amendment passed by the legislature that

Taiwan is gearing up to celebrate the New Year at events across the country, headlined by the annual countdown and Taipei 101 fireworks display at midnight. Many of the events are to be livesteamed online. See below for lineups and links: Taipei Taipei’s New Year’s Party 2026 is to begin at 7pm and run until 1am, with the theme “Sailing to the Future.” South Korean girl group KARA is headlining the concert at Taipei City Hall Plaza, with additional performances by Amber An (安心亞), Nick Chou (周湯豪), hip-hop trio Nine One One (玖壹壹), Bii (畢書盡), girl group Genblue (幻藍小熊) and more. The festivities are to