JPMorgan Chase & Co was in talks to quintuple its offer to buy Bear Stearns Cos to US$10 per share in an effort to pacify angry Bear Stearns shareholders, the New York Times said yesterday.

JPMorgan's original agreement on March 16 to pay US$2 per share for Bear Stearns was widely considered a fire-sale price for the 85-year-old Wall Street investment bank. Bear Stearns collapsed in a liquidity crisis after suffering large subprime mortgage losses and falling confidence in dealing with the company.

The original agreement had won support of federal regulators, but the US Federal Reserve is now balking at the new price, the newspaper said, citing people involved in the talks.

As a result, the renegotiated merger might be postponed or collapse, it said.

A US$10 per share offer would value Bear Stearns at more than US$1 billion. That price, however, is still less than one-third of where the stock traded on March 14, the last trading day before the original merger was announced.

It is also less than 10 percent of where the stock traded for much of last year.

Representatives of Bear Stearns, JPMorgan and the Fed were not immediately available for comment.

Jamie Dimon, JPMorgan's chief executive, grew convinced the merger was in jeopardy after spending much of the last week taking calls from indignant shareholders, the newspaper said, citing people involved in the talks.

Among these shareholders was the British entrepreneur Joseph Lewis, who spent more than US$1 billion on some 12.1 million Bear Stearns shares, including some as recently as March 13.

Last week, Lewis said he would take whatever action was needed to protect his investment, and may encourage Bear Stearns and third parties to pursue other transactions.

Bear Stearns shares closed on Thursday at US$6.39, reflecting investor expectations that JPMorgan might raise its bid, or another suitor might offer a sweetened price. JPMorgan shares closed at US$45.97.

In an attempt to speed majority shareholder approval, Bear Stearns' board was trying to authorize the sale of 39.5 percent of the firm to JPMorgan, the NYT said.

State law in Delaware, where JPMorgan and Bear Stearns are incorporated, allows a company to sell up to 40 percent without shareholder approval.

A spokeswoman for JPMorgan declined to comment Sunday night, the NYT said.

A Bear Stearns representative could not be reached.

A spokesman for the Federal Reserve would not comment on the central bank's involvement in the negotiations, but denied it had directed the original sale price, the newspaper said.

Citing people involved in the talks, the newspaper said the central bank originally directed JPMorgan to pay no more than US$2 per share to assure that it would not appear that Bear Stearns shareholders were being rescued.

As part of the original transaction, the Fed also extended a US$30 billion credit line to JPMorgan to finance Bear Stearns' most illiquid assets.

JPMorgan was in talks on Sunday night with the Fed to assume the first US$1 billion of losses on Bear Stearns assets before the US$30 billion cushion kicks in, the newspaper said.

The original agreement called for JPMorgan to swap 0.05473 of its shares for each Bear Stearns share.

Some large Bear Stearns shareholders have considered opposing the merger to send the company into bankruptcy, where they might hope to get more than US$2 per share from creditors, the newspaper said.

SECURITY: As China is ‘reshaping’ Hong Kong’s population, Taiwan must raise the eligibility threshold for applications from Hong Kongers, Chiu Chui-cheng said When Hong Kong and Macau citizens apply for residency in Taiwan, it would be under a new category that includes a “national security observation period,” Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) said yesterday. President William Lai (賴清德) on March 13 announced 17 strategies to counter China’s aggression toward Taiwan, including incorporating national security considerations into the review process for residency applications from Hong Kong and Macau citizens. The situation in Hong Kong is constantly changing, Chiu said to media yesterday on the sidelines of the Taipei Technology Run hosted by the Taipei Neihu Technology Park Development Association. With

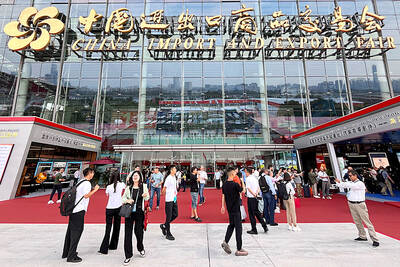

CARROT AND STICK: While unrelenting in its military threats, China attracted nearly 40,000 Taiwanese to over 400 business events last year Nearly 40,000 Taiwanese last year joined industry events in China, such as conferences and trade fairs, supported by the Chinese government, a study showed yesterday, as Beijing ramps up a charm offensive toward Taipei alongside military pressure. China has long taken a carrot-and-stick approach to Taiwan, threatening it with the prospect of military action while reaching out to those it believes are amenable to Beijing’s point of view. Taiwanese security officials are wary of what they see as Beijing’s influence campaigns to sway public opinion after Taipei and Beijing gradually resumed travel links halted by the COVID-19 pandemic, but the scale of

A US Marine Corps regiment equipped with Naval Strike Missiles (NSM) is set to participate in the upcoming Balikatan 25 exercise in the Luzon Strait, marking the system’s first-ever deployment in the Philippines. US and Philippine officials have separately confirmed that the Navy Marine Expeditionary Ship Interdiction System (NMESIS) — the mobile launch platform for the Naval Strike Missile — would take part in the joint exercise. The missiles are being deployed to “a strategic first island chain chokepoint” in the waters between Taiwan proper and the Philippines, US-based Naval News reported. “The Luzon Strait and Bashi Channel represent a critical access

Pope Francis is be laid to rest on Saturday after lying in state for three days in St Peter’s Basilica, where the faithful are expected to flock to pay their respects to history’s first Latin American pontiff. The cardinals met yesterday in the Vatican’s synod hall to chart the next steps before a conclave begins to choose Francis’ successor, as condolences poured in from around the world. According to current norms, the conclave must begin between May 5 and 10. The cardinals set the funeral for Saturday at 10am in St Peter’s Square, to be celebrated by the dean of the College