Sanford Weill built Citigroup into one of the world's largest banking companies. Now, Vikram Pandit is watching Weill's creation wither in the stock market.

Reflecting a punishing year-long decline, Citigroup's stock price plummeted on Tuesday to its lowest level since 1998, when Weill formed the financial conglomerate through the merger of Travelers and Citicorp.

The shares sank US$0.99, or 4.3 percent, to US$22.10, as concern spread that new multibillion-dollar losses might force Citigroup to go hat in hand to foreign investors once again. The market tumble left Citigroup shares down 56 percent in the last year, the worst showing among the 30 stocks that make up the Dow Jones industrials.

For now, executives say they are confident that the company is financially strong. On Tuesday evening, Pandit told employees on an internal conference call that Citigroup was "well capitalized," a person close to the company said.

The bank has no plans to seek funds from outside investors, another person close to the company said. Since November, Citigroup has raised about US$30 billion from investors in Asia and the Middle East, as well as from the public.

But those investments may not be enough to shore up Citigroup, some investors fear.

Sameer al-Ansari, head of Dubai International Capital, a government-controlled investment fund, told Reuters on Tuesday Citigroup might need "a lot more money."

Adding to the gloom, two new analyst reports on Tuesday forecast that Citigroup would remain mired in red ink this quarter. Merrill Lynch predicted that Citigroup would take US$15 billion in write-downs because of bad mortgage investments, leaving it with a net loss of US$1.66 a share. Goldman Sachs estimated Citi's loss at US$1 a share.

Since becoming chief executive in December, Pandit, 51, has rejiggered Citigroup's sprawling structure but has not made the radical overhaul that many investors called for. On Monday, for example, he announced a reorganization of the company's wealth management business.

But investors and analysts say Pandit needs to take far bolder steps to turn around the bank, which has been pummeled by the turmoil in the credit markets. Some have urged him to break up the company, saying Citigroup has become too unwieldy to be managed effectively. Pandit, like his predecessor, Charles Prince III, has resisted that step.

Citigroup's capital levels came under scrutiny in October when Meredith Whitney, now a banking analyst at Oppenheimer, issued a scathing report saying the company's weakening finances would force it to cut its dividend, sell assets and issue new stock. At the time, Citigroup executives brushed off those ideas. By the end of last year, they were heeding Whitney's advice.

On Tuesday, the person close to Citigroup said the company was strong enough to maintain its dividend, which costs the company about US$6 billion annually. Still, that leaves open the possibility that the board may elect to cut the dividend.

Citigroup says it has more than enough capital to meet regulatory guidelines and its own internal benchmarks. The bank is in the process of raising several billion dollars by selling assets from several smaller fringe businesses and has pulled back from some domestic and international markets. It will also free up several billion dollars as the number of loans on its books shrink.

The Central Election Commission has amended election and recall regulations to require elected office candidates to provide proof that they have no Chinese citizenship, a Cabinet report said. The commission on Oct. 29 last year revised the Measures for the Permission of Family-based Residence, Long-term Residence and Settlement of People from the Mainland Area in the Taiwan Area (大陸地區人民在台灣地區依親居留長期居留或定居許可辦法), the Executive Yuan said in a report it submitted to the legislature for review. The revision requires Chinese citizens applying for permanent residency to submit notarial documents showing that they have lost their Chinese household record and have renounced — or have never

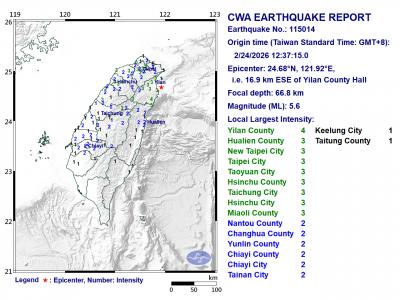

A magnitude 5.6 earthquake struck off the coast of Yilan County at 12:37pm today, with clear shaking felt across much of northern Taiwan. There were no immediate reports of damage. The epicenter of the quake was 16.9km east-southeast of Yilan County Hall offshore at a depth of 66.8km, Central Weather Administration (CWA) data showed. The maximum intensity registered at a 4 in Yilan County’s Nanao Township (南澳) on Taiwan’s seven-tier scale. Other parts of Yilan, as well as certain areas of Hualien County, Taipei, New Taipei City, Taoyuan, Hsinchu County, Taichung and Miaoli County, recorded intensities of 3. Residents of Yilan County and Taipei received

Taiwan has secured another breakthrough in fruit exports, with jujubes, dragon fruit and lychees approved for shipment to the EU, the Ministry of Agriculture said yesterday. The Animal and Plant Health Inspection Agency on Thursday received formal notification of the approval from the EU, the ministry said, adding that the decision was expected to expand Taiwanese fruit producers’ access to high-end European markets. Taiwan exported 126 tonnes of lychees last year, valued at US$1.48 million, with Japan accounting for 102 tonnes. Other export destinations included New Zealand, Hong Kong, the US and Australia, ministry data showed. Jujube exports totaled 103 tonnes, valued at

BIG SPENDERS: Foreign investors bought the most Taiwan equities since 2005, signaling confidence that an AI boom would continue to benefit chipmakers Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) market capitalization swelled to US$2 trillion for the first time following a 4.25 percent rally in its American depositary receipts (ADR) overnight, putting the world’s biggest contract chipmaker sixth on the list of the world’s biggest companies by market capitalization, just behind Amazon.com Inc. The site CompaniesMarketcap.com ranked TSMC ahead of Saudi Aramco and Meta Platforms Inc. The Taiwanese company’s ADRs on Tuesday surged to US$385.75 on the New York Stock Exchange, as strong demand for artificial intelligence (AI) applications led to chip supply constraints and boost revenue growth to record-breaking levels. Each TSMC ADR represents