HSBC's profits rose 10 percent last year, just below analysts' forecasts, as strong gains in Asia helped Europe's biggest bank absorb a US$17.2 billion hit for bad debts largely due to US housing problems.

The London-headquartered bank reported record pretax profit of US$24.2 billion last year, up from US$22.1 billion in 2006.

This was below an average forecast of US$24.7 billion from a Reuters Estimates poll of analysts, but well within the forecast range.

PHOTO: AFP

The bank's impairment charge jumped US$6.7 billion from 2006, or 63 percent.

Bad debts had been expected to come in at US$15.8 billion, based on the average of forecasts from eight analysts.

HSBC shares were up 0.6 percent at 770.5 pence, the top performing stock in a weak UK share market.

HSBC said that it had suffered an "exceptionally weak" performance in the US, hit by continued deterioration in the US subprime housing market, where it had been a major lender.

But the bank said it had produced "exceptionally strong" results in Asia-Pacific, Latin America and the Middle East.

"The outlook for the rest of 2008 is uncertain," bank chairman Stephen Green said, adding that the US economic slowdown and credit outlook "may well get worse."

But he said that HSBC's conservative balance sheet and international spread left it well positioned and it expects to improve margins and will "continue to invest in building market presence at a time when others with weaker capital positions are constrained."

The bank set new performance targets, including a return on equity of 15 percent to 19 percent over an investment cycle, a cost/efficiency ratio of 48 percent to 52 percent and total shareholder return in the top half of those achieved by its peers.

Profits at HSBC's investment banking arm, which has been renamed global banking and markets, rose 5 percent to US$6.1 billion on strong revenue growth in equities, foreign exchange and other areas.

The unit took a US$2.1 billion writedown on the value of complex financial assets that have been tarnished by the US subprime crisis and turmoil in financial markets.

The writedown was above previous estimates but less than the multibillion dollar hits take by many other banks.

In China, HSBC made profit of more than US$1 billion for the first time, through its own business and in conjunction with associates. Hong Kong profits topped US$7 billion.

The bank recommended a final dividend of US$0.39 per share, taking the full-year payout to US$0.90, up 11 percent from 2006.

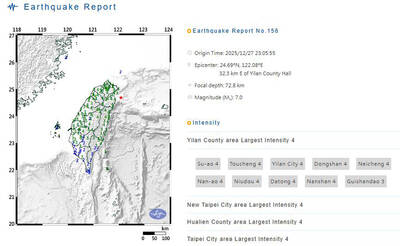

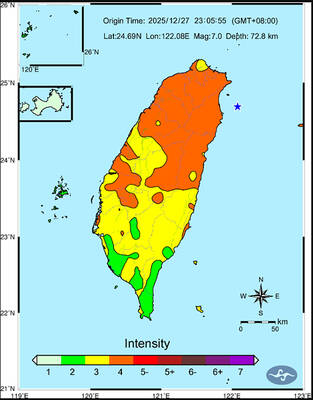

A magnitude 7.0 earthquake struck off Yilan at 11:05pm yesterday, the Central Weather Administration (CWA) said. The epicenter was located at sea, about 32.3km east of Yilan County Hall, at a depth of 72.8km, CWA data showed There were no immediate reports of damage. The intensity of the quake, which gauges the actual effect of a seismic event, measured 4 in Yilan County area on Taiwan’s seven-tier intensity scale, the data showed. It measured 4 in other parts of eastern, northern and central Taiwan as well as Tainan, and 3 in Kaohsiung and Pingtung County, and 2 in Lienchiang and Penghu counties and 1

FOREIGN INTERFERENCE: Beijing would likely intensify public opinion warfare in next year’s local elections to prevent Lai from getting re-elected, the ‘Yomiuri Shimbun’ said Internal documents from a Chinese artificial intelligence (AI) company indicated that China has been using the technology to intervene in foreign elections, including propaganda targeting Taiwan’s local elections next year and presidential elections in 2028, a Japanese newspaper reported yesterday. The Institute of National Security of Vanderbilt University obtained nearly 400 pages of documents from GoLaxy, a company with ties to the Chinese government, and found evidence that it had apparently deployed sophisticated, AI-driven propaganda campaigns in Hong Kong and Taiwan to shape public opinion, the Yomiuri Shimbun reported. GoLaxy provides insights, situation analysis and public opinion-shaping technology by conducting network surveillance

‘POLITICAL GAME’: DPP lawmakers said the motion would not meet the legislative threshold needed, and accused the KMT and the TPP of trivializing the Constitution The Legislative Yuan yesterday approved a motion to initiate impeachment proceedings against President William Lai (賴清德), saying he had undermined Taiwan’s constitutional order and democracy. The motion was approved 61-50 by lawmakers from the main opposition Chinese Nationalist Party (KMT) and the smaller Taiwan People’s Party (TPP), who together hold a legislative majority. Under the motion, a roll call vote for impeachment would be held on May 19 next year, after various hearings are held and Lai is given the chance to defend himself. The move came after Lai on Monday last week did not promulgate an amendment passed by the legislature that

AFTERMATH: The Taipei City Government said it received 39 minor incident reports including gas leaks, water leaks and outages, and a damaged traffic signal A magnitude 7.0 earthquake struck off Taiwan’s northeastern coast late on Saturday, producing only two major aftershocks as of yesterday noon, the Central Weather Administration (CWA) said. The limited aftershocks contrast with last year’s major earthquake in Hualien County, as Saturday’s earthquake occurred at a greater depth in a subduction zone. Saturday’s earthquake struck at 11:05pm, with its hypocenter about 32.3km east of Yilan County Hall, at a depth of 72.8km. Shaking was felt in 17 administrative regions north of Tainan and in eastern Taiwan, reaching intensity level 4 on Taiwan’s seven-tier seismic scale, the CWA said. In Hualien, the