Can Europe's economy stay on track even if the US goes off the rails?

This old question is being asked with new urgency across the continent, after a startling divergence last week in how the European Central Bank (ECB) and the US Federal Reserve are reading economic tea leaves.

Federal Reserve Chairman Ben Bernanke said on Thursday that the Fed would cut rates to try to ward off a recession. Earlier that day, ECB President Jean-Claude Trichet told a news conference in Frankfurt that the signals on European growth were mixed.

A growing number of economists, convinced that Europe is not as insulated from US woes as many Europeans would like to believe, are questioning why, at such a sensitive moment, the ECB is warning it might raise interest rates.

"The ECB sees the glass as half full. The Fed sees it as half empty," said Thomas Mayer, the chief European economist at Deutsche Bank. "It's not a difference in the data; it's a difference in the analysis."

The simplest explanation for the ECB's hawkish demeanor is its inflation-fighting mandate.

Trichet, for example, has warned labor unions not to use Europe's inflation rate of 3.1 percent as a pretext for demanding steep wage increases.

But while Trichet has thrust himself into German labor negotiations, several economists argue that the bank may be underestimating the impact in Europe of a US recession.

The bank, Mayer said, still does not believe that the credit crisis originating in the US mortgage market poses a grave risk to Europe's economic prospects. That is why the bank, he said, is threatening a rate increase when it should be preparing for a rate cut.

Disputing another train of thought popular in Europe, Jacques Cailloux, head of euro area economic research for the Royal Bank of Scotland, said: "The ECB is wrong in its assessment that the emerging markets can offset the US downturn."

"The whole idea of globalization is at odds with the thesis of decoupling," he said.

Decoupling refers to the argument that Europe is not as dependent on the US as it once was because Europe's exports to China and other emerging economies have grown so much faster than its exports to the US.

The thesis became fashionable in the last year as an explanation for the growth rate in the US slowing as big European economies accelerated.

In its World Economic Outlook last spring, the IMF said that the faltering US economy had limited impact on world growth because US economic fragility was rooted in a troubled housing market -- a national phenomenon that was less subject to global contagion.

The chapter was titled "Decoupling the Train," but the authors put a question mark after the title, cautioning that housing woes could spill over into other areas of the US economy, in which case the troubles in the US could become the world's troubles.

This has proven to be the case, as the mortgage problems have mutated into a credit crisis that has become trans-Atlantic.

European banks, like their counterparts in the US, have been forced to write down billions of dollars in the value of complex securities backed by subprime mortgages.

The ECB responded as forcefully as any central bank to the turmoil caused by the credit crunch. Last week, it said it would inject another US$20 billion into the financial system, the latest in a stream of liquidity injections since August.

But Trichet has stopped short of saying that the financial crisis could halt European growth. At a news conference on Thursday, after the bank left its benchmark rate unchanged at 4 percent, he said the signals on Europe's growth were mixed.

"Our baseline scenario remains one of ongoing growth, but risks are clearly on the downside," he said.

For Mayer and other economists, the question is not whether the credit crisis will dent Europe's economy, but when.

Housing sales in Spain and Ireland -- two of Europe's hottest property markets -- have already dried up, he said, and France will not be far behind.

"Europe suffers from the same problems as the US does," Mayer said. "The trade linkages between Europe and the US may have come down in recent years, but that is beside the point."

Cailloux said there was even a correlation between Germany's exports to China and its exports to the US.

As China exports less to the US, Cailloux said, it has less demand for German exports, like machine tools.

"Europe's exports to Asia are indirectly related to final demand in the US" he said.

This coupling will soon become apparent to the ECB, Cailloux said.

The bank's next shift in monetary policy, he said, would be a rate cut, not a rate increase.

SECURITY: The purpose for giving Hong Kong and Macau residents more lenient paths to permanent residency no longer applies due to China’s policies, a source said The government is considering removing an optional path to citizenship for residents from Hong Kong and Macau, and lengthening the terms for permanent residence eligibility, a source said yesterday. In a bid to prevent the Chinese Communist Party (CCP) from infiltrating Taiwan through immigration from Hong Kong and Macau, the government could amend immigration laws for residents of the territories who currently receive preferential treatment, an official familiar with the matter speaking on condition of anonymity said. The move was part of “national security-related legislative reform,” they added. Under the amendments, arrivals from the Chinese territories would have to reside in Taiwan for

CRITICAL MOVE: TSMC’s plan to invest another US$100 billion in US chipmaking would boost Taiwan’s competitive edge in the global market, the premier said The government would ensure that the most advanced chipmaking technology stays in Taiwan while assisting Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in investing overseas, the Presidential Office said yesterday. The statement follows a joint announcement by the world’s largest contract chipmaker and US President Donald Trump on Monday that TSMC would invest an additional US$100 billion over the next four years to expand its semiconductor manufacturing operations in the US, which would include construction of three new chip fabrication plants, two advanced packaging facilities, and a research and development center. The government knew about the deal in advance and would assist, Presidential

‘DANGEROUS GAME’: Legislative Yuan budget cuts have already become a point of discussion for Democrats and Republicans in Washington, Elbridge Colby said Taiwan’s fall to China “would be a disaster for American interests” and Taipei must raise defense spending to deter Beijing, US President Donald Trump’s pick to lead Pentagon policy, Elbridge Colby, said on Tuesday during his US Senate confirmation hearing. The nominee for US undersecretary of defense for policy told the Armed Services Committee that Washington needs to motivate Taiwan to avoid a conflict with China and that he is “profoundly disturbed” about its perceived reluctance to raise defense spending closer to 10 percent of GDP. Colby, a China hawk who also served in the Pentagon in Trump’s first team,

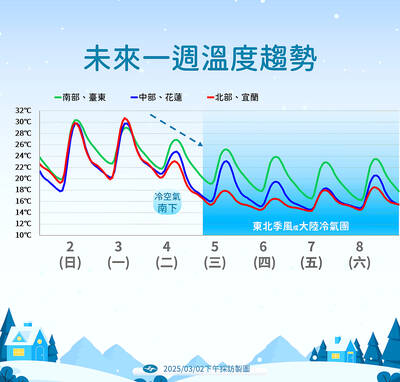

The arrival of a cold front tomorrow could plunge temperatures into the mid-teens, the Central Weather Administration (CWA) said. Temperatures yesterday rose to 28°C to 30°C in northern and eastern Taiwan, and 32°C to 33°C in central and southern Taiwan, CWA data showed. Similar but mostly cloudy weather is expected today, the CWA said. However, the arrival of a cold air mass tomorrow would cause a rapid drop in temperatures to 15°C cooler than the previous day’s highs. The cold front, which is expected to last through the weekend, would bring steady rainfall tomorrow, along with multiple waves of showers