Merrill Lynch became the latest Wall Street bank to grab a financial lifeline from a foreign government, agreeing on Monday to sell US$5 billion in new stock to Temasek Holdings, Singapore's sovereign investment company, and a smaller stake to a domestic firm, as the fallout from the mortgage mess continues to spread.

The move comes as analysts predict that Merrill, the nation's largest brokerage, will write down its mortgage investments by an additional US$8 billion or more in the fourth quarter. Such losses could force the firm to raise even more capital.

Merrill Lynch also agreed on Monday to sell most of its commercial finance business, Merrill Lynch Capital, to the General Electric Co in a deal that would raise about US$1.3 billion for other parts of its business.

"One of my first priorities at Merrill Lynch was to strengthen the firm's balance sheet, and today we have made great progress towards that by bolstering our capital position through these investments and the sale of Merrill Lynch Capital," John Thain, Merrill's chairman and chief executive, said in a statement.

To raise US$5 billion, Merrill Lynch will sell new stock to Temasek at a discount to the recent market price. It will sell an additional US$1.2 billion in discounted shares to Davis Selected Advisers, a big money management firm based in Tucson, Arizona. Together, these two investors will gain a stake of less than 10 percent in Merrill. Neither will have a role in the management of the firm nor any presence on its board.

Merrill may have to strengthen its capital position further given the likelihood of widening losses on its mortgage investments.

"If, after fourth-quarter earnings, we find that we need to enhance it further, we will," said a person close to the situation.

While news of Monday's deals initially lifted its stock, the shares quickly wiped out their gain to close down 2.95 percent at US$58.90 in a holiday-shortened session. By selling new stock, Merrill will dilute the stakes of existing shareholders.

Temasek, which is controlled by Singapore's finance ministry and manages a portion of the city-state's foreign exchange reserves, has been stepping up its investments inside and outside Asia. In September it was invited by Barclays of Britain -- along with the China Development Bank -- to become shareholders, in exchange for a cash infusion that Barclays needed to improve its offer for the Dutch bank ABN Amro.

Other sovereign wealth funds have also swooped down on weakened Western financial companies. Singapore's lesser-known government fund, the Government of Singapore Investment Corp, recently agreed to invest US$9.7 billion in UBS. Citigroup is selling a US$7.5 billion stake to the Abu Dhabi Investment Authority. And last week, Morgan Stanley agreed to sell a US$5 billion stake to the China Investment Corp.

While they are based on opposite sides of the world, both Temasek and Davis have a record of buying beaten down stocks and holding them for long periods. Both also have significant investments in financial services firms. Temasek's holdings are largely in Asia. Davis has big stakes in blue-chip companies like American Express, AIG and JPMorgan Chase.

UPDATED (3:40pm): A suspected gas explosion at a shopping mall in Taichung this morning has killed four people and injured 20 others, as emergency responders continue to investigate. The explosion occurred on the 12th floor of the Shin Kong Mitsukoshi in Situn District (西屯) at 11:33am. One person was declared dead at the scene, while three people were declared deceased later after receiving emergency treatment. Another 20 people sustained major or minor injuries. The Taichung Fire Bureau said it received a report of the explosion at 11:33am and sent rescuers to respond. The cause of the explosion is still under investigation, it said. The National Fire

ACCOUNTABILITY: The incident, which occured at a Shin Kong Mitsukoshi Department Store in Taichung, was allegedly caused by a gas explosion on the 12th floor Shin Kong Group (新光集團) president Richard Wu (吳昕陽) yesterday said the company would take responsibility for an apparent gas explosion that resulted in four deaths and 26 injuries at Shin Kong Mitsukoshi Zhonggang Store in Taichung yesterday. The Taichung Fire Bureau at 11:33am yesterday received a report saying that people were injured after an explosion at the department store on Section 3 of Taiwan Boulevard in Taichung’s Situn District (西屯). It sent 56 ambulances and 136 paramedics to the site, with the people injured sent to Cheng Ching Hospital’s Chung Kang Branch, Wuri Lin Shin Hospital, Taichung Veterans General Hospital or Chung

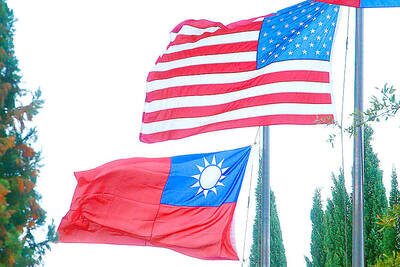

‘TAIWAN-FRIENDLY’: The last time the Web site fact sheet removed the lines on the US not supporting Taiwanese independence was during the Biden administration in 2022 The US Department of State has removed a statement on its Web site that it does not support Taiwanese independence, among changes that the Taiwanese government praised yesterday as supporting Taiwan. The Taiwan-US relations fact sheet, produced by the department’s Bureau of East Asian and Pacific Affairs, previously stated that the US opposes “any unilateral changes to the status quo from either side; we do not support Taiwan independence; and we expect cross-strait differences to be resolved by peaceful means.” In the updated version published on Thursday, the line stating that the US does not support Taiwanese independence had been removed. The updated

‘LAWFUL USE’: The last time a US warship transited the Taiwan Strait was on Oct. 20 last year, and this week’s transit is the first of US President Donald Trump’s second term Two US military vessels transited the Taiwan Strait from Sunday through early yesterday, the Ministry of National Defense said in a statement, the first such mission since US President Donald Trump took office last month. The two vessels sailed south through the Strait, the ministry said, adding that it closely monitored nearby airspace and waters at the time and observed nothing unusual. The ministry did not name the two vessels, but the US Navy identified them as the Arleigh Burke-class guided-missile destroyer USS Ralph Johnson and the Pathfinder-class survey ship USNS Bowditch. The ships carried out a north-to-south transit from