Two former executives of BNP Paribas North America, the New York-based unit of the large French bank, pleaded guilty Wednesday to stealing more than US$12 million from their employer, in a case brought by Robert Morgenthau, the Manhattan district attorney, and the Federal Reserve Bank of New York.

The two men, Edward Canale and Michael Connolly, who worked in the bank's junk bond trading and distressed real estate operations, set up shell companies that bought securities from BNP Paribas at prices significantly below those in the prevailing market.

The securities were later sold at considerable gains.

"This is about equal justice and about making sure that nobody is above the law," Morgenthau said. "We want to make people understand that when you steal, even though you are a banker with a suit and tie on, you're going to be prosecuted."

Canale and Connolly, who were arrested on Wednesday, have repaid US$8 million of the US$12.2 million that they stole, Morgenthau said, and have promised to pay back the rest.

Judge Michael Ambrecht of New York State Supreme Court, before whom the men pleaded guilty, said Canale would receive a sentence of two to six years in state prison and Connolly would be sentenced to 18 months to four and a half years. The two will be sentenced in February.

They were released on Wednesday on their own recognizance.

Three-year scheme

Canale, 56, and Connolly, 34, began their scheme in June 2001, prosecutors said, when they established two New York-based shell companies, Hydra Capital and Brel Associates.

The two companies profited by buying junk bonds and other debt securities from BNP Paribas at heavily discounted prices and then selling them for profits soon afterward.

The men also diverted payouts and equity conversions owed to BNP Paribas from companies that were being restructured.

Prosecutors said they learned of the scheme last March from a bank employee.

One transaction cited by pro-secutors involved bonds issued by Confederation Life Insurance, a company in liquidation, which netted US$5.6 million for Canale and Connolly. Another transaction, which produced gains of almost US$900,000, involved bonds of Rhythms Net-connections, a telecommunications company that filed for bankruptcy in August 2001.

quiet transactions

Securities of distressed compan-ies, like those used in the scheme, trade infrequently and are difficult to value because transactions are not posted publicly as they are in the stock market.

Canale, a managing director at BNP Paribas until he was put on leave earlier this year, joined the bank in 1992. Before that, he had been an executive at a savings and loan institution.

During the years that the theft occurred, Canale ran BNP Paribas' asset workout group, which deals in securities of distressed or bankrupt companies.

Canale hired Connolly to run the junk bond portfolio at BNP Paribas in 2001, prosecutors said.

The way the operation was set up, any sale of distressed debt from the bank's portfolio had to be approved by both Canale and Connolly.

BNP Paribas is among the largest banks in Europe by market value and the ninth-largest bank in the world. In North America, BNP Paribas offers commercial banking, investment banking and securities brokerage services.

Morgenthau said that the investigation was continuing and that the two men were cooperating with prosecutors.

That Canale and Connolly could steal US$12.2 million without attracting the attention of regulators might have been because the bank's primary regulator was the Federal Reserve of San Francisco, Morgenthau said.

Even though BNP Paribas is based in and conducts much of its business in New York City, the bank did not file regular reports with the New York state banking department, he said.

ENDEAVOR MANTA: The ship is programmed to automatically return to its designated home port and would self-destruct if seized by another party The Endeavor Manta, Taiwan’s first military-specification uncrewed surface vehicle (USV) tailor-made to operate in the Taiwan Strait in a bid to bolster the nation’s asymmetric combat capabilities made its first appearance at Kaohsiung’s Singda Harbor yesterday. Taking inspiration from Ukraine’s navy, which is using USVs to force Russia’s Black Sea fleet to take shelter within its own ports, CSBC Taiwan (台灣國際造船) established a research and development unit on USVs last year, CSBC chairman Huang Cheng-hung (黃正弘) said. With the exception of the satellite guidance system and the outboard motors — which were purchased from foreign companies that were not affiliated with Chinese-funded

PERMIT REVOKED: The influencer at a news conference said the National Immigration Agency was infringing on human rights and persecuting Chinese spouses Chinese influencer “Yaya in Taiwan” (亞亞在台灣) yesterday evening voluntarily left Taiwan, despite saying yesterday morning that she had “no intention” of leaving after her residence permit was revoked over her comments on Taiwan being “unified” with China by military force. The Ministry of the Interior yesterday had said that it could forcibly deport the influencer at midnight, but was considering taking a more flexible approach and beginning procedures this morning. The influencer, whose given name is Liu Zhenya (劉振亞), departed on a 8:45pm flight from Taipei International Airport (Songshan airport) to Fuzhou, China. Liu held a news conference at the airport at 7pm,

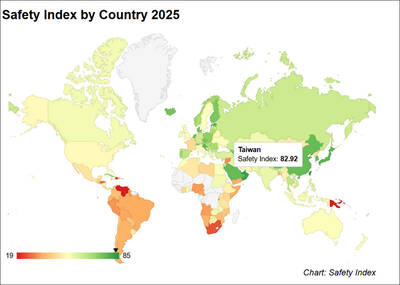

Taiwan was ranked the fourth-safest country in the world with a score of 82.9, trailing only Andorra, the United Arab Emirates and Qatar in Numbeo’s Safety Index by Country report. Taiwan’s score improved by 0.1 points compared with last year’s mid-year report, which had Taiwan fourth with a score of 82.8. However, both scores were lower than in last year’s first review, when Taiwan scored 83.3, and are a long way from when Taiwan was named the second-safest country in the world in 2021, scoring 84.8. Taiwan ranked higher than Singapore in ninth with a score of 77.4 and Japan in 10th with

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —