US Federal Reserve Chairman Alan Greenspan removed a major obstacle to a rise in interest rates on Monday, declaring the end of a near year-long deflationary threat.

Banks were prepared for rising rates, he said.

"It is apparent that pricing power is gradually being restored," Greenspan told a Senate Banking panel.

"Threats of deflation, which were a significant concern last year, by all independent indications are no longer an issue before us," the powerful 78-year-old central bank chief said.

"Clearly, it is a change that has occurred in the last number of weeks and it is a change, as best I can see, that has been long overdue and most welcome," he said.

It was his first clear pronouncement of the death of the deflation risk, removing one of the biggest obstacles lying between the Federal Reserve and a rise in near rock-bottom interest rates.

Federal Reserve policymakers have cited the threat of deflation for 11 months.

The risk, though minimal, of a broad decline in consumer prices was judged to be so grave that it justified keeping key short-term interest rates at the lowest level since 1958 for the past 10 months.

But official figures showed core consumer prices rose 0.4 percent last month, the steepest increase in underlying inflation in three years.

The prospect of an economy-cooling rise in interest rates spooked investors, sending the Dow Jones industrial average tumbling 123.35 points, or 1.18 percent, to 10,314.50.

The dollar, which attracts buyers when returns are boosted by higher rates, strengthened. The euro dropped to US$1.1858 in the afternoon from US$1.2023 late Monday.

Greenspan was speaking amid feverish worldwide speculation that he may soon decide to lift the key federal funds rate, which banks charge each other, from 1 percent.

Some investors fear banks and major financial institutions would be hurt by such a move.

But Greenspan said the data showed that the banking industry was adequately managing its interest rate exposure.

"Many banks indicate that they now either are interest-rate neutral or are positioned to benefit from rising rates," he said.

Some economists say the Federal Reserve may raise rates as soon as June if consumer prices keep rising and if employers sustain a recent spurt in jobs creation.

Policymakers had cut the federal funds target rate 13 times since January 2001, when it stood at 6.5 percent, to counteract the Internet bubble, Sept. 11, 2001 attacks, corporate scandals and the US-led Afghan and Iraq wars.

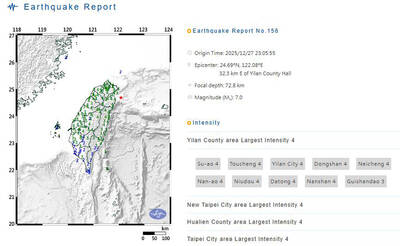

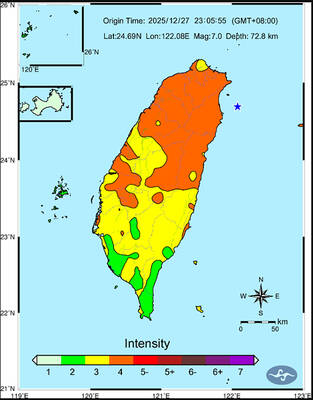

A magnitude 7.0 earthquake struck off Yilan at 11:05pm yesterday, the Central Weather Administration (CWA) said. The epicenter was located at sea, about 32.3km east of Yilan County Hall, at a depth of 72.8km, CWA data showed There were no immediate reports of damage. The intensity of the quake, which gauges the actual effect of a seismic event, measured 4 in Yilan County area on Taiwan’s seven-tier intensity scale, the data showed. It measured 4 in other parts of eastern, northern and central Taiwan as well as Tainan, and 3 in Kaohsiung and Pingtung County, and 2 in Lienchiang and Penghu counties and 1

FOREIGN INTERFERENCE: Beijing would likely intensify public opinion warfare in next year’s local elections to prevent Lai from getting re-elected, the ‘Yomiuri Shimbun’ said Internal documents from a Chinese artificial intelligence (AI) company indicated that China has been using the technology to intervene in foreign elections, including propaganda targeting Taiwan’s local elections next year and presidential elections in 2028, a Japanese newspaper reported yesterday. The Institute of National Security of Vanderbilt University obtained nearly 400 pages of documents from GoLaxy, a company with ties to the Chinese government, and found evidence that it had apparently deployed sophisticated, AI-driven propaganda campaigns in Hong Kong and Taiwan to shape public opinion, the Yomiuri Shimbun reported. GoLaxy provides insights, situation analysis and public opinion-shaping technology by conducting network surveillance

‘POLITICAL GAME’: DPP lawmakers said the motion would not meet the legislative threshold needed, and accused the KMT and the TPP of trivializing the Constitution The Legislative Yuan yesterday approved a motion to initiate impeachment proceedings against President William Lai (賴清德), saying he had undermined Taiwan’s constitutional order and democracy. The motion was approved 61-50 by lawmakers from the main opposition Chinese Nationalist Party (KMT) and the smaller Taiwan People’s Party (TPP), who together hold a legislative majority. Under the motion, a roll call vote for impeachment would be held on May 19 next year, after various hearings are held and Lai is given the chance to defend himself. The move came after Lai on Monday last week did not promulgate an amendment passed by the legislature that

AFTERMATH: The Taipei City Government said it received 39 minor incident reports including gas leaks, water leaks and outages, and a damaged traffic signal A magnitude 7.0 earthquake struck off Taiwan’s northeastern coast late on Saturday, producing only two major aftershocks as of yesterday noon, the Central Weather Administration (CWA) said. The limited aftershocks contrast with last year’s major earthquake in Hualien County, as Saturday’s earthquake occurred at a greater depth in a subduction zone. Saturday’s earthquake struck at 11:05pm, with its hypocenter about 32.3km east of Yilan County Hall, at a depth of 72.8km. Shaking was felt in 17 administrative regions north of Tainan and in eastern Taiwan, reaching intensity level 4 on Taiwan’s seven-tier seismic scale, the CWA said. In Hualien, the