The Iranian economy is starting to feel the sting from a raft of banking sanctions applied by the US to pressure Tehran over its controversial nuclear drive, analysts said.

Washington has blacklisted Iran's three main banks and has also successfully encouraged virtually all major European banks to cut business with the Islamic republic.

"Practically all the major European banks have ceased their cooperation with Iran," said an official from Iran's Export Development Bank, who asked not to be named.

"It is no longer possible to wire money by dollar into Iran and for the payments in euro there are just three European banks. They could stop cooperating with us at any moment," the official said.

British-Asian bank HSBC and the Swiss giants UBS and Credit Suisse were the first to cut business with Iran last year while Deutsche Bank, Commerzbank and BNP Paribas have followed suit this year.

Meanwhile, Washington has blacklisted Iranian banks Melli, Mellat and Saderat, accusing them of acting as a conduit for "terrorist financing" -- something the banks vehemently deny.

The decision has effectively cut the Iranian banks off from the dollar-based financial system and turned them into pariah institutions with whom their foreign counterparts are unwilling to deal.

"There has never been a single example of the involvement of the bank in any illegal activity," Bank Mellat said in an angry statement rejecting the allegations.

But it acknowledged the measures would be felt by ordinary Iranians: "It may inflict harm on the lives of ordinary people using services."

The moves against the Iranian financial system have been in parallel to two sets of UN sanctions against its ballistic missile and nuclear programs. But it is the unilateral US actions that are being felt most keenly in Iran.

In essence, the sanctions aim at cutting off Iran's financial lifeblood.

Foreign banks, who were already refusing to accept letters of credit issued by their Iranian counterparts, are now refusing to carry out even simple operations of money transfers to Iran.

"We wanted to import equipment to construct prefabricated houses but the Australian banks refused to accept letters of credit," said Touraj, an Iranian businessman who preferred not to give his surname.

Even Asian banks from countries that still have close economic links with Iran -- such as South Korea and China -- have been imposing restrictions on business with the Islamic republic.

"The big banks from China, one of Iran's most important partners, are now refusing to deal with Iran as they have important interests in the United States and fear reprisals," said Mehrdad Mahmoudi, a leading currency dealer.

Even banks on the Arabian peninsula -- notably those from the United Arab Emirates -- a US ally and Iran's No. 1 trading partner -- may not be prepared to deal with the Islamic republic over the long haul.

"Iranian banks can still use the services of small Asian banks or the Persian Gulf but that will not last forever," said Bijan Khajepour, director of Atieh Consulting in Tehran.

"Firms are increasingly having to pay in cash or go through a third country to import their goods which will make the finished product even more expensive," he said.

Iran's status as the world's fourth-largest oil exporter and OPEC's second-largest means it cannot allow itself to become detached from the world economy.

Foreign currency oil revenues are expected to reach US$70 billion this year.

"The aim of the Americans is to cut financial links between Iran and the rest of the world," said a banking expert, who asked not to be named.

"The great lesson of North Korea that the Americans understood was that they do not necessarily need to resort to the [UN] Security Council," he said, referring to US pressure on Pyong-yang's nuclear program.

"They can exercise the maximum pressure just by imposing sanctions through their own financial system," he said.

Indonesia yesterday began enforcing its newly ratified penal code, replacing a Dutch-era criminal law that had governed the country for more than 80 years and marking a major shift in its legal landscape. Since proclaiming independence in 1945, the Southeast Asian country had continued to operate under a colonial framework widely criticized as outdated and misaligned with Indonesia’s social values. Efforts to revise the code stalled for decades as lawmakers debated how to balance human rights, religious norms and local traditions in the world’s most populous Muslim-majority nation. The 345-page Indonesian Penal Code, known as the KUHP, was passed in 2022. It

‘DISRESPECTFUL’: Katie Miller, the wife of Trump’s most influential adviser, drew ire by posting an image of Greenland in the colors of the US flag, captioning it ‘SOON’ US President Donald Trump on Sunday doubled down on his claim that Greenland should become part of the US, despite calls by the Danish prime minister to stop “threatening” the territory. Washington’s military intervention in Venezuela has reignited fears for Greenland, which Trump has repeatedly said he wants to annex, given its strategic location in the arctic. While aboard Air Force One en route to Washington, Trump reiterated the goal. “We need Greenland from the standpoint of national security, and Denmark is not going to be able to do it,” he said in response to a reporter’s question. “We’ll worry about Greenland in

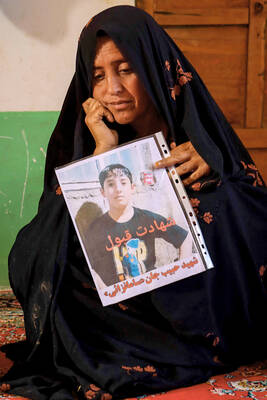

PERILOUS JOURNEY: Over just a matter of days last month, about 1,600 Afghans who were at risk of perishing due to the cold weather were rescued in the mountains Habibullah set off from his home in western Afghanistan determined to find work in Iran, only for the 15-year-old to freeze to death while walking across the mountainous frontier. “He was forced to go, to bring food for the family,” his mother, Mah Jan, said at her mud home in Ghunjan village. “We have no food to eat, we have no clothes to wear. The house in which I live has no electricity, no water. I have no proper window, nothing to burn for heating,” she added, clutching a photograph of her son. Habibullah was one of at least 18 migrants who died

Russia early yesterday bombarded Ukraine, killing two people in the Kyiv region, authorities said on the eve of a diplomatic summit in France. A nationwide siren was issued just after midnight, while Ukraine’s military said air defenses were operating in several places. In the capital, a private medical facility caught fire as a result of the Russian strikes, killing one person and wounding three others, the State Emergency Service of Kyiv said. It released images of rescuers removing people on stretchers from a gutted building. Another pre-dawn attack on the neighboring city of Fastiv killed one man in his 70s, Kyiv Governor Mykola