Lawmakers yesterday passed the Act on Financial Technology Innovations and Experiments (金融科技創新實驗條例) in a bid to upgrade the nation’s financial sector by granting technology firms more leeway when experimenting with innovative financial services.

The act was inspired by a sandbox proposed by the UK Financial Conduct Authority for field-testing financial services by tech firms.

Firms that have passed an assessment to use the sandbox would be allowed to bypass — in part or in full — certain regulations after gaining the approval of the Financial Supervisory Commission (FSC), the act stipulates.

Photo: Chen Chih-chu, Taipei Times

The FSC is to consult responsible agencies when it wants a test financial service to be exempted from certain rules, with the exception of the Money Laundering Control Act (洗錢防制法) and the Act Against the Threats of Hacking (資恐防治法), which cannot be exempted, it says.

In addition, a review committee is to be established under the FSC to review plans.

To promote innovation, the committee is required to hire experts from the private sector for between one-third and half of its staff, with the rest composed of representatives from government agencies, the act states.

To avoid profitability being harmed by red tape, the committee is to decide within 60 days of a submission whether it qualifies for the sandbox. Approved plans would then be given an 18-month time frame within which firms would be allowed to launch trial runs of their services.

The 18-month period may be extended to no more than 36 months at the discretion of the FSC.

The review committee is to submit a report to the Legislative Yuan detailing the results of a project and which regulations should be changed within 90 days of the end of a trial, so that a new service may be put on the financial market after necessary legal amendments are approved.

People who experience financial losses as a result of their participation in a financial service test are protected by the Financial Consumer Protection Act (金融消費者保護法) and should file complaints with the Financial Ombudsman Institution.

Democratic Progressive Party Legislator Karen Yu (余宛如), who initiated the bill, said that the passage of the act makes Taiwan the first nation in the world to introduce a financial regulatory sandbox law.

The act would greatly increase the flexibility of financial-oriented regulations that have been limiting innovation, Yu said, adding that it would also break down barriers between sectors, so that tech and financial firms can work together seamlessly.

The sandbox model can also be applied to a variety of fields, such as the research and development of drones, she added.

Chinese Nationalist Party (KMT) Legislator Jason Hsu (許毓仁) said the three-year trial period offered by the sandbox is the longest in the world and lauded the act as “ushering in a new era for Taiwan’s financial technology.”

He said the legislation came later than some would have hoped, as the nation’s achievements in innovative financial services have trailed behind several others in the region such as Hong Kong and South Korea, but the passage of the act was “better late than never.”

DEFENSE: The National Security Bureau promised to expand communication and intelligence cooperation with global partners and enhance its strategic analytical skills China has not only increased military exercises and “gray zone” tactics against Taiwan this year, but also continues to recruit military personnel for espionage, the National Security Bureau (NSB) said yesterday in a report to the Legislative Yuan. The bureau submitted the report ahead of NSB Director-General Tsai Ming-yen’s (蔡明彥) appearance before the Foreign and National Defense Committee today. Last year, the Chinese People’s Liberation Army (PLA) conducted “Joint Sword-2024A and B” military exercises targeting Taiwan and carried out 40 combat readiness patrols, the bureau said. In addition, Chinese military aircraft entered Taiwan’s airspace 3,070 times last year, up about

The Overseas Community Affairs Council (OCAC) yesterday announced a fundraising campaign to support survivors of the magnitude 7.7 earthquake that struck Myanmar on March 28, with two prayer events scheduled in Taipei and Taichung later this week. “While initial rescue operations have concluded [in Myanmar], many survivors are now facing increasingly difficult living conditions,” OCAC Minister Hsu Chia-ching (徐佳青) told a news conference in Taipei. The fundraising campaign, which runs through May 31, is focused on supporting the reconstruction of damaged overseas compatriot schools, assisting students from Myanmar in Taiwan, and providing essential items, such as drinking water, food and medical supplies,

STRICTER ENFORCEMENT: Taipei authorities warned against drunk cycling after a sharp rise in riding under the influence, urging greater public awareness of its illegality Taipei authorities have issued a public warning urging people not to ride bicycles after consuming alcohol, following a sharp rise in riding under the influence (DUI) cases involving bicycles. Five hundred and seven people were charged with DUI last year while riding YouBikes, personal bicycles, or other self-propelled two-wheelers — a fourfold increase from the previous year, data released by the Taipei Police Department’s Traffic Division showed. Of these, 33 cases were considered severe enough to be prosecuted under “offenses against public safety,” the data showed. Under the Road Traffic Management and Penalty Act (道路交通管理處罰條例), bicycles — including YouBikes and other

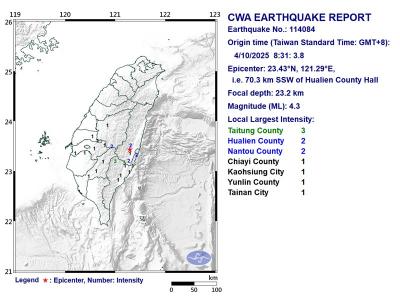

A magnitude 4.3 earthquake struck eastern Taiwan's Hualien County at 8:31am today, according to the Central Weather Administration (CWA). The epicenter of the temblor was located in Hualien County, about 70.3 kilometers south southwest of Hualien County Hall, at a depth of 23.2km, according to the administration. There were no immediate reports of damage resulting from the quake. The earthquake's intensity, which gauges the actual effect of a temblor, was highest in Taitung County, where it measured 3 on Taiwan's 7-tier intensity scale. The quake also measured an intensity of 2 in Hualien and Nantou counties, the CWA said.