Taiwanese listed companies and those traded on the over-the-counter (OTC) market have wired NT$1.08 trillion (US$34.5 billion) to China since President Ma Ying-jeou (馬英九) took office in May 2008.

That is more than 50 percent of the total NT$1.96 trillion that has been invested since listed and OTC companies were allowed to begin investing in China almost two decades ago.

The record for the most money wired to China in a year has been set — and broken — during Ma’s first and second terms, showing that Taiwanese capital’s flow to China has been accelerating.

According the recently released report on listed and OTC firms’ remittances last year, a total of NT$188.1 billion was sent to China — a 17 percent increase compared with the NT$160.8 billion sent in 2013 and the second-highest record of all time.

The highest amount sent was in 2011, when NT$194.9 billion was wired to China.

In the past six years, only 2009 saw less than NT$160 billion remitted, and remittances have topped that amount every year since 2010.

Meanwhile, only NT$8.65 billion was repatriated from China last year, the second-lowest amount in the past six years and almost one-third less than the NT$12 billion wired back in 2013 and 2012

The amount repatriated last year was just 4.6 percent of that remitted to China, which was apparently less than the 7 percent seen in the preceding two years.

Over the past six years, the total amount repatriated from China by listed and OTC Taiwanese companies was NT$64.05 billion, less than 6 percent of NT$1.08 trillion that they invested in China.

The total amount repatriated by these Taiwanese companies in China over the past two decades is NT$186.4 billion, less than 10 percent what they invested across the Taiwan Strait during that period.

Since Ma became president, not only was the amount wired back only one-third of the total amount repatriated since the investment ban was lifted, but the amount wired out was more than half of the total that has been repatriated; the capital flow across the Taiwan Strait has been highly disproportionate.

Most notable about last year’s direct investment in China by listed and OTC companies was that the remittances from Taiwan’s financial sector for the first time surpassed those of the electronics sector.

The financial sector invested a total of NT$68.4 billion, of which Fubon Financial Holding Co’s investment in China’s Hua Yi Bank accounted for NT$27.1 billion — the biggest Taiwanese investment in China last year.

Fubon Financial was also the listed company that invested the most in China last year.

Cathay Financial Holding Co was the next-biggest investor, wiring NT$13.2 billion, NT$4.8 billion was an investment in the Shanghai branch of Cathay United Bank and NT$2.9 billion went for the Qingdao branch, while NT$3.4 billion was invested in a subsidiary of Cathay Life Insurance and purchasing a commercial building for it.

State-run banks also contributed to the capital outflow.

First Financial Holding Co wired out NT$6.1 billion, Taiwan Cooperative Bank sent NT$5.9 billion and Chang Hwa Commercial Bank (彰化銀行) NT$4.9 billion.

Ever since the Ma administration granted permission for the financial sector to invest in China, the capital flow across the Taiwan Strait has skyrocketed.

Among the other big players investing in China last year were Hon Hai Precision Industry Co, which was ranked third among all of the listed and OTC companies, with NT$10.7 billion; Uni-President Group transferred NT$5.5 billion, MediaTek NT$4.6 billion, Taiwan Surface Mounting Technology Corp and Delta Electronics NT$4.1 billion each and Lite-On Technology Corp NT$4 billion.

Original equipment manufacturing firms, including Compal Electronics Co, Asustek Computer, Inventec Corp and panelmakers such as AU Optronics Corp and Innolux Corp, last year all saw reductions in the amount they invested in China.

The Mainland Affairs Council yesterday said the vast difference between what listed and OTC Taiwanese firms invested in China and what they repatriated was due to the companies using the capital they earned to expand the scope of their Chinese investments.

Such investments actually increased cross-strait trade, so the apparent acceleration of Taiwanese capital’s flow to China was not an issue, the council said.

Chinese Nationalist Party (KMT) Chairman Eric Chu (朱立倫), spokeswoman Yang Chih-yu (楊智伃) and Legislator Hsieh Lung-chieh (謝龍介) would be summoned by police for questioning for leading an illegal assembly on Thursday evening last week, Minister of the Interior Liu Shyh-fang (劉世芳) said today. The three KMT officials led an assembly outside the Taipei City Prosecutors’ Office, a restricted area where public assembly is not allowed, protesting the questioning of several KMT staff and searches of KMT headquarters and offices in a recall petition forgery case. Chu, Yang and Hsieh are all suspected of contravening the Assembly and Parade Act (集會遊行法) by holding

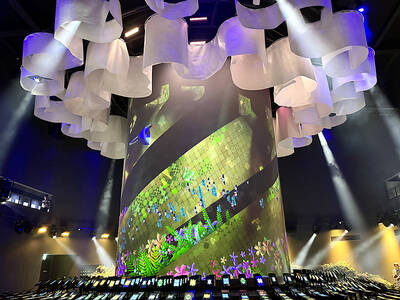

PRAISE: Japanese visitor Takashi Kubota said the Taiwanese temple architecture images showcased in the AI Art Gallery were the most impressive displays he saw Taiwan does not have an official pavilion at the World Expo in Osaka, Japan, because of its diplomatic predicament, but the government-backed Tech World pavilion is drawing interest with its unique recreations of works by Taiwanese artists. The pavilion features an artificial intelligence (AI)-based art gallery showcasing works of famous Taiwanese artists from the Japanese colonial period using innovative technologies. Among its main simulated displays are Eastern gouache paintings by Chen Chin (陳進), Lin Yu-shan (林玉山) and Kuo Hsueh-hu (郭雪湖), who were the three young Taiwanese painters selected for the East Asian Painting exhibition in 1927. Gouache is a water-based

Taiwan would welcome the return of Honduras as a diplomatic ally if its next president decides to make such a move, Minister of Foreign Affairs Lin Chia-lung (林佳龍) said yesterday. “Of course, we would welcome Honduras if they want to restore diplomatic ties with Taiwan after their elections,” Lin said at a meeting of the legislature’s Foreign Affairs and National Defense Committee, when asked to comment on statements made by two of the three Honduran presidential candidates during the presidential campaign in the Central American country. Taiwan is paying close attention to the region as a whole in the wake of a

OFF-TARGET: More than 30,000 participants were expected to take part in the Games next month, but only 6,550 foreign and 19,400 Taiwanese athletes have registered Taipei city councilors yesterday blasted the organizers of next month’s World Masters Games over sudden timetable and venue changes, which they said have caused thousands of participants to back out of the international sporting event, among other organizational issues. They also cited visa delays and political interference by China as reasons many foreign athletes are requesting refunds for the event, to be held from May 17 to 30. Jointly organized by the Taipei and New Taipei City governments, the games have been rocked by numerous controversies since preparations began in 2020. Taipei City Councilor Lin Yen-feng (林延鳳) said yesterday that new measures by