A former government official warned yesterday that Chinese investors could become majority shareholders of up to half of Taiwan’s 16 financial holding companies and almost 40 percent of the banks in Taiwan under the cross-strait service trade agreement.

“The question is whether the nation wants to hand its financial autonomy to a country which claims that Taiwan is part of its territory and does not rule out taking it by force,” former Financial Supervisory Commission (FSC) chairperson Shih Chun-chi (施俊吉) said.

Shih, who headed the financial regulatory agency in 2006 and 2007, made the comments at a forum organized by the Democratic Progressive Party (DPP) to examine its governance performance between 2000 and 2008.

While the DPP has focused its opposition to the agreement on the pact’s possible negative impacts on the local beauty parlor sector, the printing and publishing industries and small businesses, Shih said that the banking sector might be most affected when the pact takes effect.

Under the agreement, Chinese investors would be allowed to hold up to 10 percent of the total shares of financial holding companies and 20 percent of the total shares of any financial holding company’s subsidiary bank, he said.

Most shareholders of the current 16 financial holding companies control less than 10 percent of the total shares, among them the Koo (辜) family, the biggest shareholder of CTBC Financial Holding Co (中信金控) with 8 percent of the total shares, he said.

Shih estimated that Chinese capital would be able to control eight of the 16 financial holding companies and up to 14 of Taiwan’s 38 banks.

“After the signing of the service trade pact, the door has been opened. Now, it is a national security issue,” Shih said.

Local bankers who wanted to expand their businesses in China have been lobbying and advocating the benefit of an open banking market, focusing only on their personal gain, without taking national security into consideration, he said.

The DPP initiated two financial reforms while it was in power, with the first reform successfully reducing non-performing loans and the success of the second reform, which aimed to reduce the number of banks, still pending, he said.

Hu Seng-cheng (胡勝正), also a former FSC chairman under the DPP administration, and Lu Chun-wei (盧俊偉), a researcher at the Taiwan Institute of Economic Research, both agreed that the DPP was able to improve financial regulatory efficiency, which was the main reason Taiwan was able to stay relatively unaffected by the global financial crises in 2001 and in 2008.

If Taiwan is to face future challenges to its financial stability, the primary source of instability would inevitably come from China, given the increasing exchanges across the Strait, they said.

An essay competition jointly organized by a local writing society and a publisher affiliated with the Chinese Communist Party (CCP) might have contravened the Act Governing Relations Between the People of the Taiwan Area and the Mainland Area (臺灣地區與大陸地區人民關係條例), the Mainland Affairs Council (MAC) said on Thursday. “In this case, the partner organization is clearly an agency under the CCP’s Fujian Provincial Committee,” MAC Deputy Minister and spokesperson Liang Wen-chieh (梁文傑) said at a news briefing in Taipei. “It also involves bringing Taiwanese students to China with all-expenses-paid arrangements to attend award ceremonies and camps,” Liang said. Those two “characteristics” are typically sufficient

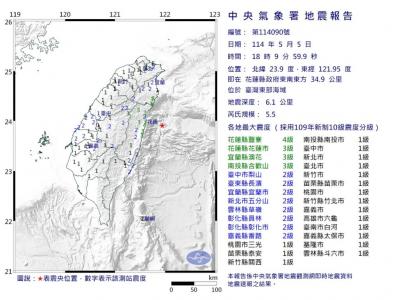

A magnitude 5.9 earthquake that struck about 33km off the coast of Hualien City was the "main shock" in a series of quakes in the area, with aftershocks expected over the next three days, the Central Weather Administration (CWA) said yesterday. Prior to the magnitude 5.9 quake shaking most of Taiwan at 6:53pm yesterday, six other earthquakes stronger than a magnitude of 4, starting with a magnitude 5.5 quake at 6:09pm, occurred in the area. CWA Seismological Center Director Wu Chien-fu (吳健富) confirmed that the quakes were all part of the same series and that the magnitude 5.5 temblor was

The brilliant blue waters, thick foliage and bucolic atmosphere on this seemingly idyllic archipelago deep in the Pacific Ocean belie the key role it now plays in a titanic geopolitical struggle. Palau is again on the front line as China, and the US and its allies prepare their forces in an intensifying contest for control over the Asia-Pacific region. The democratic nation of just 17,000 people hosts US-controlled airstrips and soon-to-be-completed radar installations that the US military describes as “critical” to monitoring vast swathes of water and airspace. It is also a key piece of the second island chain, a string of

The Central Weather Administration has issued a heat alert for southeastern Taiwan, warning of temperatures as high as 36°C today, while alerting some coastal areas of strong winds later in the day. Kaohsiung’s Neimen District (內門) and Pingtung County’s Neipu Township (內埔) are under an orange heat alert, which warns of temperatures as high as 36°C for three consecutive days, the CWA said, citing southwest winds. The heat would also extend to Tainan’s Nansi (楠西) and Yujing (玉井) districts, as well as Pingtung’s Gaoshu (高樹), Yanpu (鹽埔) and Majia (瑪家) townships, it said, forecasting highs of up to 36°C in those areas