The Cabinet recently dropped a proposal to allow individuals to deduct up to NT$12,000 (US$368) spent on cultural expenditures from their income taxes, but approved a proposal that would allow businesses to write off money spend buying tickets to cultural events for students as an operating loss or operating expense.

Under the proposal, there would be no limit to the amount a company could spend on tickets for elementary and junior high school students, which would help reduce its business income tax.

The Cabinet move drew mix reactions and prompted debates on whether it would help boost the cultural sector.

Premier Liu Chao-shiuan (劉兆玄) said earlier the tax incentive proposal was meant to encourage an interest in the arts in young people.

“I was very much impressed during a visit to an European friend who spends most of his income on cultural activities and eats simple meals based on bread and milk. To cultivate a devotion to arts should start in childhood,” Liu said.

Council for Council Affairs (CCA) official Fang Jy-shiuh (方芷絮) said on average, individuals spend 13 percent of their annual expenditures on arts and cultural activities. The government would like to see that raised in four years to 15 percent and has planned a series of programs aimed at doubling the output value of cultural and creative industry from NT$580 billion last year to NT$1 trillion a year, she said.

The government’s decision to drop the individual tax deduction in favor of businesses was criticized by Hsu Po-yun (??, founder of the New Aspect Cultural and Education Foundation and an adviser to President Ma Ying-jeou (馬英九).

Hsu said Liu had “made the wrong decision” and the move illustrated a lack of cultural education among policymakers

It was inappropriate to make a comparison between tax incentives for businesses with tax deductions for individuals because they served different functions.

Council for Cultural Affairs Minister Huang Pi-twin (黃碧端) previously said the main opposition to the individual tax deduction came from the Ministry of Finance, which estimated such a deduction would cost the treasury NT$6.5 billion a year and feared it might have a domino effect on other sectors.

Democratic Progressive Party Legislator Wong Chin-chu (翁金珠), who proposed a bill to offer the credit to taxpayers, said it was shortsighted of the government to focus on possible lost revenues.

It didn’t make sense for the government to say that offering tax credits for cultural expenses would lead to tax losses when the government often granted tax credits to businesses to encourage new investments on the basis such incentives would eventually bring in more revenue.

Chinese Nationalist Party (KMT) Legislator Kuo Su-chun (郭素春) disagreed.

A tax credit for taxpayers would only benefit people with medium and high incomes because low-income households prefer to take the standard deductions instead of itemizing deductions on their tax returns.

There could also be insurmountable technical difficulties in implementing an individual tax credit, Kuo said.

“For example, it would be a laborious task for tax officials to verify each and every receipt submitted by taxpayers to claim for the [cultural] tax deduction,” she said. “Some people might also use other people’s receipts to claim the deduction.”

Chinese Nationalist Party (KMT) Chairman Eric Chu (朱立倫), spokeswoman Yang Chih-yu (楊智伃) and Legislator Hsieh Lung-chieh (謝龍介) would be summoned by police for questioning for leading an illegal assembly on Thursday evening last week, Minister of the Interior Liu Shyh-fang (劉世芳) said today. The three KMT officials led an assembly outside the Taipei City Prosecutors’ Office, a restricted area where public assembly is not allowed, protesting the questioning of several KMT staff and searches of KMT headquarters and offices in a recall petition forgery case. Chu, Yang and Hsieh are all suspected of contravening the Assembly and Parade Act (集會遊行法) by holding

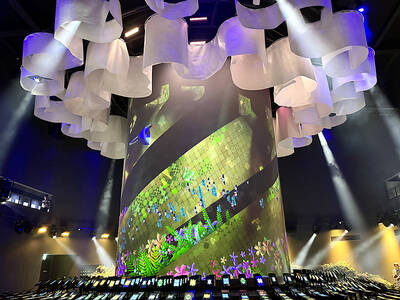

PRAISE: Japanese visitor Takashi Kubota said the Taiwanese temple architecture images showcased in the AI Art Gallery were the most impressive displays he saw Taiwan does not have an official pavilion at the World Expo in Osaka, Japan, because of its diplomatic predicament, but the government-backed Tech World pavilion is drawing interest with its unique recreations of works by Taiwanese artists. The pavilion features an artificial intelligence (AI)-based art gallery showcasing works of famous Taiwanese artists from the Japanese colonial period using innovative technologies. Among its main simulated displays are Eastern gouache paintings by Chen Chin (陳進), Lin Yu-shan (林玉山) and Kuo Hsueh-hu (郭雪湖), who were the three young Taiwanese painters selected for the East Asian Painting exhibition in 1927. Gouache is a water-based

Taiwan would welcome the return of Honduras as a diplomatic ally if its next president decides to make such a move, Minister of Foreign Affairs Lin Chia-lung (林佳龍) said yesterday. “Of course, we would welcome Honduras if they want to restore diplomatic ties with Taiwan after their elections,” Lin said at a meeting of the legislature’s Foreign Affairs and National Defense Committee, when asked to comment on statements made by two of the three Honduran presidential candidates during the presidential campaign in the Central American country. Taiwan is paying close attention to the region as a whole in the wake of a

OFF-TARGET: More than 30,000 participants were expected to take part in the Games next month, but only 6,550 foreign and 19,400 Taiwanese athletes have registered Taipei city councilors yesterday blasted the organizers of next month’s World Masters Games over sudden timetable and venue changes, which they said have caused thousands of participants to back out of the international sporting event, among other organizational issues. They also cited visa delays and political interference by China as reasons many foreign athletes are requesting refunds for the event, to be held from May 17 to 30. Jointly organized by the Taipei and New Taipei City governments, the games have been rocked by numerous controversies since preparations began in 2020. Taipei City Councilor Lin Yen-feng (林延鳳) said yesterday that new measures by