The nation’s economy has slumped while unemployment soared to a record high during President Ma Ying-jeou’s (馬英九) first year in office, though his administration managed to avert a confidence crisis thanks to a mix of interest rate cuts, tax reform and stimulus efforts.

Ma won the presidency by a wide margin after a campaign in which he made his “6-3-3 pledge” to raise GDP growth to 6 percent, trim unemployment to 3 percent and boost national per capita income to US$30,000 a year.

After Ma’s inauguration, Minister of Economic Affairs Yiin Chii-ming (尹啟銘) boasted that the TAIEX would rally to 20,000 points, from 9,068.89 on May 20 last year. The TAIEX yesterday stood at 6,655.59, a drop of 26.6 percent from a year ago.

GDP contracted 1.05 percent in the third quarter of last year and another 8.36 percent in the fourth quarter, in stark contrast with 5.4 percent growth in the first half of last year. The decline persists into this year, with analysts predicting a 10 percent contraction for the first quarter. The official figure is due out tomorrow.

The unemployment rate rose to a historic high of 5.81 percent last month, from 3.84 percent last May. Unemployment is expected to keep rising for months even once the economy has started to recover — analysts expect this to happen no sooner than the fourth quarter of this year.

Polaris Research Institute president Liang Kuo-yuan (梁國源) says that, as the global financial crisis began, the Ma administration underestimated its severity as well as its eventual impact on the nation’s export-dependent economy.

“Not until exports had suffered a two-digit decline did the government realize the seriousness of the economic dilemma,” Liang said. “That would account for its inaction and slow response last year.”

In November, the Directorate-General of Budget, Accounting and Statistics was still predicting that GDP would expand 2.12 percent this year, sustained by fiscal stimulus measures and warming trade relations with China. The optimism proved misplaced in February, when the statistics agency eventually revised its GDP growth forecast to minus 2.97 percent for this year.

The government seemed to wake up to the need for a more aggressive response after exports plunged 41.9 percent in December, when manufacturers complained that orders were drying up.

In January, the government distributed NT$3,600 consumer vouchers in the nation in the hope of stimulating private consumption. It also introduced a NT$500 billion (US$15.2 billion) spending program to improve infrastructure and create jobs over the next four years.

Liang said the measures might help mitigate the pain of the downturn.

The government has since moved to reduce dependence on the US, the epicenter of the economic turmoil, and has sought to promote trade with China, whose massive domestic market supposedly improves its ability to weather the global slump.

To that end, the Ma administration has raised the ceiling on China-bound investment to 60 percent of a company’s net worth, lifted bans on direct cross-strait flights and allowed investments from China.

Yang Chia-yen (楊家彥), a researcher at the Taiwan Institute of Economic Research, expressed concern about the tilt to China.

Yang said the recession exposed the need to revamp the nation’s industrial policy, which has long placed too much emphasis on a few electronic products sold to a few markets by a few industries.

“The increasing dependence on China — already our largest trade partner — will make Taiwan more vulnerable to external shocks,” Yang said.

Yang said the nation should rely more on domestic demand and bolster the service sector.

“That would entail mass legal reforms and construction,” Yang said. “It takes politicians with grand vision to embark on a venture that may not bear fruit for a long time.”

Norman Yin (殷乃平), a money and banking professor at National Chengchih University, said the government could have been more prudent in allocating funds, adding that its NT$58.3 billion budget for minor public works smacked more of pork-barrel spending than a true attempt to provide an economic stimulus.

Private sector players seemed to be less critical of the administration after the TAIEX recently regained some momentum.

Roscher Lin (林秉彬), president of the National Association of Small and Medium Enterprises, says the government averted a systematic liquidity strain by asking banks not to tighten credit and providing a blanket guarantee of saving deposits.

Lin also lauded the reduction of inheritance tax, which he said lured more than US$20 billion in capital home and invigorated the equity market despite poor economic fundamentals.

“The prospects remain uncertain but appear less dismal now,” Lin said.

Stanley Su (蘇啟榮), a senior researcher at Sinyi Realty Co, Taiwan’s only listed property broker, agreed.

Su said slumping property transactions stabilized in March, thanks to a series of rate cuts and recent rallies in the equity market.

“Owing to the easy monetary policy and preferential interest rates on mortgage loans, the property market contracted less than the market expectation,” Su said.

GRAPHIC: TAIPEI TIMES

Chinese Nationalist Party (KMT) Chairman Eric Chu (朱立倫), spokeswoman Yang Chih-yu (楊智伃) and Legislator Hsieh Lung-chieh (謝龍介) would be summoned by police for questioning for leading an illegal assembly on Thursday evening last week, Minister of the Interior Liu Shyh-fang (劉世芳) said today. The three KMT officials led an assembly outside the Taipei City Prosecutors’ Office, a restricted area where public assembly is not allowed, protesting the questioning of several KMT staff and searches of KMT headquarters and offices in a recall petition forgery case. Chu, Yang and Hsieh are all suspected of contravening the Assembly and Parade Act (集會遊行法) by holding

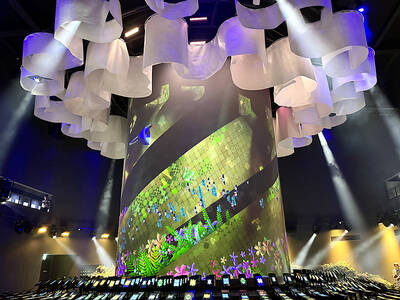

PRAISE: Japanese visitor Takashi Kubota said the Taiwanese temple architecture images showcased in the AI Art Gallery were the most impressive displays he saw Taiwan does not have an official pavilion at the World Expo in Osaka, Japan, because of its diplomatic predicament, but the government-backed Tech World pavilion is drawing interest with its unique recreations of works by Taiwanese artists. The pavilion features an artificial intelligence (AI)-based art gallery showcasing works of famous Taiwanese artists from the Japanese colonial period using innovative technologies. Among its main simulated displays are Eastern gouache paintings by Chen Chin (陳進), Lin Yu-shan (林玉山) and Kuo Hsueh-hu (郭雪湖), who were the three young Taiwanese painters selected for the East Asian Painting exhibition in 1927. Gouache is a water-based

Taiwan would welcome the return of Honduras as a diplomatic ally if its next president decides to make such a move, Minister of Foreign Affairs Lin Chia-lung (林佳龍) said yesterday. “Of course, we would welcome Honduras if they want to restore diplomatic ties with Taiwan after their elections,” Lin said at a meeting of the legislature’s Foreign Affairs and National Defense Committee, when asked to comment on statements made by two of the three Honduran presidential candidates during the presidential campaign in the Central American country. Taiwan is paying close attention to the region as a whole in the wake of a

OFF-TARGET: More than 30,000 participants were expected to take part in the Games next month, but only 6,550 foreign and 19,400 Taiwanese athletes have registered Taipei city councilors yesterday blasted the organizers of next month’s World Masters Games over sudden timetable and venue changes, which they said have caused thousands of participants to back out of the international sporting event, among other organizational issues. They also cited visa delays and political interference by China as reasons many foreign athletes are requesting refunds for the event, to be held from May 17 to 30. Jointly organized by the Taipei and New Taipei City governments, the games have been rocked by numerous controversies since preparations began in 2020. Taipei City Councilor Lin Yen-feng (林延鳳) said yesterday that new measures by