The Chinese Nationalist Party’s (KMT) Central Investment Co (中央投資公司) yesterday downplayed a report claiming that the party has sought to sell a nine-story building in Tokyo for ¥4.5 billion (US$43.9 million), saying that the company has halted the building’s sale following a failure to open tenders and the passage of an act governing ill-gotten party assets in July.

In a news release issued yesterday, the company said it purchased the Taiwan Trade Development (TTD) building in Tokyo in 1993 for ¥14 billion in an effort to comply with the government’s policy at the time to promote trade between Taiwan and Japan, and help small and medium-sized enterprises expand their businesses to Tokyo.

“Due to Japan’s long-lasting economic recession, the building’s value has plunged significantly… to merely ¥3.3 billion in book value at the moment. For the purpose of paying off our debts, and with approval from our board of directors to sell the TTD, we organized an open tender process on July 27,” the investment firm said.

However, the firm said it had to declare the process a failure after no tender was submitted on that day, adding that it has not attempted to sell the property since because of the legislature’s passage of the Act Governing the Handling of Ill-gotten Properties by Political Parties and Their Affiliate Organizations (政黨及其附隨組織不當取得財產處理條例) on July 25.

The company added that two independent agencies have determined the current value of the building at between ¥4 billion and ¥5 billion.

The act, which went into affect on Aug. 12, assumes that all KMT assets — except for party membership fees, political donations, government subsidies for KMT candidates running for public office and interest generated from these funds — are ill-gotten and must be transferred to the state or returned to their rightful owners.

The KMT-run investment firm made the remarks after the Chinese-language Liberty Times (the Taipei Times’ sister paper) yesterday published an article saying that TTD Co, an overseas subsidiary of Central Investment Co that is in charge of managing the TTD building, has not changed its mind about selling the property and is merely keeping a low profile.

The building, with a total area of 1,579.69m2, houses a convenience store on the first floor and a number of companies run by Taiwanese, with the second and third floors occupied by TTD Co.

Statistics show that the company earns approximately ¥250 million annually by renting out building spaces.

The building is managed by Chiang Yu-chen (江玉真), the niece of former Straits Exchange Foundation chairman Chiang Pin-kung (江丙坤), who is also the president of Japan-based Tokyo Star Bank, which is owned by CTBC Financial Holding Co (中信金控).

According to the proprietor of a Japanese real-estate company, which was founded by some of the employees of a now-dissolved real-estate firm that sold the building to TTD Co in 1993, there have been three attempts to sell the building in recent years, with the latest one going through the CTBC Financial Holding at the end of last year.

A source familiar with the matter, who requested anonymity, said the reason the company has been unable to liquidate the building was because it insisted on selling the property and the firm together.

“A potential Japanese buyer at the time received a copy of TTD Co’s financial statements including only its revenues. It was only willing to buy the building out of concern that the company might be indebted,” the source said.

KMT Culture and Communications Committee deputy director Hu Wen-chi (胡文琦) confirmed on Saturday evening that the party is seeking to sell the building, which he says has a market value of more than ¥10 billion, but there has yet to be any interested buyer.

The Cabinet’s Ill-gotten Party Assets Settlement Committee spokeswoman Shih Chin-fang (施錦芳) said if the committee finds the building to be an ill-gotten asset, the government can demand that the KMT return it to the nation.

“If the KMT seeks to dispose of its assets before they are verified by the committee, it could face a fine ranging from one to three times the value of the properties in question,” Shih said, urging potential overseas buyers to refrain from purchasing such assets to avoid unnecessary disputes.

Additional reporting by Tseng Wei-chen and Lee Ching-hui

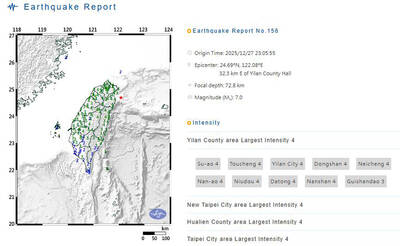

A magnitude 7.0 earthquake struck off Yilan at 11:05pm yesterday, the Central Weather Administration (CWA) said. The epicenter was located at sea, about 32.3km east of Yilan County Hall, at a depth of 72.8km, CWA data showed There were no immediate reports of damage. The intensity of the quake, which gauges the actual effect of a seismic event, measured 4 in Yilan County area on Taiwan’s seven-tier intensity scale, the data showed. It measured 4 in other parts of eastern, northern and central Taiwan as well as Tainan, and 3 in Kaohsiung and Pingtung County, and 2 in Lienchiang and Penghu counties and 1

A car bomb killed a senior Russian general in southern Moscow yesterday morning, the latest high-profile army figure to be blown up in a blast that came just hours after Russian and Ukrainian delegates held separate talks in Miami on a plan to end the war. Kyiv has not commented on the incident, but Russian investigators said they were probing whether the blast was “linked” to “Ukrainian special forces.” The attack was similar to other assassinations of generals and pro-war figures that have either been claimed, or are widely believed to have been orchestrated, by Ukraine. Russian Lieutenant General Fanil Sarvarov, 56, head

FOREIGN INTERFERENCE: Beijing would likely intensify public opinion warfare in next year’s local elections to prevent Lai from getting re-elected, the ‘Yomiuri Shimbun’ said Internal documents from a Chinese artificial intelligence (AI) company indicated that China has been using the technology to intervene in foreign elections, including propaganda targeting Taiwan’s local elections next year and presidential elections in 2028, a Japanese newspaper reported yesterday. The Institute of National Security of Vanderbilt University obtained nearly 400 pages of documents from GoLaxy, a company with ties to the Chinese government, and found evidence that it had apparently deployed sophisticated, AI-driven propaganda campaigns in Hong Kong and Taiwan to shape public opinion, the Yomiuri Shimbun reported. GoLaxy provides insights, situation analysis and public opinion-shaping technology by conducting network surveillance

‘POLITICAL GAME’: DPP lawmakers said the motion would not meet the legislative threshold needed, and accused the KMT and the TPP of trivializing the Constitution The Legislative Yuan yesterday approved a motion to initiate impeachment proceedings against President William Lai (賴清德), saying he had undermined Taiwan’s constitutional order and democracy. The motion was approved 61-50 by lawmakers from the main opposition Chinese Nationalist Party (KMT) and the smaller Taiwan People’s Party (TPP), who together hold a legislative majority. Under the motion, a roll call vote for impeachment would be held on May 19 next year, after various hearings are held and Lai is given the chance to defend himself. The move came after Lai on Monday last week did not promulgate an amendment passed by the legislature that