American International Group (AIG) yesterday said it has inked an agreement to sell its 97.57 percent share in Nan Shan Life Insurance Co (南山人壽) to Ruen Chen Investment Holding Co (潤成投資) for US$2.16 billion in cash.

The move marked the second attempt by the US insurance giant to divest itself of its stake in the local subsidiary after Taiwan rejected its first attempt in August over concerns about the long-term commitment and capital increase capability of the previous suitors, China Strategic Holdings Ltd (中策集團) and Primus Financial Holdings Ltd (博智金融).

“AIG has decided to shift its focus to non-life insurance business in the American market following the global financial crisis,” company assistant general counsel Andrew Borodach told a media briefing in Taipei.

Photo: Reuters

Owing to debt obligations to the US government, AIG no longer has the professional expertise or financial capability to support Nan Shan, which may not grow or flourish under AIG’s continued ownership, Borodach said.

AIG is satisfied with the sale price and confident the new buyer group will meet the review criteria set by the Financial Supervisory Commission.

The commission has also required that the buyers safeguard the rights of Nan Shan employees and policyholders, demonstrate professional management competence and comply with funding rules, especially if Chinese capital is involved.

Established in 1963, Nan Shan is the third-largest local insurer by total premiums, serving 4 million policyholders via 4,100 employees and 33,000 agents in 24 branches and 500 agency offices.

“AIG conducted a fair review before selecting the buyer” who can obtain regulatory approval, Borodach said.

He declined to comment on other buyers or the prices they offered.

Ruen Chen, created for the Nan Shan acquisition, is 80 percent owned by Ruentex Group (潤泰集團), a Taiwan-based conglomerate, and 20 percent owned by Pou Chen Corp (寶成工業), a footwear maker.

Samuel Yin (尹衍樑), chairman of Ruentex Group, whose business interests range from textiles to construction and retailing in Taiwan and China, said Ruen Chen will not sell Nan Shan shares in the next 10 years and could meet new capital needs in the next 10 to 20 years.

“We intend to hire all Nan Shan employees for at least two years and keep their current compensation and benefits intact,” Yin said. “We also will keep the Nan Shan brand and maintain the existing agency’s organizational and commission structure.”

Ruen Chen will not make a big reshuffle of the management team, but was recruiting a new chairman and president, Yin said.

The tycoon said that Ruentex and Pou Chen derive their funds from Taiwan, although both firms own businesses in China.

Ruen Chen has a paid-in capital of NT$2.5 billion (US$85.8 million) and the board has approved raising its capital to NT$60 billion.

Tu Ying-tzyong (杜英宗), chairman of Citigroup Global Markets Taiwan Ltd (花旗環球財務管理顧問), which consulted with Ruen Chen on the acquisition, said the consortium would sell Nan Shan shares on the local bourse to raise additional funds.

Borodach said if AIG leads the initial public offering (IPO), the proceeds would go to debt payments in the US, but they would stay with Nan Shan to strengthen its financial strength if the new buyer conducts the IPO plan.

The Financial Supervisory Commission issued a brief statement last night, saying it would soon put together an ad hoc panel to screen the share transfer application.

The review, however, should start with an investment committee under the Ministry of Economic Affairs, the commission said.

The nation’s three largest financial holding firms, Cathay Financial Holdings Co (國泰金控), Fubon Financial Holding Co (富邦金控) and Chinatrust Financial Holdings Co (中信金控), all entered the bidding, but failed.

Another consortium comprised of Primus Financial and Goldsun Development and Construction Co (國產實業), which offered to jointly run Nan Shan with AIG, also failed.

ENDEAVOR MANTA: The ship is programmed to automatically return to its designated home port and would self-destruct if seized by another party The Endeavor Manta, Taiwan’s first military-specification uncrewed surface vehicle (USV) tailor-made to operate in the Taiwan Strait in a bid to bolster the nation’s asymmetric combat capabilities made its first appearance at Kaohsiung’s Singda Harbor yesterday. Taking inspiration from Ukraine’s navy, which is using USVs to force Russia’s Black Sea fleet to take shelter within its own ports, CSBC Taiwan (台灣國際造船) established a research and development unit on USVs last year, CSBC chairman Huang Cheng-hung (黃正弘) said. With the exception of the satellite guidance system and the outboard motors — which were purchased from foreign companies that were not affiliated with Chinese-funded

PERMIT REVOKED: The influencer at a news conference said the National Immigration Agency was infringing on human rights and persecuting Chinese spouses Chinese influencer “Yaya in Taiwan” (亞亞在台灣) yesterday evening voluntarily left Taiwan, despite saying yesterday morning that she had “no intention” of leaving after her residence permit was revoked over her comments on Taiwan being “unified” with China by military force. The Ministry of the Interior yesterday had said that it could forcibly deport the influencer at midnight, but was considering taking a more flexible approach and beginning procedures this morning. The influencer, whose given name is Liu Zhenya (劉振亞), departed on a 8:45pm flight from Taipei International Airport (Songshan airport) to Fuzhou, China. Liu held a news conference at the airport at 7pm,

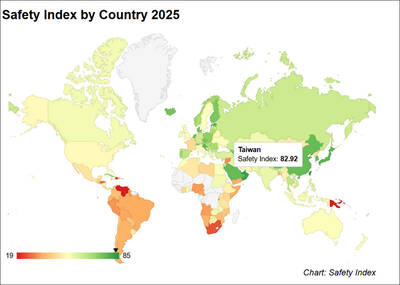

Taiwan was ranked the fourth-safest country in the world with a score of 82.9, trailing only Andorra, the United Arab Emirates and Qatar in Numbeo’s Safety Index by Country report. Taiwan’s score improved by 0.1 points compared with last year’s mid-year report, which had Taiwan fourth with a score of 82.8. However, both scores were lower than in last year’s first review, when Taiwan scored 83.3, and are a long way from when Taiwan was named the second-safest country in the world in 2021, scoring 84.8. Taiwan ranked higher than Singapore in ninth with a score of 77.4 and Japan in 10th with

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —