Investors recoiled from risky assets yesterday and dumped shares in Asian banks and builders, fearing a Dubai debt default could reignite the financial turmoil of the credit crisis.

Stocks from Tokyo to Mumbai were haunted by suspicion of lenders’ exposure to Dubai firms that built islands in the Gulf, planned cities from Pakistan to Africa and fashioned the financial hub of the world’s biggest oil exporting region.

“This an important reminder that the credit crisis is forgotten, but not gone,” Robert Rennie, strategist at Westpac Global Markets Group, said in a note.

PHOTO: EPA

Asian banks, like their European peers, scrambled to distance themselves from Dubai, a desert emirate that emerged from dusty obscurity to invest in global lenders such as Standard Chartered and lure fund managers with the promise of a tax-free lifestyle.

Dubai, part of the oil-exporting United Arab Emirates (UAE), said on Wednesday it would ask creditors of state-owned Dubai World and Nakheel to agree to a standstill on billions of dollars of debt as a first step toward restructuring.

Dubai World, the conglomerate that led the emirate’s expansion, had US$59 billion in liabilities as of August, most of Dubai’s total debt of US$80 billion. Nakheel was the builder of three palm-shaped islands off Dubai.

The news shook markets recovering from the collapse of the US housing bubble and contagion that threatened to rupture the global financial system last year.

“The panic button’s been hit again,” said Francis Lun, general manager of Fulbright Securities in Hong Kong.

Analysts expect financial support from Abu Dhabi, the UAE’s largest emirate and producer of most of its oil. However, Dubai may have to abandon an economic model that focused on developing swathes of desert with foreign money and labor.

The prospect of a bailout did little to allay concerns among investors, already worried the global economy may not be recovering quickly enough to justify a near doubling of prices for emerging market stocks and many commodities since March.

“The biggest worry I have is whether this will trigger a repricing in the overall emerging market,” said Arthur Lau, a fund manager in Hong Kong with JF Asset Management.

The nerves showed in credit markets, at the center of the financial storm triggered by the Lehman Brothers’ bankruptcy last year.

Asian credit default swaps, used to insure against default, were at their widest in a month, with the Asia ex-Japan iTraxx investment-grade index touching 124/129 basis points.

Dubai’s credit default swaps were being quoted as high as 500 to 550 basis points, some traders said on Thursday.

Dubai’s debt problems are a hangover from a property bubble that imploded after the financial crisis derailed its plans to become a magnet for tourists and a regional hub for everything from shipping to entertainment.

Banks’ exposure to a Dubai default pales in comparison with the US$2.8 trillion in writedowns the IMF estimates US and European lenders will have to make between 2007 and next year as a result of the credit crisis.

International banks’ exposure to Dubai World could be as high as US$12 billion, banking sources told Thomson Reuters LPC.

It was the fear of the unknown that was driving trade.

“Similar stories to the one in Dubai are likely to come out, leading risk money to pull out from assets such as commodities and stocks,” said Takahiko Murai, general manager of equities at Nozomi Securities in Japan.

Japan’s biggest bank, Mitsubishi UFJ Financial Group, fell as Japan’s Nikkei average struck a four-month closing low. It also came under pressure from weak exporters after the US dollar hit a fresh 14-year low against the yen. The Australian and New Zealand dollars retreated.

Oil extended Thursday’s decline to tumble below US$75 a barrel. Shanghai copper and Chicago grains each dropped about 2 percent.

Shares in HSBC Holdings, one of the bookrunners on an outstanding US$5.5 billion Dubai World loan, dropped more than 7 percent and Standard Chartered losses topped 6 percent. The London-listed shares of the two lenders led the biggest tumble in European bank stocks in six months on Thursday.

The Dubai crisis could have a “meaningful impact” on banks across Asia, said Daniel Tabbush, Asia banks analyst at CLSA in Bangkok, listing Standard Chartered, HSBC and Singapore’s DBS Group as the most exposed in the region.

DBS shares were not traded because of a market holiday in Singapore.

China State Construction International ICICI Bank was among Asian banks that said they had no exposure to Dubai after their shares fell.

Builders, such as Australian construction firm Leighton Holdings, took a beating on concern that money due from Dubai’s grandiose construction projects, including the world’s tallest building, would not be paid.

INVESTIGATION: The case is the latest instance of a DPP figure being implicated in an espionage network accused of allegedly leaking information to Chinese intelligence Democratic Progressive Party (DPP) member Ho Jen-chieh (何仁傑) was detained and held incommunicado yesterday on suspicion of spying for China during his tenure as assistant to then-minister of foreign affairs Joseph Wu (吳釗燮). The Taipei District Prosecutors’ Office said Ho was implicated during its investigation into alleged spying activities by former Presidential Office consultant Wu Shang-yu (吳尚雨). Prosecutors said there is reason to believe Ho breached the National Security Act (國家安全法) by leaking classified Ministry of Foreign Affairs information to Chinese intelligence. Following interrogation, prosecutors petitioned the Taipei District Court to detain Ho, citing concerns over potential collusion or tampering of evidence. The

Seventy percent of middle and elementary schools now conduct English classes entirely in English, the Ministry of Education said, as it encourages schools nationwide to adopt this practice Minister of Education (MOE) Cheng Ying-yao (鄭英耀) is scheduled to present a report on the government’s bilingual education policy to the Legislative Yuan’s Education and Culture Committee today. The report would outline strategies aimed at expanding access to education, reducing regional disparities and improving talent cultivation. Implementation of bilingual education policies has varied across local governments, occasionally drawing public criticism. For example, some schools have required teachers of non-English subjects to pass English proficiency

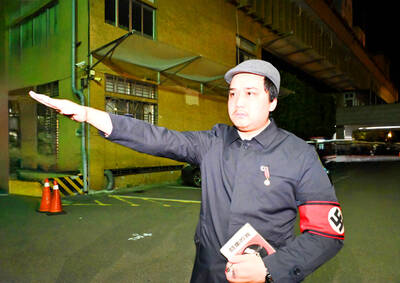

‘FORM OF PROTEST’: The German Institute Taipei said it was ‘shocked’ to see Nazi symbolism used in connection with political aims as it condemned the incident Sung Chien-liang (宋建樑), who led efforts to recall Democratic Progressive Party (DPP) Legislator Lee Kun-cheng (李坤城), was released on bail of NT$80,000 yesterday amid an outcry over a Nazi armband he wore to questioning the night before. Sung arrived at the New Taipei City District Prosecutors’ Office for questioning in a recall petition forgery case on Tuesday night wearing a red armband bearing a swastika, carrying a copy of Adolf Hitler’s Mein Kampf and giving a Nazi salute. Sung left the building at 1:15am without the armband and apparently covering the book with a coat. This is a serious international scandal and Chinese

TRADE: The premier pledged safeguards on ‘Made in Taiwan’ labeling, anti-dumping measures and stricter export controls to strengthen its position in trade talks Products labeled “made in Taiwan” must be genuinely made in Taiwan, Premier Cho Jung-tai (卓榮泰) said yesterday, vowing to enforce strict safeguards against “origin laundering” and initiate anti-dumping investigations to prevent China dumping its products in Taiwan. Cho made the remarks in a discussion session with representatives from industries in Kaohsiung. In response to the US government’s recent announcement of “reciprocal” tariffs on its trading partners, President William Lai (賴清德) and Cho last week began a series of consultations with industry leaders nationwide to gather feedback and address concerns. Taiwanese and US officials held a videoconference on Friday evening to discuss the