The nation’s financial regulator unexpectedly signed a financial memorandum of understanding (MOU) with Beijing at 6pm via a document exchange yesterday, sealing the much awaited pact.

Financial Supervisory Commission (FSC) chairman Sean Chen (陳冲) announced in the evening that he represented Taiwan in signing the documents — one in traditional Chinese and one in simplified Chinese — with Chinese authorities through a document exchange at 6pm.

“The MOU will take effect in 60 days,” he told a media briefing yesterday.

The agreements were signed by Chen and Liu Mingkang (劉明康), head of the China Banking Regulatory Commission, the regulators said in separate statements.

The two sides agreed on issues including cross-strait financial supervision, information-sharing and risk management, giving Taiwan and China wider access to each other’s banks, insurers and securities brokerages.

After the accord takes effect, financial institutions in Taiwan and China can officially apply to tap into each other’s market by either setting up liaison offices or applying to upgrade their liaisons offices into branches.

However, before banking rules are revised in Taiwan and China to determine terms on market access, no banks can begin operations in the other side’s market.

The market access terms are expected to be addressed during the nation’s upcoming negotiations of an economic cooperation framework agreement (ECFA) with China.

Yesterday’s signing of the MOU came as a twist since Chen just told the legislature in the morning that the signing “won’t be later than county elections scheduled for Dec. 5.”

He made the comments while briefing the legislature’s Financial Committee on the MOU, which was signed without the mention of official titles of either side because of political sensitivities.

At a separate briefing at the Economic Committee yesterday, lawmakers raised doubts about the impact of a possible influx of Taiwanese banks to China after the MOU goes into effect, saying the number of local lenders’ branches would be outnumbered by Chinese rivals.

“We’ve already entered the [Chinese] market late and it is not going to be easy,” FSC vice chairwoman Lee Jih-chu (李紀珠) said. “Lenders should have strategies to make profits before expanding their foothold in the mainland.”

The signing of the MOU only opens the doors to China’s financial services industry, while the proposed ECFA — which is expected to be signed before spring — would help local banks compete with much better conditions, Lee said.

To enjoy competitiveness across the Taiwan Strait, local financial institutions should create a niche by bringing over their more mature financial services and use their language and cultural advantages, she said.

The large number of Taiwanese businesses in China are also expected to utilize services tendered by branches of Taiwanese banks, she said.

Bank of China Ltd (中國銀行) president Li Lihui (李禮輝) aims to set up a Taipei branch once an MOU is signed, the Economic Daily News reported yesterday, citing an interview with the executive.

Industrial & Commercial Bank of China Ltd (中國工商銀行, ICBC), the world’s most profitable bank, needs a presence in Taiwan and wants to expand here in future, chairman Jiang Jianqing (姜建清) said on Nov. 13 at the APEC business leaders meeting in Singapore.Beijing-based ICBC has a market capitalization of 1.82 trillion yuan (US$267 billion), more than three times the value of Taiwan’s 37 listed financial and insurance companies.

The accord could pave the way for banks to set up branches in each other’s markets and Taiwan’s lenders may have their representative offices in China upgraded to full service branches, skipping the usual three-year wait, said Tseng Fan-jen, an analyst at KGI Securities.

Earlier yesterday, Lee said that Chinese financial institutions planning to invest in the Taiwanese market would not be subject to WTO rules or the treatment enjoyed by local banks.

“Chinese financial institutions in Taiwan will be treated as neither foreign institutional investors nor as their local counterparts, in order to minimize the impact on the development of the local financial sector or its investment prospects in China,” Lee told a joint meeting of the legislative economic and energy committees while reporting on the MOU.

Lee said Taiwan should not grant Chinese financial institutions the same treatment as that stipulated in the WTO regulations and she predicted that there will be no disputes on the matter as long as both sides accept the terms they agree upon.

Last night, Democratic Progressive Party Legislator William Lai (賴清德) criticized the signing of the MOU.

Lai said the move would put Taiwan at a major disadvantage.

“Taiwan is losing too much ground in the international arena, but the government is in such a hurry to sign an MOU and an ECFA,” he said.

“As a result, Taiwan will be isolated and its economy will depend on China,” he said.

ADDITIONAL REPORTING BY CNA AND SHELLEY HUANG

INVESTIGATION: The case is the latest instance of a DPP figure being implicated in an espionage network accused of allegedly leaking information to Chinese intelligence Democratic Progressive Party (DPP) member Ho Jen-chieh (何仁傑) was detained and held incommunicado yesterday on suspicion of spying for China during his tenure as assistant to then-minister of foreign affairs Joseph Wu (吳釗燮). The Taipei District Prosecutors’ Office said Ho was implicated during its investigation into alleged spying activities by former Presidential Office consultant Wu Shang-yu (吳尚雨). Prosecutors said there is reason to believe Ho breached the National Security Act (國家安全法) by leaking classified Ministry of Foreign Affairs information to Chinese intelligence. Following interrogation, prosecutors petitioned the Taipei District Court to detain Ho, citing concerns over potential collusion or tampering of evidence. The

Seventy percent of middle and elementary schools now conduct English classes entirely in English, the Ministry of Education said, as it encourages schools nationwide to adopt this practice Minister of Education (MOE) Cheng Ying-yao (鄭英耀) is scheduled to present a report on the government’s bilingual education policy to the Legislative Yuan’s Education and Culture Committee today. The report would outline strategies aimed at expanding access to education, reducing regional disparities and improving talent cultivation. Implementation of bilingual education policies has varied across local governments, occasionally drawing public criticism. For example, some schools have required teachers of non-English subjects to pass English proficiency

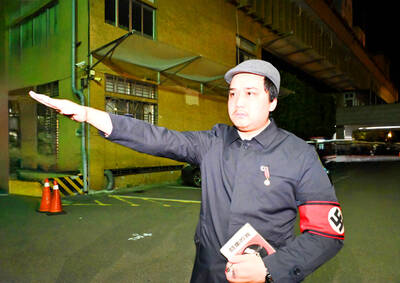

‘FORM OF PROTEST’: The German Institute Taipei said it was ‘shocked’ to see Nazi symbolism used in connection with political aims as it condemned the incident Sung Chien-liang (宋建樑), who led efforts to recall Democratic Progressive Party (DPP) Legislator Lee Kun-cheng (李坤城), was released on bail of NT$80,000 yesterday amid an outcry over a Nazi armband he wore to questioning the night before. Sung arrived at the New Taipei City District Prosecutors’ Office for questioning in a recall petition forgery case on Tuesday night wearing a red armband bearing a swastika, carrying a copy of Adolf Hitler’s Mein Kampf and giving a Nazi salute. Sung left the building at 1:15am without the armband and apparently covering the book with a coat. This is a serious international scandal and Chinese

TRADE: The premier pledged safeguards on ‘Made in Taiwan’ labeling, anti-dumping measures and stricter export controls to strengthen its position in trade talks Products labeled “made in Taiwan” must be genuinely made in Taiwan, Premier Cho Jung-tai (卓榮泰) said yesterday, vowing to enforce strict safeguards against “origin laundering” and initiate anti-dumping investigations to prevent China dumping its products in Taiwan. Cho made the remarks in a discussion session with representatives from industries in Kaohsiung. In response to the US government’s recent announcement of “reciprocal” tariffs on its trading partners, President William Lai (賴清德) and Cho last week began a series of consultations with industry leaders nationwide to gather feedback and address concerns. Taiwanese and US officials held a videoconference on Friday evening to discuss the