Vice Premier Paul Chiu (邱正雄) said yesterday that establishing a sovereign wealth fund might be an effective way to boost the economy.

“Many countries have established sovereign wealth funds. Of course the measure would be helpful [in reviving the economy],” Chiu said when approached by reporters yesterday morning.

“But it also comes with management and transparency issues,” Chiu said, adding that the Council for Economic Planning and Development would hold meetings to deliberate over the issue.

Chiu’s remarks came after Tuesday’s meeting of an economic advisory task force, during which Vice President Vincent Siew (蕭萬長) broached the subject of a sovereign fund.

But the council said yesterday afternoon that it was not the government’s priority to create a sovereign wealth fund, because such funds are intended for investment abroad, while the government needs money to finance public works at home.

Council Vice Chairman San Gee (單驥) said the most urgent task facing the country was to stimulate economic growth, and to that end the government should seek to integrate idle funds and channel them into domestic construction projects.

“A sovereign fund, even if desirable, will not provide an immediate or short-term remedy to bolster financial markets,” San told a press briefing after a 90-minute meeting to discuss the necessity and feasibility of the fund.

A sovereign fund, or sovereign wealth fund, is a state-owned investment fund composed of financial assets such as stocks, bonds, property or other financial instruments. National assets are typically held in both domestic and foreign reserve currencies.

San acknowledged that an increasing number of countries have set up sovereign wealth funds with their current account surpluses to obtain resources from other nations.

More than 20 countries have these funds and half a dozen others have expressed interest in establishing one.

“The council will take note of the global trend,” San said. “But it needs to … do more research before reaching a conclusion.”

While the council would not rule out creating a sovereign fund, San painted the measure as a medium-term national investment option that would require legislation over which the executive branch does not have a final say.

He said the National Stabilization Fund and other instruments offer more effective measures in stabilizing financial markets.

“[Economic and financial] officials attending the meeting agreed that the government should remained focused on boosting the economy,” he said.

Earlier in the day, the central bank issued a statement denying reports it supported the idea of using interest from the nation’s foreign reserves to set up a sovereign fund.

Central bank Governor Perng Fai-nan (彭淮南) said he met administration officials twice on Tuesday but made no mention of foreign exchange interest.

The sovereign fund proposal, however, received mixed reviews from across party lines in the Legislative Yuan yesterday.

“This [sovereign fund] is a form of public goods. It can make investments around the world. I believe it is a good measure [to boost the economy],” KMT Legislator Lin Te-fu (林德福) told a press conference held by the KMT caucus.

But KMT Legislator Lai Shyh-bao (賴士葆), a member of the legislature’s Finance Committee, said he was concerned about the risk, adding that the government needed to carefully deliberate over this issue and that the legislature needed to pass regulations on supervising such a fund.

Saying that such funds often exist in countries that are ruled by dictators, DPP Legislator Wang Sing-nan (王幸男) criticized the idea of setting up a sovereign wealth fund as “illogical.”

The KMT should use its party assets to establish the sovereign fund if the government is determined to do it, he added.

KMT caucus deputy secretary-general Yang Chiung-ying (楊瓊櫻) said the KMT “legitimately” owns its assets.

In related news, Premier Liu Chao-shiuan (劉兆玄) yesterday said the government was expected to relax some 100 investment regulations by the end of this year, but he did not elaborate.

During an address to an assembly of the Chinese International Economic Cooperation Association in Taipei, Liu said the government had eased 44 regulations related to cross-strait trade and the finance and tax systems.

He said the government hoped to create a more open investment environment in a bid to lure foreign investment.

INVESTIGATION: The case is the latest instance of a DPP figure being implicated in an espionage network accused of allegedly leaking information to Chinese intelligence Democratic Progressive Party (DPP) member Ho Jen-chieh (何仁傑) was detained and held incommunicado yesterday on suspicion of spying for China during his tenure as assistant to then-minister of foreign affairs Joseph Wu (吳釗燮). The Taipei District Prosecutors’ Office said Ho was implicated during its investigation into alleged spying activities by former Presidential Office consultant Wu Shang-yu (吳尚雨). Prosecutors said there is reason to believe Ho breached the National Security Act (國家安全法) by leaking classified Ministry of Foreign Affairs information to Chinese intelligence. Following interrogation, prosecutors petitioned the Taipei District Court to detain Ho, citing concerns over potential collusion or tampering of evidence. The

Seventy percent of middle and elementary schools now conduct English classes entirely in English, the Ministry of Education said, as it encourages schools nationwide to adopt this practice Minister of Education (MOE) Cheng Ying-yao (鄭英耀) is scheduled to present a report on the government’s bilingual education policy to the Legislative Yuan’s Education and Culture Committee today. The report would outline strategies aimed at expanding access to education, reducing regional disparities and improving talent cultivation. Implementation of bilingual education policies has varied across local governments, occasionally drawing public criticism. For example, some schools have required teachers of non-English subjects to pass English proficiency

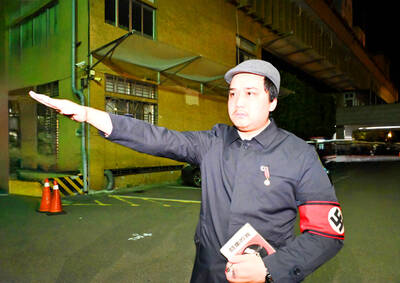

‘FORM OF PROTEST’: The German Institute Taipei said it was ‘shocked’ to see Nazi symbolism used in connection with political aims as it condemned the incident Sung Chien-liang (宋建樑), who led efforts to recall Democratic Progressive Party (DPP) Legislator Lee Kun-cheng (李坤城), was released on bail of NT$80,000 yesterday amid an outcry over a Nazi armband he wore to questioning the night before. Sung arrived at the New Taipei City District Prosecutors’ Office for questioning in a recall petition forgery case on Tuesday night wearing a red armband bearing a swastika, carrying a copy of Adolf Hitler’s Mein Kampf and giving a Nazi salute. Sung left the building at 1:15am without the armband and apparently covering the book with a coat. This is a serious international scandal and Chinese

NEGOTIATIONS: The US response to the countermeasures and plans Taiwan presented has been positive, including boosting procurement and investment, the president said Taiwan is included in the first group for trade negotiations with the US, President William Lai (賴清德) said yesterday, as he seeks to shield Taiwanese exporters from a 32 percent tariff. In Washington, US Trade Representative Jamieson Greer said in an interview on Fox News on Thursday that he would speak to his Taiwanese and Israeli counterparts yesterday about tariffs after holding a long discussion with the Vietnamese earlier. US President Donald Trump on Wednesday postponed punishing levies on multiple trade partners, including Taiwan, for three months after trillions of US dollars were wiped off global markets. He has maintained a 10 percent