Bear Stearns Cos' 85 years as an independent Wall Street firm may be coming to an end as JPMorgan Chase & Co considers buying the crippled company.

Teetering on the brink of collapse from a lack of cash, Bear Stearns got emergency funding on Friday from the US Federal Reserve and JPMorgan in the largest government bailout of a US securities firm. The move failed to avert a crisis of confidence among Bear Stearns' customers and shareholders, who drove the stock down a record 47 percent.

After denying earlier this week that access to capital was at risk, Bear Stearns chief executive officer (CEO) Alan Schwartz said on Friday that the company's cash position had "significantly deteriorated" in the past 24 hours. The Fed agreed to provide financing through JPMorgan for up to 28 days, the bank said in a statement on Friday.

Now JPMorgan, led by CEO Jamie Dimon, is considering buying Bear Stearns, three people briefed on the matter said. No agreement has been reached and it's possible no deal will be completed, said the sources, who declined be identified because the discussions were confidential.

A person close to JPMorgan said the bank might also be interested in buying Bear Stearns' prime brokerage unit, which provides loans and processes trades for hedge funds.

Dimon, whose firm has suffered fewer losses than rivals during the credit-market contraction, has said that he would be open to making an acquisition.

The bank has "plenty of capital," he told the audience at a dinner hosted by the Economic Club of Washington last week.

Other potential Bear Stearns buyers include private equity firms such as J.C. Flowers & Co, the Wall Street Journal reported.

HSBC Holdings Plc, Europe's largest bank by market value, also has the resources to make an acquisition.

Bear Stearns, founded in 1923, acted in response to "market rumors" of a liquidity crisis, Schwartz, 57, said in a separate statement.

He said earlier this week that the company's "liquidity cushion" was sufficient to weather the credit-market contraction. Traders have been reluctant to engage in long-term transactions with Bear Stearns as a counterparty, the Wall Street Journal reported on Wednesday.

"We have tried to confront and dispel these rumors and parse fact from fiction," Schwartz, who was named CEO less than three months ago, said in the New York-based company's statement on Friday. "Nevertheless, amidst this market chatter, our liquidity position in the last 24 hours had significantly deteriorated."

The announcement caused financial shares to plunge, with Bear Stearns tumbling US$27 to close at US$30 in New York Stock Exchange composite trading.

The stock has lost 66 percent of its value this year. The sinking share price has wiped out US$10.5 billion in shareholder value in the last three months.

Bear Stearns' long-term counterparty credit rating was reduced three levels to BBB by Standard & Poor's.

The rating may be cut further, New York-based S&P said. It lowered the short-term rating to A3 from A1.

Bear Stearns helped trigger a crash in the market for home loans after two of its hedge funds collapsed last July.

During a conference call with analysts and investors after Friday's announcement, Schwartz said that the company's book value was "fundamentally" unchanged.

AIR SUPPORT: The Ministry of National Defense thanked the US for the delivery, adding that it was an indicator of the White House’s commitment to the Taiwan Relations Act Deputy Minister of National Defense Po Horng-huei (柏鴻輝) and Representative to the US Alexander Yui on Friday attended a delivery ceremony for the first of Taiwan’s long-awaited 66 F-16C/D Block 70 jets at a Lockheed Martin Corp factory in Greenville, South Carolina. “We are so proud to be the global home of the F-16 and to support Taiwan’s air defense capabilities,” US Representative William Timmons wrote on X, alongside a photograph of Taiwanese and US officials at the event. The F-16C/D Block 70 jets Taiwan ordered have the same capabilities as aircraft that had been upgraded to F-16Vs. The batch of Lockheed Martin

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

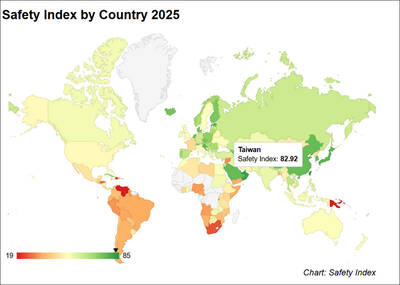

Taiwan was ranked the fourth-safest country in the world with a score of 82.9, trailing only Andorra, the United Arab Emirates and Qatar in Numbeo’s Safety Index by Country report. Taiwan’s score improved by 0.1 points compared with last year’s mid-year report, which had Taiwan fourth with a score of 82.8. However, both scores were lower than in last year’s first review, when Taiwan scored 83.3, and are a long way from when Taiwan was named the second-safest country in the world in 2021, scoring 84.8. Taiwan ranked higher than Singapore in ninth with a score of 77.4 and Japan in 10th with

China's military today said it began joint army, navy and rocket force exercises around Taiwan to "serve as a stern warning and powerful deterrent against Taiwanese independence," calling President William Lai (賴清德) a "parasite." The exercises come after Lai called Beijing a "foreign hostile force" last month. More than 10 Chinese military ships approached close to Taiwan's 24 nautical mile (44.4km) contiguous zone this morning and Taiwan sent its own warships to respond, two senior Taiwanese officials said. Taiwan has not yet detected any live fire by the Chinese military so far, one of the officials said. The drills took place after US Secretary