Last week the Executive Yuan announced measures that would initiate the breakup of Taiwan Power Co’s (Taipower, 台電) monopoly in the name of enhancing the generation of green power. The government is making good on its election commitment to amend the Electricity Act (電業法) by allowing renewable energy companies to sell direct to the grid, without having to use Taipower as an intermediary. This move is viewed as a direct means of encouraging the growth of green power in Taiwan.

Indeed, there seems to be a genuine green shift underway. The government announced its firm intention of reaching a target of 20 gigawatts (GW) of solar power to be online by 2025 — more than enough to compensate for nuclear power plants anticipated to be taken offline by then. Vice President Chen Chien-Jen (陳建仁) stated that this goal would call for investment of NT$1.2 trillion (US$38 billion) — bringing Taiwan abreast of world leaders in green energy.

And Taipower itself launched a new offshore wind power company, with a goal of building its first offshore power plant rated at 110 megawatts (MW) by 2020, with a budget of NT$19.5 billion.

Photo: Chang tsong-chiu

How times have changed.

Three years ago, we published an article, “China key to Taiwan energy crisis (page 8 of Taipei Times, Apr. 15, 2013). At the time, Taiwan was embroiled in endless debates over its commitment to nuclear power, a commitment that precluded a shift to more secure renewable energy sources. We argued that Taiwan’s obsession with nuclear power obscured other energy options. In particular, we argued that the country could extend its great successes in IT, semiconductors and flat panel displays to the next great technological challenge, namely renewable energy. We pointed to the example of China and its green energy strategy which is gradually replacing its black, fossil fueled strategy, thereby enhancing China’s energy security as well as building renewable energy industries as export platforms for the future.

NEW GREEN ENERGY POLICY

Graphic courtesy of PV Magazine/Harald Schutt

Three years on, the situation in Taiwan is completely different. The transfer of power from the Chinese Nationalist Party (KMT) to the Democratic Progressive Party (DPP) at both the executive and legislative level in January has led to a new green energy strategy. President Tsai Ing-wen (蔡英文) is taking Taiwan in a new energy direction, headlined by a commitment for Taiwan to be nuclear-free by 2025. That opens the way to an alternative energy strategy, now focused on building Taiwan’s strength in solar photovoltaic (PV) and offshore wind power.

New targets like the one just announced for solar power in 2025 are providing the investment certainty that the previous nuclear preoccupations had denied. The government has been backing its energy targets with talk of total investment of NT$1.5 trillion, induced initially by government expenditure and then followed by foreign capital and domestic investment. As the power monopoly, and with a nod to the new government policy, Taipower has already announced an investment target of NT$400 billion in the development of renewable energy (mainly in solar and wind power) up to 2025. So things are on the move on the energy front in Taiwan.

NUCLEAR MORATORIUM

The main initiative since the election has been the announced moratorium on nuclear power and a commitment to phase it out completely by 2025. Taiwan has three nuclear power sites in operation, with a total capacity of 5.1GW. A fourth nuclear power plant was completed last year, but it was mothballed as soon as the construction was finished due to social pressure for a nuclear-free homeland.

The recent announcements have elaborated on the stated government policies to replace these nuclear plants and build 20GW of solar power by 2025 as well as 3GW of offshore wind power — which on their own would be sufficient to replace the nuclear power plants as they are mothballed. An initial step toward this goal is a projected doubling of solar PV power generating capacity to reach 1.4GW by next year. As a means of coordinating green energy initiatives with a view to reducing Taiwan’s carbon emissions, the Executive Yuan in July created an office for energy and carbon-reduction.

SOLAR AND WIND POWER

At this stage the best prospects for Taiwan would appear to be solar PV systems and offshore wind because they are now mature technologies where Taiwan already has industrial experience and can utilize its fast follower strategies to good effect, while investing in research and development R&D to bring it abreast of world leaders.

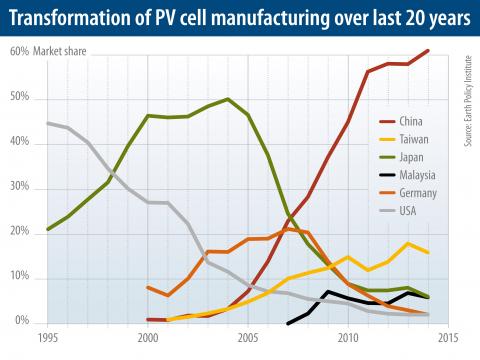

Taiwan is already the world’s second largest producer of solar cells, shipping 10.6GW of cells last year — nearly a fifth of the world total of 55GW. Taiwan is also one of the leading solar wafer and module makers in the world, with well-established firms like Motech Industries (茂迪), Gintech Energy Corp (昱晶能源), Solartech Energy Corp (昇陽科技), E-Ton Solar Tech Co (益通光能) and newcomer Taiwan Solar Energy Corp (元晶太陽能) providing a solid industrial value chain. Taiwan’s solar PV production activities got under way around 2000, and by 2009 Taiwan was second producer in the world, after China.

To achieve the goal of 3GW wind power by 2025, the government is aggressively implementing the ‘thousand wind turbines’ project utilizing the Taiwan Strait, one of the world’s best offshore wind sites. The development of the offshore wind farms (apart from Taipower’s announcement last week) also includes strategic environmental assessments, infrastructure construction and fisheries compensation negotiations. The Offshore Demonstration Incentive Program originally planned to complete four demonstration turbines by last year, but was held up because the fisheries compensation negotiation is not finalized. Three demonstration wind farms are targeted for 2020.

LIBERALIZING THE ELECTRIC POWER MARKET

The main initiative involves breaking the Taipower monopoly. Like other East Asian countries, including Japan, Korea and China, Taiwan has inherited a quasi-monopoly power company, Taipower, which could be viewed as an obstacle to further greening.

Founded in 1946, Taipower generates power, buys power from a handful of independent power producers (IPPs), distributes power and manages most of the country’s retail and wholesale power activities. There have been many attempts to break the Taipower monopoly, going back at least to 2001 (postponed to 2006) — which came to nothing. Now there is new urgency, since the green power shift is clearly underway and is potentially being delayed by the Taipower monopoly.

When campaigning for the presidency, Tsai committed the government to review the country’s Electricity Act with a view to introducing greater competition and efficiency.

In mid-August, the new government reached agreement with Taipower’s labor union, making four significant concessions. First, the Ministry of Economic Affairs agreed to exclude privatization of Taipower from any proposed amendments. Second, within six to nine years (up to 2025) in two developmental stages, green power is to be directly supplied by Taipower to customers (in the first stage) while independent producers in the industrial parks will be allowed to distribute the power produced by their own power plants. In other words, the entities managing power supply and power grid are to be separated.

Third, Taipower has to be reorganized as a parent holding company with two subsidiaries for power supply and power grid responsible for distribution, transmission and sales. And fourth, any further subsidiaries would be established only if workers’ rights and interests are not affected. Such organizational restructuring of Taipower and deregulation of the power sector are aimed to encourage the dispersal of power sources and micro grid communities.

The announcements made last week go some way to implement this agreement, with market reform opening up prospects for direct sale of power by renewable energy producers. We understand that it will take time to introduce full competition to the electric power market and that a staged approach is needed.

IMPLEMENTATION OF TAIWAN MODEL

While the new government’s determination to end the nuclear power era in Taiwan is clear, we would stress that there now needs to be greater emphasis on a sustained investment strategy that will drive Taiwan’s energy production and manufacturing industries towards renewable power. This would be a continuation of Taiwan’s past successful industrial strategies. It is worth pointing out that Taiwan has the reserves needed for investment once a clear signal is given. Bank deposits in Taiwan’s banks as a whole recorded an historical high at NT$40 trillion in July of this year, according to the statistics of Taiwan’s central bank.

Taiwan has well-tested industrial development models involving the promotion of new industries through market stimulation and domestic technology leverage. For years it has been missing opportunities due to the focus on nuclear power and fossil fuels (which probably owed more to Taiwan’s geopolitical situation than to strictly energy-related concerns). Now is the time to apply the skills learned in the past to the urgent needs of cleaning up its energy system and creating new pillar industries for the future.

This article is adapted from a longer version published in Asia-Pacific Journal: Japan Focus. John A Mathews is a professor at the Macquarie Graduate School of Management at Macquarie University. Hu Mei-chih is a professor at the Institute of Technology Management at National Tsing Hua University.

Last week Elbridge Colby, US President Donald Trump’s nominee for under secretary of defense for policy, a key advisory position, said in his Senate confirmation hearing that Taiwan defense spending should be 10 percent of GDP “at least something in that ballpark, really focused on their defense.” He added: “So we need to properly incentivize them.” Much commentary focused on the 10 percent figure, and rightly so. Colby is not wrong in one respect — Taiwan does need to spend more. But the steady escalation in the proportion of GDP from 3 percent to 5 percent to 10 percent that advocates

A series of dramatic news items dropped last month that shed light on Chinese Communist Party (CCP) attitudes towards three candidates for last year’s presidential election: Taiwan People’s Party (TPP) founder Ko Wen-je (柯文哲), Terry Gou (郭台銘), founder of Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), and New Taipei City Mayor Hou You-yi (侯友宜) of the Chinese Nationalist Party (KMT). It also revealed deep blue support for Ko and Gou from inside the KMT, how they interacted with the CCP and alleged election interference involving NT$100 million (US$3.05 million) or more raised by the

While riding a scooter along the northeast coast in Yilan County a few years ago, I was alarmed to see a building in the distance that appeared to have fallen over, as if toppled by an earthquake. As I got closer, I realized this was intentional. The architects had made this building appear to be jutting out of the Earth, much like a mountain that was forced upward by tectonic activity. This was the Lanyang Museum (蘭陽博物館), which tells the story of Yilan, both its natural environment and cultural heritage. The museum is worth a visit, if only just to get a

More than 100,000 people were killed in a single night 80 years ago yesterday in the US firebombing of Tokyo, the Japanese capital. The attack, made with conventional bombs, destroyed downtown Tokyo and filled the streets with heaps of charred bodies. The damage was comparable to the atomic bombings a few months later in August 1945, but unlike those attacks, the Japanese government has not provided aid to victims and the events of that day have largely been ignored or forgotten. Elderly survivors are making a last-ditch effort to tell their stories and push for financial assistance and recognition. Some are speaking