and a rival of Bill Gates in philanthropy

He is a moderate Muslim religious leader and a descendant of the Prophet Mohammed. He is also a twice-married jet-setter, and he owns hundreds of racehorses, valuable stud farms, an exclusive yacht club on Sardinia and a lavish estate near Paris.

He has poured money into poorer, neglected parts of the world, often into businesses as basic as making fish nets, plastic bags and matches, while also teaming up with private equity powerhouses like the Blackstone Group on a huge US$750 million hydroelectric system in Uganda.

And as he tries to present a less threatening face of Islam on the global business stage during a time of war, the Aga Khan - one of the world's wealthiest Muslim investors - preaches the ethical acquisition and use of wealth and financial aid that promotes economic self-reliance among developing countries and their poorest people.

PHOTO: NY TIMES NEWS SERVICE

In a rare interview, the Aga Khan, who is chairman of the Aga Khan Fund for Economic Development, a for-profit company based in Geneva, says he is more concerned with the long-term outcomes of his investments than with short-term profits. Rather than fretting daily over the bottom line, he says, he tries to ensure that his businesses become self-sustaining and achieve stability, which he defines as "operational break-even," within a "logical time frame."

"If you travel the developing world, you see poverty is the driver of tragic despair, and there is the possibility that any means out will be taken," he says in a telephone interview from Paris. By assisting the poor through business, he says, "we are developing protection against extremism."

The company's main purpose "is to contribute to development," he adds. "It is not a capitalist enterprise that aims at declaring dividends to its shareholders." Central to his ethos is the notion that his investments can prompt other forms of economic growth within a country or region that results in greater employment and hope for the poor.

PHOTO: AFP

Economic developments experts say the Aga Khan's activities offer a useful template for others - including philanthropists like Bill Gates and George Soros - who are trying to assist the world's poorest by marrying business practices to social goals, but whose foundation work usually stops short of owning businesses outright in poor countries.

Paul Collier, an economist at Oxford University who specializes in the problems of poor countries, says he believes that aid agencies could benefit from operating more like venture capitalists - and more like the Aga Khan. "He gets a multiplier effect from his investments that's really lacking in foreign aid," Collier says. "I'm impressed with his way of accepting risk and thinking long term."

At the same time, the Aga Khan embodies many of the conflicting social and financial tides sweeping the global economy. He is the spiritual leader of the Ismaili Muslim sect, but he is also surrounded by unusual material riches - none of which he or his followers see as a contradiction.

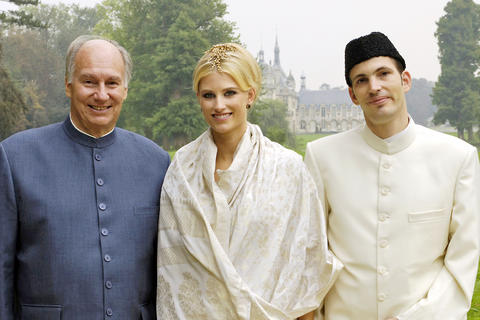

PHOTO: NY TIMES NEWS SERVICE

The Aga Khan concedes that he owns two jets, but says that he drives an Audi and that his yacht is 25 years old. Ismailis "wouldn't like to see him living the life of a pauper - we want him to live a decent, an affluent life," says Kris Janowski, the Aga Khan's spokesman. Janowski adds that the imam is "surprised that anyone would apply the word 'lavish' to his lifestyle because he doesn't see it as lavish."

Part of the Aga Khan's personal wealth, which his advisers say exceeds $1 billion, comes from a dizzyingly complex system of tithes that some of the world's 15 million Ismaili Muslims pay him each year - an amount that he won't disclose but which may reach hundreds of millions of US dollars annually.

The Aga Khan, 70, has had unconditional control of this money since his grandfather placed him in his position 50 years ago. He has invested those resources in a free-form portfolio of 90 businesses that employ more than 36,000 people. These holdings include five-star hotels, mobile phone companies and an airline, but most are small and medium-size enterprises in Central Asia and sub-Saharan Africa.

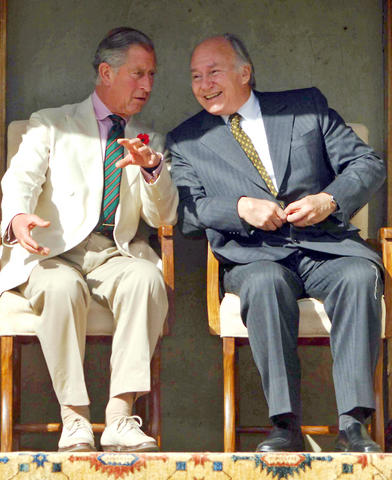

PHOTO: AFP

"The Aga Khan is making a significant contribution that people too often underestimate - many of his investments have become huge successes, but he's not driven by profit," says Praful Patel, a vice president in Central Asia for the World Bank. "He's treated like a head of state, has access to the highest levels in any country and his gravitas is worth a lot. It allows his outfit to succeed in investments where others cannot."

The Aga Khan was born Prince Karim in 1936 in Geneva. He grew up in Nairobi during World War II, and he attended a Swiss boarding school before he was named imam at age 20.

There have been 49 Ismaili imams over the centuries, but only three previous Aga Khans, a title the king of Persia bestowed on the family in the 1830s. The third - the current Aga Khan's grandfather - was Sir Sultan Mahomed Shah Aga Khan, a legendary figure in colonial India who later moved to Britain and served as a president of the League of Nations.

PHOTO: NY TIMES NEWS SERVICE

Upon his death in 1957, Shah Aga Khan's will instructed that his son (the current Aga Khan's father), Aly Khan, be passed over in favor of his grandson, Prince Karim, who was studying Islamic history at Harvard at the time.

That the Aga Khan attended secular universities, wore Western dress and espoused Western values reflected his sect's historical need to adapt to varying cultures. The Ismailis are a minority within the minority Shia branch of Islam and have experienced frequent persecution through the centuries; as recently as the 1990s, the Taliban in Afghanistan persecuted Ismailis.

Over the centuries, as the Ismailis dispersed across Asia and Africa and later Europe and North America, they often adopted Western ways. This invited criticism from other Muslims, who questioned how someone could wear a suit and still call himself an imam. But Ismailis say they see no conflict between Westernization and their faith.

"The central trait of their long history is a remarkable tendency to acculturate to different contexts," says Ali Asani, a professor of Indo-Muslim languages and culture at Harvard and an Ismaili.

The Aga Khan's fluency in Western ways - and what he describes as his desire to show that "an imam's responsibilities include caring for the quality of life of the people who he leads, including their economic progress" - animated his first major business venture, the start of a media company in Nairobi in 1961. "The origin of this exercise was the need at the time of British withdrawal from Eastern Africa to have African politics explained to the African public in African terms," he says. "There was no independent media in the region at the time, so we had a delicate mandate but a necessary one."

Over time, his Nairobi company, the Nation Media Group, became the most successful media concern in East Africa, with print, radio and television properties in Tanzania and Uganda as well. The company is profitable and considered among the most professional in Africa, while also offering a voice to government critics.

"If he was a non-sophisticated, profit-only guy, these newspapers and broadcasters would not be the independent voices for the public good that they are," says Andrew Mwenda, a radio commentator and a newspaper columnist in Kampala, the Ugandan capital.

The 1970s and 1980s were difficult times for the Aga Khan's businesses, most of which were in Africa. African leaders nationalized industries. Civil wars broke out. And economies contracted or collapsed. In East Africa, where a large number of Ismailis lived, African leaders blamed outsiders for their troubles. The government evicted most Ismailis from Uganda, while Ismailis in Central Asia suffered under Soviet repression of religious groups.

"The Cold War was prominent on my horizon all the time," the Aga Khan recalls. "The question I was asking all the time: 'What is going to happen after the Cold War ends?' It wasn't going to be eternal. So we stayed engaged and waited."

With the breakup of the Soviet Union in 1991, the Cold War did end, and the Aga Khan saw fresh opportunities to energize and expand his Ismaili institutions. In Tajikistan in Central Asia, where many Ismailis lived, a civil war created an urgent need for outside assistance, and the Aga Khan rushed charitable resources into the country. More recently, he has invested in power generation and a mobile phone company there.

In Uganda, decades of civil war and social collapse came to an end when Yoweri Museveni consolidated political power in the early 1990s. Museveni personally appealed to the Aga Khan to encourage Ismailis to return to Uganda, promising to restore all their properties seized by the deposed dictator, Idi Amin. Many Ismailis returned to Uganda, and so did the Aga Khan's business.

"Uganda is still lacking big-time investors, and the Aga Khan provides some of that," says Moses Byaruhanga, a political adviser to Museveni.

Today, Uganda is home to some of the Aga Khan's most ambitious business enterprises. He owns the country's largest pharmaceutical company, a tannery, a bank and an insurance company.

And then there is the fish net factory. On a spring morning in Kampala, amid the pounding noise of textile machines spinning nylon into sturdy nets, Karen Veverica, an aquaculture expert with Auburn University, cradles in her arms a new net, made to her specifications by the Aga Khan's factory. The net is part of her campaign, financed by the US Agency for International Development, to help jump-start a fish-farming industry in Uganda.

"Fish farmers can't just grow fish out of the blue," she says. "To get fish out of the pond, we need a net like this."

Making new types of nets represents a classic economic development quandary: there is no demand for the nets, yet without them fish farming cannot take off. New nets, in short, are an unlikely "enabling technology" that might spur growth in the local economy. But it requires patient investors.

"We can take a decision like this because we think long term," Mahmood Ahmed, the Aga Khan's representative in Uganda, says of the nets. "We won't enter a business without the promise of profit, but we have more considerations than profit."

While fish nets are decidedly small potatoes, the same approach applies to the US$750 million hydroelectric system that the Aga Khan is developing in Uganda. The project, at Bujagali Falls on the Nile River, is the largest project ever undertaken by the Aga Khan Fund for Economic Development, known by its acronym, Akfed.

Despite vast unmet needs for electricity in the region, the Bujagali project is one that few capitalists would touch, partly "because the big global power companies have shunned Africa, fearing risks," says Kevin Kariuki, who was born in Kenya and is a senior executive in the Aga Khan's infrastructure unit. "The American electricity companies aren't going to come. The Europeans will stick to their home markets. We want to be the developer of choice in this part of the world, and Bujagali creates an opportunity for us."

In what analysts describe as one of the most innovative electrification campaigns in Africa, the Aga Khan's infrastructure group is building a series of inexpensive "minihydro" systems around very small dams. They provide electricity to parts of Uganda where the national electricity grid does not reach.

The poor West Nile region of the country now has electricity 18 hours a day, compared with its previous schedule of just four hours every other day. And prices for the electricity, which the Aga Khan sells as well as produces, are high enough to generate internal profit rates of more than 10 percent, Kariuki says.

Financing businesses that can spur economic growth in marginal regions is what the Aga Khan says animates many of his investments. That has led him, he says, to forgo the merger-and-acquisition plays of Wall Street, to avoid investing in booming domestic economies like China's and to shy away from charitable giving that is not linked to a clear business goal. He says he prefers to put money into unglamorous enterprises that are engines of employment and have great long-term potential - even if profits aren't immediate.

Ismaili investments occur alongside cultural, educational and health initiatives, carried out by various units of the Aga Khan's development network. Spending on these non-business activities can run into the hundreds of millions of US dollars annually, Semin Abdulla, a spokeswoman, says. (She says the group's charitable giving will amount to about US$320 million this year.) The Aga Khan Development Network, formed 10 years ago, looks for synergy between its business and philanthropic activities.

Mixing business and charity, while long at odds with mainstream capitalist practice, is growing in prominence, making the Aga Khan an unlikely innovator.

"If you can get capital that's partly philanthropic, you can help reach a lot of people," says Mark Kramer, managing director of FSG Social Impact Advisers, a consulting firm in Boston. "In many cases, businesses are much better positioned to deliver sustained social benefits than charities."

Evaluating the effectiveness of the Aga Khan's charitable network is difficult because neither the network nor Akfed publishes any performance data. But analysts who are conversant with Akfed and its finances say that the investor deserves credit for taking risks and backing projects that might otherwise not attract any private support.

After the US started an offensive against the Taliban in Afghanistan in 2001, he stepped in with private investments, including building both the first five-star hotel in Kabul and Roshan, the leading mobile phone company.

Roshan has 1.3 million subscribers and is adding 60,000 a month. The Afghan government gets 6 percent of its tax revenue from the company, Abdulla says. Roshan says it employs 900 people, about 180 of whom are women.

"In Afghanistan, the Aga Khan is creating an enabling environment for business," says Patel at the World Bank. "While producing results, these are early days. It's too soon to see a payoff from his investments."

That does not bother the Aga Khan. Building businesses, he says, "is part of the ethics of the faith."

April 14 to April 20 In March 1947, Sising Katadrepan urged the government to drop the “high mountain people” (高山族) designation for Indigenous Taiwanese and refer to them as “Taiwan people” (台灣族). He considered the term derogatory, arguing that it made them sound like animals. The Taiwan Provincial Government agreed to stop using the term, stating that Indigenous Taiwanese suffered all sorts of discrimination and oppression under the Japanese and were forced to live in the mountains as outsiders to society. Now, under the new regime, they would be seen as equals, thus they should be henceforth

Last week, the the National Immigration Agency (NIA) told the legislature that more than 10,000 naturalized Taiwanese citizens from the People’s Republic of China (PRC) risked having their citizenship revoked if they failed to provide proof that they had renounced their Chinese household registration within the next three months. Renunciation is required under the Act Governing Relations Between the People of the Taiwan Area and the Mainland Area (臺灣地區與大陸地區人民關係條例), as amended in 2004, though it was only a legal requirement after 2000. Prior to that, it had been only an administrative requirement since the Nationality Act (國籍法) was established in

With over 80 works on display, this is Louise Bourgeois’ first solo show in Taiwan. Visitors are invited to traverse her world of love and hate, vengeance and acceptance, trauma and reconciliation. Dominating the entrance, the nine-foot-tall Crouching Spider (2003) greets visitors. The creature looms behind the glass facade, symbolic protector and gatekeeper to the intimate journey ahead. Bourgeois, best known for her giant spider sculptures, is one of the most influential artist of the twentieth century. Blending vulnerability and defiance through themes of sexuality, trauma and identity, her work reshaped the landscape of contemporary art with fearless honesty. “People are influenced by

Three big changes have transformed the landscape of Taiwan’s local patronage factions: Increasing Democratic Progressive Party (DPP) involvement, rising new factions and the Chinese Nationalist Party’s (KMT) significantly weakened control. GREEN FACTIONS It is said that “south of the Zhuoshui River (濁水溪), there is no blue-green divide,” meaning that from Yunlin County south there is no difference between KMT and DPP politicians. This is not always true, but there is more than a grain of truth to it. Traditionally, DPP factions are viewed as national entities, with their primary function to secure plum positions in the party and government. This is not unusual