Back in 1956, an American geophysicist called Marion King Hubbert came up with a startling prediction: that production of oil from the continental US would peak within the next 10 to 15 years. Few paid any attention. This, after all, was the era when the car was king and king-sized; when James Dean was racing in the streets in Rebel Without a Cause and former US president Eisenhower was investing billions of US dollars in the interstate network.

Yet Hubbert's prediction proved unerringly correct. Peak oil — as it was known — duly arrived right on cue in 1970, and since then the US has become more and more dependent on imported crude to meet growing demand for energy. There was, however, another dimension to Hubbert's analysis. The same model, he said, could be used to estimate when peak oil would arrive, not just for the US, but for the entire globe. That moment, he said, would come in about half a century; round about now, in other words.

Hubbert's many champions have used his work to construct a theory of just about everything. Peak oil explains why oil prices are so high; it explains why US President George Bush invaded Iraq and why there is a new scramble for Africa. As the world's oil wells start to run dry, there will be recession and war. After a century or more in which modern industrial societies have been built on seemingly unlimited supplies of oil, the lights are about to go off.

In The Last Oil Shock, David Strahan argues that we ignore the warnings at our peril. Modern industrial societies, he says, are dependent on oil, but over the past 50 years it has become evident that all the big fields have been discovered. Oil companies are busily exploring inhospitable parts of the globe and using the most up-to-date technologies to extract more crude from existing fields, but sooner or later we are going to have accept the inevitable: supply will be unable to keep up with demand.

Even worse, Strahan sees no possibility that alternatives to oil will be developed in time to prevent a full-scale economic crisis. The Last Oil Shock dismisses the idea that we can move seamlessly into an age of hydrogen-powered cars, biofuels and wind farms. Instead, we all need to be changing our lifestyles: buying smaller cars, driving less aggressively, taking our rucksacks to the shops to avoid using plastic carrier bags, spurning apples that have been shipped halfway round the world.

Duncan Clarke's The Battle for Barrels says we should take warnings of impending armageddon with a pinch of salt. The peak oil theorists take an overly deterministic view of the world, he argues, and far from being imminent, peak oil may be decades, perhaps even a century, ahead. His argument is that it is far too simplistic to extrapolate, with any degree of precision, when the world will reach the point of maximum oil production from Hubbert's 50-year-old study of the US.

Clarke, who has 25 years of experience in the oil exploration business, says the flaw in the peak oil argument is that it ignores the basic rules of economics: that when the price of something goes up, either supply increases or demand falls. It doesn't make financial sense to explore particularly inhospitable parts of the world when oil prices are US$10 a barrel; but it is quite a different story when a barrel of crude is changing hands at US$60 a barrel.

The evidence from the oil industry suggests that Clarke has a point. Following the two oil shocks of the 1970s, exploration activity was high in the first half of the 1980s, then fell sharply as oil prices tumbled, and carried on declining throughout the 1990s. According to the peak oil analysis, the decline in exploration is a function of geology; there's simply less oil to find. According to Clarke, it's a question of dollars and cents, and the doubling of the oil price since 2003 should lead to renewed activity. But, as Strahan points out, that presupposes the oil is there in the first place. Even adjusted for inflation, the price of crude is much higher now than it was 50 years ago, yet discoveries of new reserves have fallen sharply over the same period. Nor does technology seem to help that much; the US and the UK have some of the most advanced oil industries in the world, yet production in both countries is still in inexorable decline.

There's not a lot of love lost between the two camps. Strahan says Clarke and, indeed, the whole of the mainstream global oil industry is in class-one denial about the looming energy crisis. Clarke's view is that the peak oilers are using a flawed methodology to come up with unfounded and alarmist conclusions. There's clearly a market out there for both books: an Internet search for "peak oil" comes up with more than six million hits.

Of the two books, Strahan's is definitely the better read. The Battle for Barrels is barely 250 pages long, but it's tough going, giving the impression of being a much shorter academic paper expanded to book length. There is far too much repetition and score-settling, and, unless you happen to work in the oil industry or be obsessed with peak oil, the excessive use of acronyms makes it impossible to read without one finger permanently wedged in the glossary at the back. The writing is leaden and all too frequently lapses into management-speak. Referring to the debate about the size of global oil reserves, for example, Clarke says: "Here it is pertinent to note that peak oil forecasters do not enjoy an undiluted view of the state or corporate portfolios that contain these internal and hidden assessments which their models logically require." Presumably that sentence means something; it is by no means clear what.

Although it will win no prizes for the limpidity of its prose, The Battle for Barrels is a useful corrective to Strahan's argument that the end is nigh. In the end, of course, the peak oil lobby will be proved right. Oil is a finite resource, and once the last drops are squeezed from the Middle East, once the Canadian tar sands have been exploited and the frozen wastes of the Antarctic have been sucked dry, the world will have to find another source of energy. What's really at issue is when that moment will be.

Most heroes are remembered for the battles they fought. Taiwan’s Black Bat Squadron is remembered for flying into Chinese airspace 838 times between 1953 and 1967, and for the 148 men whose sacrifice bought the intelligence that kept Taiwan secure. Two-thirds of the squadron died carrying out missions most people wouldn’t learn about for another 40 years. The squadron lost 15 aircraft and 148 crew members over those 14 years, making it the deadliest unit in Taiwan’s military history by casualty rate. They flew at night, often at low altitudes, straight into some of the most heavily defended airspace in Asia.

Taiwan’s democracy is at risk. Be very alarmed. This is not a drill. The current constitutional crisis progressed slowly, then suddenly. Political tensions, partisan hostility and emotions are all running high right when cool heads and calm negotiation are most needed. Oxford defines brinkmanship as: “The art or practice of pursuing a dangerous policy to the limits of safety before stopping, especially in politics.” It says the term comes from a quote from a 1956 Cold War interview with then-American Secretary of State John Foster Dulles, when he said: ‘The ability to get to the verge without getting into the war is

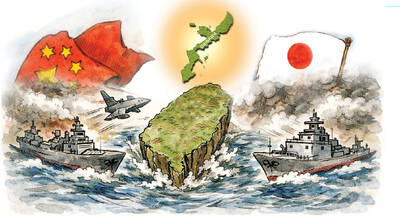

Beijing’s ironic, abusive tantrums aimed at Japan since Japanese Prime Minister Sanae Takaichi publicly stated that a Taiwan contingency would be an existential crisis for Japan, have revealed for all the world to see that the People’s Republic of China (PRC) lusts after Okinawa. We all owe Takaichi a debt of thanks for getting the PRC to make that public. The PRC and its netizens, taking their cue from the Chinese Communist Party (CCP), are presenting Okinawa by mirroring the claims about Taiwan. Official PRC propaganda organs began to wax lyrical about Okinawa’s “unsettled status” beginning last month. A Global

Like much in the world today, theater has experienced major disruptions over the six years since COVID-19. The pandemic, the war in Ukraine and social media have created a new normal of geopolitical and information uncertainty, and the performing arts are not immune to these effects. “Ten years ago people wanted to come to the theater to engage with important issues, but now the Internet allows them to engage with those issues powerfully and immediately,” said Faith Tan, programming director of the Esplanade in Singapore, speaking last week in Japan. “One reaction to unpredictability has been a renewed emphasis on