The Greek financial crisis has put the very survival of the euro at stake. At the euro’s creation, many worried about its long-term viability. When everything went well, these worries were forgotten, but the question of how adjustments would be made if part of the eurozone were hit by a strong adverse shock lingered. Fixing the exchange rate and delegating monetary policy to the European Central Bank eliminated two primary means by which national governments stimulate their economies to avoid recession. What could replace them?

The Nobel Laureate Robert Mundell laid out the conditions under which a single currency could work. Europe didn’t meet those conditions at the time and it still doesn’t. The removal of legal barriers to the movement of workers created a single labor market, but linguistic and cultural differences make US-style labor mobility unachievable.

Moreover, Europe has no way of helping those countries facing severe problems. Consider Spain, which has an unemployment rate of 20 percent — and more than 40 percent among young people. It had a fiscal surplus before the crisis — after the crisis, its deficit increased to more than 11 percent of GDP, but, under EU rules, Spain must now cut its spending, which will likely exacerbate unemployment. As its economy slows, the improvement in its fiscal position may be minimal.

Some hoped that the Greek tragedy would convince policymakers that the euro cannot succeed without greater cooperation (including fiscal assistance), but Germany (and its Constitutional Court), partly following popular opinion, has opposed giving Greece the help that it needs.

To many, both inside and outside of Greece, this stance was peculiar — billions had been spent saving big banks, but evidently saving a country of 11 million people was taboo.

It was not even clear that the help Greece needed should be labeled a bailout. While the funds given to financial institutions, such as American International Group, were unlikely to be recouped, a loan to Greece at a reasonable interest rate would likely be repaid.

A series of half-offers and vague promises, intended to calm the market, failed. Just as the US had cobbled together assistance for Mexico 15 years ago by combining help from the IMF and the G7, so too, the EU put together an assistance program with the IMF. The question was, what conditions would be imposed on Greece? How big would be the adverse impact?

For the EU’s smaller countries, the lesson is clear — if they do not reduce their budget deficits, there is a high risk of a speculative attack, with little hope for adequate assistance from their neighbors, at least not without painful and counterproductive pro-cyclical budgetary restraints. As European countries take these measures, their economies are likely to weaken — with unhappy consequences for the global recovery.

It may be useful to see the euro’s problems from a global perspective. The US has complained about China’s current account surpluses, but as a percentage of GDP, Germany’s surplus is even greater. Assume that the euro was set so that trade in the eurozone as a whole was roughly in balance. In that case, Germany’s surplus means that the rest of Europe is in deficit and the fact that these countries are importing more than they are exporting contributes to their weak economies.

The US has been complaining about China’s refusal to allow its exchange rate to appreciate relative to the US dollar, but the euro system means that Germany’s exchange rate cannot increase relative to other eurozone members. If the exchange rate did increase, Germany would find it more difficult to export and its economic model, based on strong exports, would face a challenge. At the same time, the rest of Europe would export more, GDP would increase and unemployment would decrease.

Germany, like China, views its high savings and export prowess as virtues, not vices, but John Maynard Keynes pointed out that surpluses lead to weak global aggregate demand — countries running surpluses exert a “negative externality” on their trading partners. Indeed, Keynes believed that it was surplus countries, far more than deficit countries, that posed a threat to global prosperity — he went so far as to recommend a tax on surplus countries.

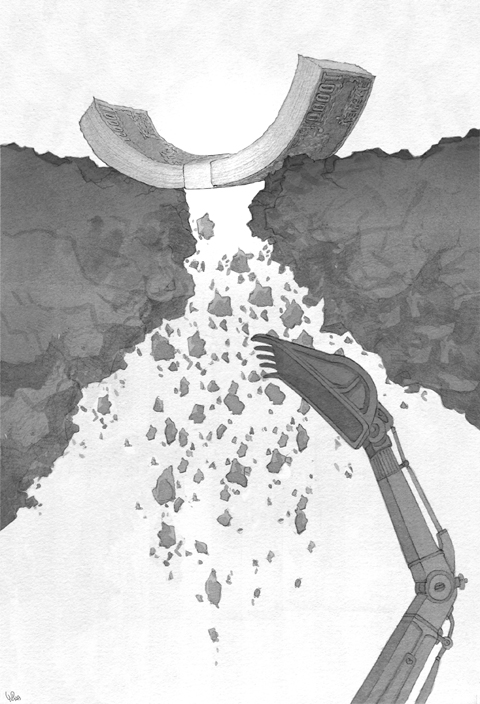

The social and economic consequences of the current arrangements should be unacceptable. Those countries whose deficits have soared as a result of the global recession should not be forced into a death spiral — as Argentina was a decade ago.

One proposed solution is for these countries to engineer the equivalent of a devaluation — a uniform decrease in wages. This, I believe, is unachievable and its distributive consequences are unacceptable. The social tensions would be enormous. It is a fantasy.

There is a second solution — the exit of Germany from the eurozone or the division of the eurozone into two sub-regions. The euro was an interesting experiment, but like the almost-forgotten exchange rate mechanism that preceded it and fell apart when speculators attacked the British pound in 1992, it lacks the institutional support required to make it work.

There is a third solution, which Europe may come to realize is the most promising for all — implement the institutional reforms, including the necessary fiscal framework, that should have been made when the euro was launched.

It is not too late for Europe to implement these reforms and thus live up to the ideals, based on solidarity, that underlay the euro’s creation, but if Europe cannot do so, then perhaps it is better to admit failure and move on than to extract a high price in unemployment and human suffering in the name of a flawed economic model.

Joseph Stiglitz is a professor at Columbia University and a Nobel laureate in economics.

COPYRIGHT: PROJECT SYNDICATE

Taiwan is a small, humble place. There is no Eiffel Tower, no pyramids — no singular attraction that draws the world’s attention. If it makes headlines, it is because China wants to invade. Yet, those who find their way here by some twist of fate often fall in love. If you ask them why, some cite numbers showing it is one of the freest and safest countries in the world. Others talk about something harder to name: The quiet order of queues, the shared umbrellas for anyone caught in the rain, the way people stand so elderly riders can sit, the

Taiwan’s fall would be “a disaster for American interests,” US President Donald Trump’s nominee for undersecretary of defense for policy Elbridge Colby said at his Senate confirmation hearing on Tuesday last week, as he warned of the “dramatic deterioration of military balance” in the western Pacific. The Republic of China (Taiwan) is indeed facing a unique and acute threat from the Chinese Communist Party’s rising military adventurism, which is why Taiwan has been bolstering its defenses. As US Senator Tom Cotton rightly pointed out in the same hearing, “[although] Taiwan’s defense spending is still inadequate ... [it] has been trending upwards

After the coup in Burma in 2021, the country’s decades-long armed conflict escalated into a full-scale war. On one side was the Burmese army; large, well-equipped, and funded by China, supported with weapons, including airplanes and helicopters from China and Russia. On the other side were the pro-democracy forces, composed of countless small ethnic resistance armies. The military junta cut off electricity, phone and cell service, and the Internet in most of the country, leaving resistance forces isolated from the outside world and making it difficult for the various armies to coordinate with one another. Despite being severely outnumbered and

After the confrontation between US President Donald Trump and Ukrainian President Volodymyr Zelenskiy on Friday last week, John Bolton, Trump’s former national security adviser, discussed this shocking event in an interview. Describing it as a disaster “not only for Ukraine, but also for the US,” Bolton added: “If I were in Taiwan, I would be very worried right now.” Indeed, Taiwanese have been observing — and discussing — this jarring clash as a foreboding signal. Pro-China commentators largely view it as further evidence that the US is an unreliable ally and that Taiwan would be better off integrating more deeply into