Wall Street heads into next week packing a better than expected February jobs report that has fired up visions of stronger economic recovery that could prove a turning point for equities.

The US Labor Department’s monthly report revealed on Friday that Mother Nature’s wintry blasts were no match for a US economy gaining steam. Stocks soared on the news, forging gains over the week after last week’s losses.

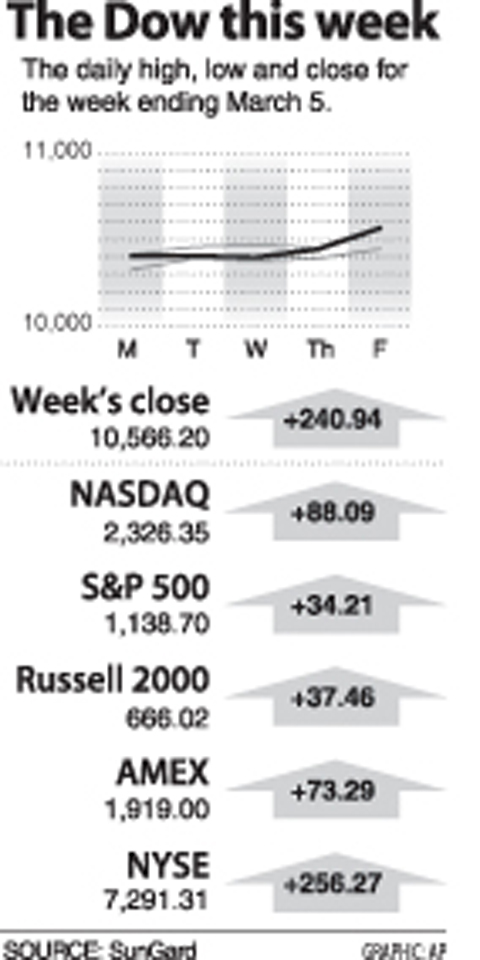

The Dow Jones Industrial Average rose 2.33 percent to close at 10,566.20. It was the first time the blue-chip Dow topped the 10,500-point threshold since January 20.

The technology-rich NASDAQ composite leaped 3.94 percent over the week to 2,326.35, its highest level since September 2008. The broad-market Standard & Poor’s 500 index advanced 3.10 percent to 1,138.70 points.

The market spent much of the past week waiting for the government’s monthly labor market report, largely shrugging off negative news as it braced for the key indicator of economic momentum, which this time delivered a powerful lift to sentiment.

The Labor Department said that nonfarm payrolls fell by 36,000, surprising most analysts who projected 67,000 job losses because of massive snow storms that crippled the country’s northeastern region.

The unemployment rate remained unchanged from 9.7 percent in January, instead of an expected rise to 9.8 percent.

“If this is the kind of jobs report we get with a record blizzard on the East Coast and unusually harsh weather in the Midwest, get ready for a blow-out positive payroll number next month,” said Brian Wesbury at FT Advisors.

Investors got a further boost when the Federal Reserve said consumer credit rose 2.4 percent or US$5 billion in January from December, the first rise since January 2009 and the biggest since July 2008.

“This was seen as a sign that Americans are gaining confidence in the economy. The report also suggested that banks may be more willing to lend money,” Scott Marcouiller at Wells Fargo Advisors said.

The market will find little new economic fuel in the next week to keep the momentum going, which could test the strength of investors’ convictions in the sustainability of the recovery.

The data calendar is relatively light throughout the week until Thursday, when the government reports the January trade balance and weekly initial unemployment claims.

Retail sales is the highlight on Friday, when investors will be looking to see if there is an increase in consumer spending, which accounts for two-thirds of economic activity and is crucial for recovery.

“The January trade balance is expected to widen slightly in response to higher oil prices,” IHS Global Insight economists Brian Bethune and Nigel Gaust said in a client note.

“February retail sales are expected to be close to flat — lower auto sales are expected to be offset by higher sales in other major channels,” they said.

Market action in the week ahead is “difficult to predict” given the dearth of major economic indicators, said Hugh Johnson of Johnson Illington Advisors.

“The mood started to pick up primarily because it looks as though the economy has not been hurt as much by the bad weather as we thought.”

Bonds slumped over the week. The yield on the 10-year Treasury bond rose to 3.682 percent Friday from 3.595 percent a week earlier and that on the 30-year bond climbed to 4.639 percent from 4.529 percent. Bond yields and prices move in opposite directions.

CALL FOR SUPPORT: President William Lai called on lawmakers across party lines to ensure the livelihood of Taiwanese and that national security is protected President William Lai (賴清德) yesterday called for bipartisan support for Taiwan’s investment in self-defense capabilities at the christening and launch of two coast guard vessels at CSBC Corp, Taiwan’s (台灣國際造船) shipyard in Kaohsiung. The Taipei (台北) is the fourth and final ship of the Chiayi-class offshore patrol vessels, and the Siraya (西拉雅) is the Coast Guard Administration’s (CGA) first-ever ocean patrol vessel, the government said. The Taipei is the fourth and final ship of the Chiayi-class offshore patrol vessels with a displacement of about 4,000 tonnes, Lai said. This ship class was ordered as a result of former president Tsai Ing-wen’s (蔡英文) 2018

‘SECRETS’: While saying China would not attack during his presidency, Donald Trump declined to say how Washington would respond if Beijing were to take military action US President Donald Trump said that China would not take military action against Taiwan while he is president, as the Chinese leaders “know the consequences.” Trump made the statement during an interview on CBS’ 60 Minutes program that aired on Sunday, a few days after his meeting with Chinese President Xi Jinping (習近平) in South Korea. “He [Xi] has openly said, and his people have openly said at meetings, ‘we would never do anything while President Trump is president,’ because they know the consequences,” Trump said in the interview. However, he repeatedly declined to say exactly how Washington would respond in

WARFARE: All sectors of society should recognize, unite, and collectively resist and condemn Beijing’s cross-border suppression, MAC Minister Chiu Chui-cheng said The number of Taiwanese detained because of legal affairs by Chinese authorities has tripled this year, as Beijing intensified its intimidation and division of Taiwanese by combining lawfare and cognitive warfare, the Mainland Affairs Council (MAC) said yesterday. MAC Minister Chiu Chui-cheng (邱垂正) made the statement in response to questions by Democratic Progressive Party (DPP) Legislator Puma Shen (沈柏洋) about the government’s response to counter Chinese public opinion warfare, lawfare and psychological warfare. Shen said he is also being investigated by China for promoting “Taiwanese independence.” He was referring to a report published on Tuesday last week by China’s state-run Xinhua news agency,

‘ADDITIONAL CONDITION’: Taiwan will work with like-minded countries to protect its right to participate in next year’s meeting, the foreign ministry said The US will “continue to press China for security arrangements and protocols that safeguard all participants when attending APEC meetings in China,” a US Department of State spokesperson said yesterday, after Beijing suggested that members must adhere to its “one China principle” to participate. “The United States insists on the full and equal participation of all APEC member economies — including Taiwan — consistent with APEC’s guidelines, rules and established practice, as affirmed by China in its offer to host in 2026,” the unnamed spokesperson said in response to media queries about China putting a “one China” principle condition on Taiwan’s