Retired security guard Tam Kai-biu does not like to take risks.

The 74-year-old never gambles on the horses or the lottery. When his banks tried to sell him an investment product, he would say: “Please, I don’t need any funds or stocks.”

Now he fears he may have lost the HK$2 million (US$260,000) in savings and pension money he and his wife had built up since he arrived penniless in Hong Kong from Guangzhou in 1955.

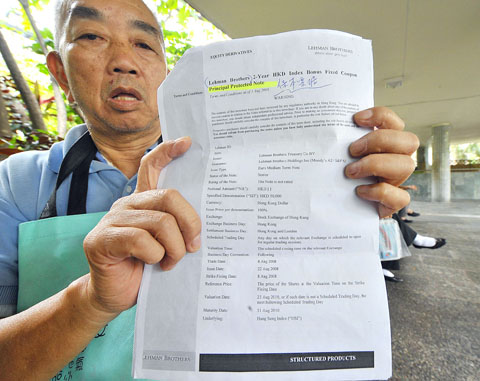

PHOTO: AFP

While the global financial crisis has triggered massive and unprecedented government intervention to try to shore up plummeting markets, his story is a potent indicator of how the squeeze affects ordinary people around the world far removed from once-mighty banking and investment titans.

Tam and his wife had saved the money over almost four decades from what was left after raising four sons. He worked as a wood craftsman during the day and a security guard at night, while his wife was a cleaner.

“We earned the money with our own hands and we would not do anything risky with it,” he said.

In mid-August, Tam received a phone call from his long-time financial adviser at Hong Kong’s Dah Sing Bank (大新銀行).

At the time, shares in US investment bank Lehman Brothers were collapsing on concerns that the 158-year-old company could not raise enough capital to cover mortgage losses.

None of this was mentioned. Instead, Tam’s adviser told him about an attractive “savings plan” offering interest of 3.8 percent, significantly higher than the 2 percent he was getting.

“He said the plan was great and that although Dah Sing was not the ‘boss’ behind it, there would be no risk at all. He advised me to transfer all my money into it,” Tam said.

Tam, who dropped out of school and is barely literate, said he had never heard of Lehman Brothers when he was sold the so-called minibonds, a complex financial instrument linked to both bonds and derivatives.

Even if he had, he would not have known that the US$600 billion Wall Street giant was behind what he had signed his life savings into.

His financial adviser gave him an English-only document spelling out the nature of the “savings plan” and made no attempt to translate it for him, he said.

The document contains a scribbled Chinese note on one page saying the products were “principal protected” — which Tam said was written by his financial adviser.

On another page in smaller English print, the document reads: “There is a risk that any investor may lose the value of their entire investment or part of it.”

On Sept. 15, the US bank filed for bankruptcy.

Tam said his financial adviser contacted him that day and said for the first time that his money had been used to buy Lehman Brothers financial products.

Tam tried but failed to locate the adviser at the bank, but said the manager showed him the document he had signed, drew brackets around the words “Lehman Brothers” and asked him: “Here, can’t you see the name of the issuer bank yourself?”

Tam said he is now having trouble sleeping and eating, and his wife is suicidal.

They are among the more than 8,000 angry Hong Kong investors who claim that various local banks mis-sold them the “mini-bonds” and other complex financial products backed by Lehmans, which are now potentially worthless.

Their combined loss could be around HK$12.7 billion.

It’s not just in Hong Kong. In Singapore, about 600 investors who have lost savings rallied on Saturday, urging the city-state’s central bank to help recover their money.

Like Tam, many of those who gathered were retirees who invested their life savings in financial products linked to Lehmans and other institutions.

They, too, said that they felt “cheated” and “betrayed” that the banks did not fully inform them of the risks when they were offered the products.

A spokeswoman for Dah Sing refused comment on Tam’s case.

But asked why they continued to sell Lehman products despite knowing the bank was close to collapse, she said: “The rating of Lehman Brothers was still high at that time. … Its collapse happened so suddenly that it was unexpected for all of us.”

For weeks, the investors have staged protests outside the banks and clashed with police while demanding a full refund of their original investments.

Hong Kong’s de facto central bank said it is investigating the banks that sold the products, while politicians have threatened class action suits.

Sitting under the trees to recover after an hour of shouting slogans and waving placards in a recent protest outside the city’s legislature, Tam said: “I will keep protesting until they give me back my money. What else can I do?”

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to