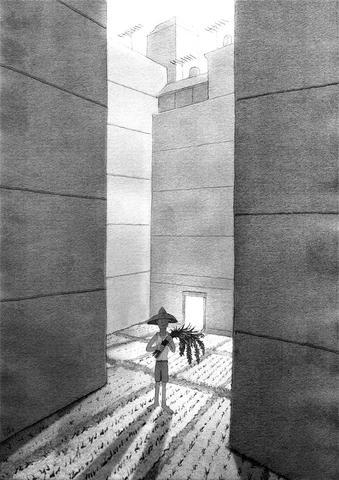

Knee-deep in muddy water, her face smeared with sandalwood paste and a broad-brimmed hat for protection against the broiling sun, Samniang Ketia grins broadly at her good fortune to be in the rice growing business as she replants shoots for the next harvest two months off.

The 37-year-old, who leases a small plot of land in Samblong, central Thailand, knows the price of rice has rocketed -- in some cases nearly doubling in three months -- and that she is about to reap the benefit when she sells what her family does not eat.

But the price rises have a downside and spawned a new phenomenon: rice rustling.

One night, one of Samniang's neighbor's fields was stripped as it was about to be harvested. Local police have now banned harvesting machines from the roads at night while on the northern plains farmers are camping in their fields, shotguns at the ready.

"I've never heard of it happening before, that people have stolen rice," said Lung Choop, 68, who grows rice on his smallholding.

"But it's happening now because rice is so expensive. I guess I'll have to guard my own distant fields when they're ready," he said.

Across Asia the suddenly stratospheric rice prices have prompted countries to ban exports amid fears that shortages could provoke food riots.

While prices of wheat, corn and other agricultural commodities have surged since the end of 2006, partly because of extra demand for biofuels to offset rising oil prices, rice held fairly steady.

However, prices for the staple food of about 2.5 billion Asian people rocketed two months ago. Thai rice, the global benchmark, which was quoted at just below US$400 a tonne in January rose to US$760 last week.

Aware that shortages of such a vital staple could spell trouble at home, Asian governments have moved to ensure their people get enough to eat at a price they could afford, an insurance policy which has in turn raised prices further.

Late last week, Cambodia banned all exports for two months to ensure "food security," following the lead of Egypt, a major exporter. Vietnam, which ships 5 million tonnes abroad each year, on Friday declared a 20 percent cut in exports.

India started the ball rolling late last year. With dwindling stocks, the large exporter introduced curbs that effectively banned exports, around 4 million tonnes. Pakistan and China also introduced curbs.

Hopes that India would re-enter the market within the next few months were dashed last Thursday when it raised the minimum price for exports from US$650 a tonne to US$1,000, effectively maintaining the ban, which was escaped only by the foreign currency-earning premium basmati.

The Philippines is potentially among the biggest losers -- with 91 million people, it cannot feed itself. After its farmers warned of a looming shortfall Manila's fast-food outlets offered to serve "half portions" of rice to conserve stocks. Philippine President Gloria Macapagal Arroyo has also pleaded with Vietnam to guarantee 1.5m tonnes of rice this year.

While Indonesians took to the streets of the capital, Jakarta, in protest at rising prices even Thailand, the world's largest exporter, is bracing itself.

The country produces 30 million tonnes of rice a year, and aims to export 8.5 million tonnes. Last year 9.5 million tonnes was sold abroad and more may be exported this year, prompting ministers to consider curbs.

"A rice shortage in the local market is very likely," said Prasert Kosalwit, director general of the government's rice department.

Rice shortfalls were reported in southern Thailand as traders from the northern rice belt bought up stocks at inflated prices.

With global rice stocks at their lowest level since 1976, analysts expect price rises to continue until the end of next year. Some analysts predict it could hit US$1,000 a tonne before farmers, spurred by the high prices, plant more crops and increase supplies.

Demand outstripped supply by nearly 2 million tonnes last year. The predicted shortfall this year is more than 3 million tonnes on the 424 million tonnes required.

Across Asia, with its vast and growing population, there is little if any extra land to bring into production, and it may take several years for any "supply response" to materialize.

Growing urbanization over the longer term in countries such as China and India is cited as a key factor in the shortfall, where the increasingly affluent middle classes demand more meat and dairy products, with land turned over to growing feed for livestock.

Rising wealth in Africa has also become a factor. Oil-rich Nigeria is now the largest importer in Africa, a continent which takes the lion's share of Thai exports, about 40 percent. Asia soaks up 35 percent.

Severe weather across Asia has also damaged production. Record icy temperatures were recorded in China and Vietnam, the latter of which also suffered a pest outbreak. Bangladesh endured a devastating cyclone while Australia suffered a prolonged drought.

"It's been described as a `perfect storm' of factors that have pushed prices to their highest levels since the 1970s," said Adam Barclay, of the International Rice Research Institute.

The World Food Program is also alarmed. The extra cost of feeding the 28 million "poorest of the poor" spread across 14 Asian countries will cost US$160 million a year and it has asked three dozen donor governments for the cash, part of a US$500 million global appeal to offset rising food prices.

"The real danger with rising rice prices is that the `working poor' will simply be pushed into the category of `poor' who will look to us to feed them," said Paul Risley, spokesman for WFP Asia.

"There are hundreds of millions living at, or just below, the poverty line of U$1-a-day, spending 70 percent of their day-labor wages on food," he said.

"If food costs double they've no opportunity to increase their earnings and no alternative but to reduce what they and their families eat," Risley said.

Is a new foreign partner for Taiwan emerging in the Middle East? Last week, Taiwanese media reported that Deputy Minister of Foreign Affairs Francois Wu (吳志中) secretly visited Israel, a country with whom Taiwan has long shared unofficial relations but which has approached those relations cautiously. In the wake of China’s implicit but clear support for Hamas and Iran in the wake of the October 2023 assault on Israel, Jerusalem’s calculus may be changing. Both small countries facing literal existential threats, Israel and Taiwan have much to gain from closer ties. In his recent op-ed for the Washington Post, President William

Taiwan-India relations appear to have been put on the back burner this year, including on Taiwan’s side. Geopolitical pressures have compelled both countries to recalibrate their priorities, even as their core security challenges remain unchanged. However, what is striking is the visible decline in the attention India once received from Taiwan. The absence of the annual Diwali celebrations for the Indian community and the lack of a commemoration marking the 30-year anniversary of the representative offices, the India Taipei Association and the Taipei Economic and Cultural Center, speak volumes and raise serious questions about whether Taiwan still has a coherent India

A stabbing attack inside and near two busy Taipei MRT stations on Friday evening shocked the nation and made headlines in many foreign and local news media, as such indiscriminate attacks are rare in Taiwan. Four people died, including the 27-year-old suspect, and 11 people sustained injuries. At Taipei Main Station, the suspect threw smoke grenades near two exits and fatally stabbed one person who tried to stop him. He later made his way to Eslite Spectrum Nanxi department store near Zhongshan MRT Station, where he threw more smoke grenades and fatally stabbed a person on a scooter by the roadside.

Recent media reports have again warned that traditional Chinese medicine pharmacies are disappearing and might vanish altogether within the next 15 years. Yet viewed through the broader lens of social and economic change, the rise and fall — or transformation — of industries is rarely the result of a single factor, nor is it inherently negative. Taiwan itself offers a clear parallel. Once renowned globally for manufacturing, it is now best known for its high-tech industries. Along the way, some businesses successfully transformed, while others disappeared. These shifts, painful as they might be for those directly affected, have not necessarily harmed society