Wolfgang Porsche still chafes at the memory of being told, as a seven-year-old, that he could not attend the 75th birthday party of Ferdinand Porsche, his grandfather and the family patriarch.

It was a glittering affair, celebrating the man who designed the forerunner of the Volkswagen Beetle and laid the groundwork for one of Germany's mightiest industrial empires. For young Wolfgang, it would have been a precious chance to see a beloved but often absent figure. Four months after the party, in January 1951, Ferdinand was dead.

Now, nearly six decades later, Wolfgang Porsche is the one making family history: He stands on the brink of uniting Volkswagen with Porsche, the elite sports-car maker founded by his grandfather and built by his father, Ferry Porsche.

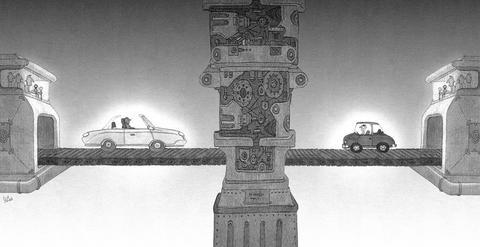

It seems a bizarre mismatch: the Beetle, an enduring symbol of mobility for the masses, sharing the same garage as the 911 Turbo, the ultimate totem of privilege for Beverly Hills plastic surgeons, Russian oligarchs and anyone else with a need for speed, and US$125,000 to burn.

Porsche's takeover -- which began with a surprise 20 percent investment in 2005 and is likely to be completed with a majority stake next year -- has inspired all sorts of bromides in the German news media: a David-and-Goliath tale, an audacious power play, a collision of mass and class.

At its heart, though, it represents a closing of the circle for one of Europe's great automotive dynasties.

"We're just a small automaker from Stuttgart and now we're going to be one of the largest automobile companies in the world," said Porsche, a cordial, soft-spoken 64-year-old who as chairman of Porsche's supervisory board is the current leader of this sprawling German-Austrian family.

Not that he wants to be seen as taking over a US$150 billion company, 14 times the size of Porsche, on sentimental grounds.

"My father and my grandfather would have been very pleased to see this, but that wasn't the reason we did it," Porsche said at the company's headquarters in an interview. "It's a nice side effect."

Porsche, he said, needed to bring Volkswagen into the fold to ensure that others do not get their hands on it. The two carmakers already collaborate in building sport utility vehicles (SUVs) and in developing hybrid engines. Porsche plans to use a Volkswagen assembly plant to stamp out the body of its eagerly awaited four-door sedan, the Panamera, due in 2009.

The takeover, which was the brainchild of Porsche's chief executive, Wendelin Wiedeking, is intended to lock in that partnership. By acting when it did, Porsche headed off private equity investors, which it says were circling Volkswagen in 2005.

Bluff, opinionated and combative, Wiedeking is the public face of Porsche. But Porsche is the behind-the-scenes power -- a gentleman hunter and painter who has a business degree and hands-on car experience at Daimler-Benz, where he worked as a controller from 1976 to 1981.

Fortune

The youngest of Ferry Porsche's four sons, Wolfgang was overshadowed by his eldest brother, Ferdinand Alexander, who designed the 911. But with his brother in poor health, Wolfgang speaks for a family whose fortune is worth well over US$20 billion.

"They're a kind of dream team," said Ferdinand Dudenhoffer, the director of the Center for Automotive Research in Gelsenkirchen. "Wiedeking is the boss and Wolfgang is the patron."

Even with all the family history, and money, Porsche says the decision to buy into Volkswagen was not easy.

"My first thought when Wiedeking proposed it was, `Now, we're getting a bit crazy; Volkswagen is such a big company,"' Porsche said, sitting in his father's old office, beneath a portrait of his grandfather.

The office is above the brick workshop where Porsche's founders used to tinker with engines.

After listening to the sales pitch at a meeting in Salzburg, Austria, five senior members of the family huddled.

"When we looked at the numbers, it made sense," Porsche said.

Two years and US$8 billion worth of stock purchases later, Porsche owns 31 percent of Volkswagen's shares. It has amassed options for several million more shares, which it could convert into close to a majority stake. Porsche says that it is under no pressure to get to 51 percent, though Wiedeking leaves little doubt about the eventual outcome.

"The greater stake you have in a company, the more influence you have," he said in an interview. "If you want to have lasting influence, you have to have over 50 percent. There's no way around it."

For placing Porsche on this threshold, the family has rewarded Wiedeking, 55, with the richest pay package in German industry: an estimated US$85 million to US$100 million this year.

Those US-style numbers set off a protest in Germany, with even conservative German Chancellor Angela Merkel urging executives to show restraint. But Porsche said Wiedeking was worth every cent.

Like many other wealthy families, the Porsches are a complicated lot, subject to bitter feuds, internecine rivalries and political intrigue, particularly when enormous amounts of money are involved.

The Volkswagen investment has aggravated these tensions, people who know the family said, not least because a prominent family member, Ferdinand K. Piech, has been affiliated with Volkswagen since 1993 and is still its supervisory board chairman.

Piech, another grandson of Ferdinand Porsche, is Wolfgang's first cousin. His mother, Louise, was Ferry's sister, and married Anton Piech, a Viennese lawyer and longtime business partner of Ferdinand Porsche. The Piech family is the second branch of the Porsche dynasty.

At Volkswagen, where he was chief executive from 1993 to 2002, Piech is credited with a striking turnaround. He revived its reputation for engineering, turned its Audi division into a rival to Mercedes and BMW and brought the New Beetle to the US.

More controversially, he moved Volkswagen away from its proletarian roots as "the people's car." Among his pet projects were deals to acquire rarefied brands like Lamborghini and Bentley. He created an elegant sedan, the Phaeton, to vault Volkswagen into the luxury market.

A brilliant engineer, Piech, 70, is perhaps Ferdinand Porsche's most accomplished heir. But he is a remote and prickly man, according to people who know him, and he has long had difficult relations with other family members. (Piech turned down a request for an interview.)

Porsche seems likely to dismantle at least some of Piech's legacy. One sore point is the Phaeton, which loses money and is no longer sold in the US. Wolfgang Porsche, though careful not to criticize his cousin directly, said such prestige projects would face heightened scrutiny.

"Piech created many beautiful things at Volkswagen," he said. "Whether we need all of them in the future is another question. There are a lot of money-losing projects at Volkswagen."

Dire problems

Volkswagen, Porsche noted, has dire problems in the US, where it has lost all the gains it made when Piech was chief executive and now has a market share of less than 2 percent. Analysts said its cars were overpriced and too gadget-stuffed for US motorists.

The tension is reaching beyond the family. Wiedeking also speaks freely about what he thinks must change at Volkswagen -- noting, in a dig at the Phaeton, that from now on, every new model must make a profit. He wants Volkswagen to vie with Toyota of Japan to be the world's leading mass-market manufacturer, a far cry from Piech's more aristocratic vision.

Piech also faces questions about a bribery scandal at Volkswagen that began when he was chief executive. The company paid out cash and perks to its top employee representative to secure his support. German prosecutors are asking whether Piech was informed of the arrangement. Piech, the company and former colleagues deny that he knew about it.

Piech is a skilled corporate infighter. Last year, he engineered the dismissal of his successor as Volkswagen chief executive after he lost confidence in him. The new chief, Martin Winterkorn, is a protege of Piech's who shares his passions. But analysts said they were not sure he could outmaneuver Wiedeking, with Porsche standing behind him.

"At the moment, Wolfgang Porsche and Wiedeking seem to have the upper hand because they've got the support of the majority of the family," said Dudenhoffer, the auto analyst.

Wiedeking's muscle stems from his track record. In his 15 years as chief executive Porsche has gone from near-bankruptcy to reaping the highest profit margins of any carmaker.

In 1992, in the grip of a recession, Porsche sales plummeted from their peak in the 1980s. Owning a Porsche was suddenly outre. Costs had spun out of control, the family was squabbling, chief executives were coming and going, and Porsche seemed destined to lose its independence.

"We were this close to the precipice," Porsche said, putting his fingers centimeters from the edge of a table.

He leaned on family members to promote a young production executive, Wiedeking, who had returned to Porsche after three years running an auto parts supplier.

The new boss brought in Japanese managers, mostly from Toyota, to lecture the Porsche workers about efficiency. At the behest of one Japanese visitor, Wiedeking took a saw and cut down shelves stocked with parts -- a vivid demonstration that he was serious about reducing inventory and costs.

The shock therapy worked. By 1995, Porsche was back in the black. It set about refurbishing its image with a successful "entry-level" car, the Boxster, and a new version of its flagship 911. In 2002, it made its biggest gamble, introducing an SUV, the Cayenne.

Today, the Cayenne, which starts at US$43,400, is Porsche's second-largest seller, after the 911, and by far its most popular model in emerging markets like Russia, China, India and the Middle East. A common sight on streets from Shanghai to St Petersburg, it is Porsche's calling card.

That makes Porsche less dependent on the US, which in the mid-1980s accounted for 60 percent of its sales. (Remember when Tom Cruise let his father's Porsche 928 roll into Lake Michigan in the film Risky Business?) This year, its North American sales slid 10.3 percent.

"In the last year, we took almost 6,000 cars intended for the US and shipped them directly to Russia and China," Wiedeking said. "Every Saturday, we run extra shifts. We can't produce enough Cayennes."

If selling SUVs to wealthy Russians or Chinese is not enough, Porsche has also made a bundle on its Volkswagen investment. Last month, it reported that its pretax profit for the 2006-2007 fiscal year rose to 5.85 billion euros (US$8.4 billion), from 2.11 billion euros the previous year. Most of that, a staggering US$5.1 billion, came from trading profit on its Volkswagen options.

Shares of Volkswagen have nearly doubled this year -- thanks partly to its better performance -- netting Porsche a huge gain on its cash-settled options. Analysts joke that Wiedeking is paid like the manager of a successful hedge fund, which Porsche resembles these days.

One could hardly tell from visiting Porsche's poky headquarters that this is a giant cash register. Wiedeking works in a modest office down the hall from Porsche, in a low-slung, red-brick building that dates from Ferdinand Porsche's era. The Porsche sports cars parked out front seem less a showy statement than a sign of a company that eats its own cooking.

"They have a frugal, almost Calvinist approach," said Garel Rhys, director of the Center for Automotive Industry Research at Cardiff University in Wales. "They don't flaunt their wealth. This is a family that knew the dreadful conditions in Europe before World War II."

War Criminal

Like other German industrialists, Ferdinand Porsche cooperated with the Nazi regime. In 1934, three years after setting up his firm, he designed a car for Hitler that was the precursor to the Beetle. Later, he designed tanks and amphibious vehicles. In 1945, he was imprisoned for nearly two years by the French as a war criminal, though he was never formally charged.

The Porsches have long used their native Austria as a refuge, temporarily moving the company there in 1945. The family owns the Volkswagen distribution network for Austria, another pillar of its fortune. They live in castles and villas sprinkled around the resort of Zell am See.

Now, though, the Porsches will be tied more than ever to Germany, and controlling Volkswagen could thrust the family into a harsh political spotlight. The state of Lower Saxony retains a 20 percent stake in Volkswagen. Thanks to this state involvement, the company's 324,000 workers have historically wielded outsize influence in its affairs.

Porsche has already gotten off on the wrong foot, setting up a new entity, Porsche Automobil Holding, as an umbrella for the sports-car company and Volkswagen, which will keep its board. Volkswagen's employee leaders assert that the arrangement is calculated to dilute their voice.

Porsche signed a deal with its 12,000 workers, giving them and the Volkswagen work force each three seats on the 12-member holding company board. It changed its legal status from a German to a European company, fueling suspicions that it was trying to skirt strict German worker protection laws.

Volkswagen's worker representatives have filed a lawsuit challenging the makeup of the board.

"You can't take over a company against the will of its work force," the company's chief employee representative, Bernd Osterloh, told the Berliner Zeitung last month.

Workers from Volkswagen and Porsche are trying to negotiate a compromise, but feelings are raw on both sides.

"People are afraid of losing the power and influence they once had," Porsche said.

If Porsche wanted to curtail the rights of Volkswagen's workers, he said, it could have moved the headquarters outside Germany, something that the family considered.

"But I don't want to put oil on the fire," he added.

The angst of Volkswagen's workers is perhaps understandable: their future now depends on Porsche's ability to steer a much larger company. Two other successful German carmakers, Daimler and BMW, stumbled in recent years when they tried similar expansions.

After more than a year of review, the National Security Bureau on Monday said it has completed a sweeping declassification of political archives from the Martial Law period, transferring the full collection to the National Archives Administration under the National Development Council. The move marks another significant step in Taiwan’s long journey toward transitional justice. The newly opened files span the architecture of authoritarian control: internal security and loyalty investigations, intelligence and counterintelligence operations, exit and entry controls, overseas surveillance of Taiwan independence activists, and case materials related to sedition and rebellion charges. For academics of Taiwan’s White Terror era —

On Feb. 7, the New York Times ran a column by Nicholas Kristof (“What if the valedictorians were America’s cool kids?”) that blindly and lavishly praised education in Taiwan and in Asia more broadly. We are used to this kind of Orientalist admiration for what is, at the end of the day, paradoxically very Anglo-centered. They could have praised Europeans for valuing education, too, but one rarely sees an American praising Europe, right? It immediately made me think of something I have observed. If Taiwanese education looks so wonderful through the eyes of the archetypal expat, gazing from an ivory tower, how

China has apparently emerged as one of the clearest and most predictable beneficiaries of US President Donald Trump’s “America First” and “Make America Great Again” approach. Many countries are scrambling to defend their interests and reputation regarding an increasingly unpredictable and self-seeking US. There is a growing consensus among foreign policy pundits that the world has already entered the beginning of the end of Pax Americana, the US-led international order. Consequently, a number of countries are reversing their foreign policy preferences. The result has been an accelerating turn toward China as an alternative economic partner, with Beijing hosting Western leaders, albeit

During the long Lunar New Year’s holiday, Taiwan has shown several positive developments in different aspects of society, hinting at a hopeful outlook for the Year of the Horse, but there are also significant challenges that the country must cautiously navigate with strength, wisdom and resilience. Before the holiday break, Taiwan’s stock market closed at a record 10,080.3 points and the TAIEX wrapped up at a record-high 33,605.71 points, while Taipei and Washington formally signed the Taiwan-US Agreement on Reciprocal Trade that caps US tariffs on Taiwanese goods at 15 percent and secures Taiwan preferential tariff treatment. President William Lai (賴清德) in