The chief economist for the IMF on Thursday said one of the bright spots in the world economy is Japan, which was reaping the rewards of banking reform and growing private consumption -- in contrast to a lagging euro zone that has failed to tackle its structural problems.

"The Japanese economy offers more hope, with the first half of this year coming in very strong," Raghuram Rajan said. "Particularly gratifying has been the steady improvement in private consumption," he said.

"Coupled with buoyant private investment, Japan has been reducing its reliance on exports for growth," he said.

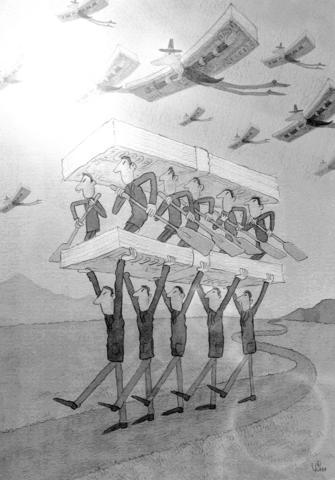

ILLUSTRATION: YU SHA

He spoke to reporters after the release of the IMF's fall World Economic Outlook, which anticipated robust global growth of 4.3 percent but warned of the ill effects of soaring oil prices, elevated asset and house price levels and consumer-driven growth.

The oil issue, driven in recent weeks by the effect of Hurricane Katrina on the US Gulf Coast, overlays most other economic issues discussed in the report, released this week ahead of the IMF's joint fall meetings with the World Bank in Washington that started on Saturday.

For Japan, the report noted, "robust private consumption was underpinned by a strengthening labor market" with "full time employment expanding for the first time in seven years."

Business investment grew and wage growth was positive, the IMF said.

The IMF said that much of the progress stemmed from addressing "weaknesses in the bank and corporate sectors."

"This reform momentum ... needs to be maintained," the IMF wrote, adding that bank profitability of Japanese banks "needs to be increased" and the "corporate sector needs to earn a higher rate of return on its assets."

Expectations of future "tightness" in the oil market continue to drive up oil prices, and Hurricane Katrina has only made matters worse, the IMF said.

While the expansion of the global economy "remains broadly on track," the higher oil prices are an "increasingly important offset" that are exacerbating regional differences, the IMF said.

Only the US, China, Japan (with 2 percent growth) and India (with 7.7 percent growth) are expected to escape a downward economic trend expected for most other regions of the world, the report said.

India, however, although booming from outsourcing of its technological services, was limited by its high import tariffs in its contribution to world trade.

In view of rising oil prices, OPEC on Tuesday said it would offer up to another 2 million barrels of oil a day to the world market, beginning with a half million barrel boost immediately.

The advent of a second hurricane -- Rita -- heading to the US Gulf Coast drove prices to more than US$67 a barrel by the beginning of the week.

Oil prices have risen over US$20 a barrel since last year, and there was a "15 percent chance" that West Texas crude could rise above US$80 a barrel, according to options markets cited by the IMF.

Soaring oil prices in fact are the downside of the "forecasts of continued robust global economic growth," flagging capacity among OPEC producers and "fears" that the recent slowdown in non-OPEC production may be "somewhat permanent," the report said.

"The sensitivity of prices to short-term developments was strikingly demonstrated by the damage recently caused by Hurricane Katrina to the oil and gas infrastructure of the Gulf of Mexico," which accounts for 20 percent of US needs, the IMF said.

The report notes that oil prices continued to rise despite US President George W. Bush's release of strategic oil reserves after Katrina struck on Aug. 29, and despite OPEC's "accommodative stance."

The phenomenon raises concerns about the normal "seasonal surge" during the approaching Northern Hemisphere's winter. Natural gas prices, for example, are expected to rise by 70 percent in the US Midwest, according to government figures quoted by US Senator Byron Dorgan.

The IMF said that the US and China continue to lead the global expansion, but growth projections for this year "in most other regions have been marked downward -- with the important exceptions of Japan and India."

On the upside, the IMF said that core inflation "appears generally contained, inflationary expectations well-anchored and wage increases moderate."

Other factors that are expected to weigh against the downward pull of oil prices are unusually low long-term interest rates, strong corporate profits, favorable emerging market finance conditions and the "increased presence of long-term investors" in the developing world.

The report noted that protectionist sentiments are rising, driven by "global imbalances and growing fears of emerging market competition," and emphasized concerns about the possible burst of the housing market bubble in the US and Canada.

"Notwithstanding these risks, the short-term outlook remains generally solid, with the global economy having proved remarkably resilient to the shocks of the last several years," the IMF wrote.

The IMF said the ongoing IT revolution would continue to push economic growth, but worried that the "longer-run foundations" of the expansion were "shakier," because the recovery "continues to depend unduly on developments in the United States and China."

In specific regional notations, the IMF reported:

-- India's recent "robust growth" of 7.7 percent may raise questions as to whether it has "become an engine for global growth, the IMF said. India has accounted for just under 20 percent of Asian growth and 10 percent of world growth over the past years, compared with 53 percent and 28 percent for China, the IMF said.

But the IMF noted that because India remains a "relatively closed economy," its role as a growth engine is limited. Despite India's success in outsourcing its technological talent, "trade linkages remain weak" -- with tariffs averaging 22 percent, far above the average emerging Asia and global tariff rates of 9.5 and 11.5 percent.

India still only accounts for 2.5 percent of the global trade in goods and services, the IMF noted.

-- There were continuing worries about Western Europe's sluggish growth, which averaged about 1.25 percent in the first half of this year, but the IMF said the rejection of the EU constitution by France and the Netherlands did not have a major effect on growth.

-- GDP growth has exceeded expectations in emerging economies of Asia, led by China and India, while growth has slowed in Latin America, particularly in Brazil, due to political uncertainties, the IMF said.

-- Oil prices have buoyed growth in the Middle East, growth in Turkey has slowed to a "more sustainable pace," while growth in Russia has slowed since the middle of last year, "reflecting rising capacity constraints and the adverse effect of the Yukos affair."

-- GDP growth in sub-Saharan Africa was forecast at 4.8 percent this year, 0.4 percent less than expected in April, "partly reflecting a sharp slowdown in Nigeria as oil production nears capacity." But by next year, that figure was expected to rebound to 5.9 percent.

The gutting of Voice of America (VOA) and Radio Free Asia (RFA) by US President Donald Trump’s administration poses a serious threat to the global voice of freedom, particularly for those living under authoritarian regimes such as China. The US — hailed as the model of liberal democracy — has the moral responsibility to uphold the values it champions. In undermining these institutions, the US risks diminishing its “soft power,” a pivotal pillar of its global influence. VOA Tibetan and RFA Tibetan played an enormous role in promoting the strong image of the US in and outside Tibet. On VOA Tibetan,

Sung Chien-liang (宋建樑), the leader of the Chinese Nationalist Party’s (KMT) efforts to recall Democratic Progressive Party (DPP) Legislator Lee Kun-cheng (李坤城), caused a national outrage and drew diplomatic condemnation on Tuesday after he arrived at the New Taipei City District Prosecutors’ Office dressed in a Nazi uniform. Sung performed a Nazi salute and carried a copy of Adolf Hitler’s Mein Kampf as he arrived to be questioned over allegations of signature forgery in the recall petition. The KMT’s response to the incident has shown a striking lack of contrition and decency. Rather than apologizing and distancing itself from Sung’s actions,

US President Trump weighed into the state of America’s semiconductor manufacturing when he declared, “They [Taiwan] stole it from us. They took it from us, and I don’t blame them. I give them credit.” At a prior White House event President Trump hosted TSMC chairman C.C. Wei (魏哲家), head of the world’s largest and most advanced chip manufacturer, to announce a commitment to invest US$100 billion in America. The president then shifted his previously critical rhetoric on Taiwan and put off tariffs on its chips. Now we learn that the Trump Administration is conducting a “trade investigation” on semiconductors which

By now, most of Taiwan has heard Taipei Mayor Chiang Wan-an’s (蔣萬安) threats to initiate a vote of no confidence against the Cabinet. His rationale is that the Democratic Progressive Party (DPP)-led government’s investigation into alleged signature forgery in the Chinese Nationalist Party’s (KMT) recall campaign constitutes “political persecution.” I sincerely hope he goes through with it. The opposition currently holds a majority in the Legislative Yuan, so the initiation of a no-confidence motion and its passage should be entirely within reach. If Chiang truly believes that the government is overreaching, abusing its power and targeting political opponents — then