We are likely to hear a lot about former US president Herbert Hoover in the coming months as the US presidential election approaches in November. But it is a name that President George W. Bush would rather forget.

Hoover, a Republican, was president from 1929 to 1933 and his term saw the stock market crash of 1929 and the early years of the Great Depression. He was walloped by Franklin D. Roosevelt in 1933, having presided over huge job losses and having shanty towns on the edge of cities dubbed "Hoovervilles."

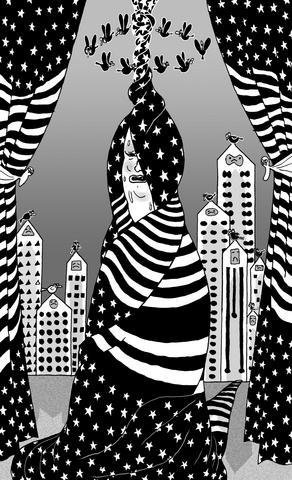

ILLUSTRATION MOUNTAIN PEOPLE

The similarity to Bush, also a Republican, is that the present incumbent faces the prospect of becoming the first president since Hoover to preside over a net loss of jobs in a four-year term.

As Bush's term has followed the eight years of economic boom under Democrat Bill Clinton, the Hoover comparison is one that hurts.

It hands Democratic challenger Senator John Kerry one of his strongest cards in the campaign.

It has been touch-and-go all year as to whether jobs growth, measured by monthly non-farm payrolls data, would be sufficiently rapid to save Bush from having to adopt the Hoover mantle.

But last month's low jobs figure of 32,000, compared with a Wall Street forecast of a 220,000 gain, combined with a downward revision of 50,000 to the jobs numbers of the previous two months, means Bush needs almost a quarter of a million new jobs a month between now and the end of the year to replace all the jobs lost since he took power in 2000. True, the economy has created 1.5 million jobs in the past year, but that has barely kept pace with the country's population growth, so it has made little dent in the ranks of the unemployed and is the slowest employment recovery in several decades.

Since the payrolls number emerged, radio programs in the US have been dominated by phone-ins about the economy and jobs, to the delight of the Kerry camp and the chagrin of the Bush team, who prefer to talk tough about their wartime leader.

Bush regularly argues that the economy has "turned the corner." Kerry retorts that the recovery has made a U-turn to nowhere.

On the grounds that, to borrow a famous phrase from a Clinton campaign adviser in 1992, "it's the economy, stupid" that decides elections, Bush Jr. is only too aware that he could yet be defeated by a so-called "jobless recovery," as his father was 12 years ago.

There is little dispute that the economy, which began to grow robustly earlier this year and create jobs at a decent pace, has stumbled over the past couple of months with consumer spending grinding to a halt and growth slowing to 3 percent annualized in the second quarter from 4.5 percent in the first.

Economists blame the stumbling economy on the rising cost of energy, with oil prices up nearly one-third this year, and the fading impact of last year's tax cuts.

US Federal Reserve chairman Alan Greenspan has assured Americans that this is a "soft patch" that will prove short-lived. He needs to hope so. Interest rates, at 1.5 percent, are only a touch above their lowest level for decades, leaving Greenspan almost no possibility of cutting rates sharply if the economy remains in the doldrums. Indeed, he says the Fed will continue gradually raising rates to more normal levels, but that could be awkward if the economy proves more sluggish than expected. Economists remain divided as to whether the slowdown is normal for this stage of a recovery and will be temporary, or whether it represents the running out of steam of a house price and credit bubble which has been driven by cheap money and the tax cuts of the past three years. For Bush that is an argument that will play itself out in the fullness of time. He needs good news on the economy and he needs it fast.

The trouble is, it is not easy to see where that is going to come from in the near future. Payrolls data may show some recovery but are unlikely to bring down the unemployment rate of 5.5 percent by much and are also unlikely to chase the Hoover comparisons away.

Although manufacturing appears to be prospering and cars sold well last month, stock markets have fallen to their lowest levels this year and oil prices have been marching relentlessly to a record high of nearly US$49 a barrel last Friday, leading to steep rises in gasoline prices at the pumps.

Last week's oil price rises will feed through to the forecourts in the coming weeks. With taxes on fuel much lower in the US than in Britain, rises in oil prices have a proportionately greater impact on gasoline prices there than here, where tax makes up 85 percent of the price.

Some estimates put the amount Americans are spending on gasoline at US$10 billion a month more than they were a year ago. That is money unavailable for other spending and Americans are feeling the pinch.

Concern about the strength of the recovery is likely to keep share prices under pressure on Wall Street. The prices of gas and shares, along with jobs, are the sort of things Americans notice and care about and the flow of news has been almost universally negative.

True, other measures of employment have been stronger than the payrolls numbers but it is the payrolls that grab the headlines. Greenspan, after all, has told us that it is the payrolls numbers that matter.

All of this makes Bush sound almost like the hapless victim of unfavorable economic circumstances but the idea that he is an innocent bystander, so to speak, is a long way from the truth.

Apart from the fact that the fighting in Iraq is a key element in keeping oil prices high, there are two other, related factors for which Bush is responsible and which, if he loses to Kerry, will go down as key reasons for the defeat. Those are his tax cuts and the explosion of the government deficit.

Bush's tax cuts have been staggering in their scope and audacity. A report this month showed that Bush's US$270 billion tax cut last year, which the Republicans said would boost growth and jobs, had overwhelmingly gone to the rich, as sceptics such as Harvard economist Paul Krugman have long argued.

The non-partisan Congressional Budget Office said one-third of the tax cuts had gone to the richest 1 percent of Americans, who earn an average of $1.2 million a year. The average tax cut for them totaled US$78,500.

By contrast, those in the middle income bracket got a tax cut of US$1,000, and the poorest one-fifth were doled out the majestic sum of US$250 for the whole year. Some tax cut.

The problem for the economy is that rich people don't spend tax cuts as a rule. Poor people do, as any economist could have told Bush, had he been inclined to listen, which is doubtful.

As a result of the tax cuts, Bush has managed to turn a budget surplus of about US$100 billion three years ago into a deficit of more than US$400 billion this year. That is some swing. Bush likes to say the deficit is due to the increased cost of his war on terror. But a glance at the figures shows the tax cuts are to blame.

Both candidates for the presidency have said they will tackle the deficit, although Bush wants to make his tax cuts permanent, meaning a total giveaway of up to US$2 trillion over the next decade.

He would like to cut spending on things such as social security to close the gap. So the poor would end up paying for the tax cut to the rich.

Kerry would reduce the tax cuts for households earning over US$200,000 a year, making the rich give back the money heaped on them by Bush. His campaign says this would raise nearly US$1 trillion over the next decade and finance a new healthcare system.

So, given the state of the economy and the fact that only the rich have really benefited from the Bush tax cuts, the really puzzling thing about all of this is why Bush is still neck-and-neck with Kerry in the opinion polls. Maybe, after all, it isn't the economy, stupid.

The saga of Sarah Dzafce, the disgraced former Miss Finland, is far more significant than a mere beauty pageant controversy. It serves as a potent and painful contemporary lesson in global cultural ethics and the absolute necessity of racial respect. Her public career was instantly pulverized not by a lapse in judgement, but by a deliberate act of racial hostility, the flames of which swiftly encircled the globe. The offensive action was simple, yet profoundly provocative: a 15-second video in which Dzafce performed the infamous “slanted eyes” gesture — a crude, historically loaded caricature of East Asian features used in Western

Is a new foreign partner for Taiwan emerging in the Middle East? Last week, Taiwanese media reported that Deputy Minister of Foreign Affairs Francois Wu (吳志中) secretly visited Israel, a country with whom Taiwan has long shared unofficial relations but which has approached those relations cautiously. In the wake of China’s implicit but clear support for Hamas and Iran in the wake of the October 2023 assault on Israel, Jerusalem’s calculus may be changing. Both small countries facing literal existential threats, Israel and Taiwan have much to gain from closer ties. In his recent op-ed for the Washington Post, President William

A stabbing attack inside and near two busy Taipei MRT stations on Friday evening shocked the nation and made headlines in many foreign and local news media, as such indiscriminate attacks are rare in Taiwan. Four people died, including the 27-year-old suspect, and 11 people sustained injuries. At Taipei Main Station, the suspect threw smoke grenades near two exits and fatally stabbed one person who tried to stop him. He later made his way to Eslite Spectrum Nanxi department store near Zhongshan MRT Station, where he threw more smoke grenades and fatally stabbed a person on a scooter by the roadside.

Taiwan-India relations appear to have been put on the back burner this year, including on Taiwan’s side. Geopolitical pressures have compelled both countries to recalibrate their priorities, even as their core security challenges remain unchanged. However, what is striking is the visible decline in the attention India once received from Taiwan. The absence of the annual Diwali celebrations for the Indian community and the lack of a commemoration marking the 30-year anniversary of the representative offices, the India Taipei Association and the Taipei Economic and Cultural Center, speak volumes and raise serious questions about whether Taiwan still has a coherent India