Caribbean and Atlantic offshore finance centers are hitting back against attempts to portray them as shady tax havens and say world leaders are making them scapegoats for the global downturn.

Leaders of the G20 economic powers, meeting on Friday in Pittsburgh, Pennsylvania, on global economic issues, launched a campaign in April to name and shame tax havens and penalize those who failed to tighten tax standards and transparency.

Spurred by public outrage over big bonus-earning bankers and high-profile frauds by wealthy financiers, G20 governments have pointed accusing fingers at tax havens across the globe, many of them on tiny, beach-rimmed islands in the Caribbean.

As US investigators probe Swiss bank accounts held by suspected US tax cheats, leading offshore jurisdictions say they resent being cast as hide-outs for tax evaders and crooks.

“It’s not fair,” said McKeeva Bush, political leader and Minister of Financial Services of the Cayman Islands, the tiny British overseas territory south of Cuba that is one of the world’s biggest domiciles of hedge funds.

He and other policymakers and business chiefs from prominent Caribbean and Atlantic offshore centers say the anti-tax haven “finger pointing” by the world’s richest and most powerful governments is hypocritical and seeks to shift blame away from their own failed policies and lax regulation.

“It’s the fault of the onshore centers who taxed their own people ... money is running away from them now,” Bush said.

“Cayman had nothing to do with the investing in sub-prime derivatives, US housing bubble or gross over-leveraging of the main banks ... It’s a nice diversion to blame the evil guys in the Caribbean instead of laying blame where it belongs,” Grand Cayman real estate developer Michael Ryan said.

“There is a lot of finger pointing at the offshore world,” said Cheryl Packwood, chief executive officer of the Bermuda International Business Association.

Bermuda, a tiny Atlantic island that is also a British territory, is a center for the global insurance industry.

But in the US alone, offshore tax havens are estimated to deprive the Treasury of US$100 billion a year. Official efforts to track down tax dodgers have gained pace as the US government seeks to collect more revenues without raising tax rates to offset its vast and growing budget deficit.

After G20 leaders this year declared a crackdown against tax havens, the Organization for Economic Cooperation and Development (OECD) in April published a “gray list” of jurisdictions they said fell short of full compliance with internationally agreed tax standards. More than a dozen Caribbean jurisdictions and Bermuda were on the list.

But while Caribbean and Atlantic offshore financial centers reject what they see as a one-sided witch hunt against them, their governments have nevertheless scrambled to get themselves dropped from the damning OECD noncompliance list.

The Caymans and the British Virgin islands achieved this in July after signing at least 12 bilateral tax agreements in line with OECD standards. Bermuda has also moved up to the “white list,” and other Caribbean states are signing tax treaties.

Anthony Travers, chairman of the Cayman Islands Financial Services Association, sees an attempt by the G20 nations to impose what he calls a “new world order predicated on a global one-size-fits-all higher rate of taxation.”

Bermuda’s finance minister, Paula Cox, also suspects the world’s richest states may be seeking “extra-territorial solutions to their economic, fiscal and financial challenges.”

“There is now a strong suspicion that the G20 has an undisclosed agenda item to drive forward a global corporate tax policy, which may fly in the face of a nation’s sovereign right to set down its own tax policy,” she said.

Timothy Ridley, former chairman of the Cayman Islands Monetary Authority, believes the crackdown on tax havens stems largely from fear of competition by “those ... who wish to retain control of the world’s capital and to tax it.”

Some experts in the Bahamas suggested the offshore sector should ensure its future by shifting away from clients in the US, Europe and Canada to new wealthy customers in emerging powers like Brazil, China, Nigeria, Russia and India.

“If you can provide new services to these markets, you will swim, not sink,” said Julian Malins, a London-based barrister who has acted as counsel for cases originating in the Bahamas.

While insisting they have put their finance sectors in order from the regulatory viewpoint, political and business leaders of these offshore jurisdictions admit their territories have not escaped the battering of the global financial crisis.

“Fewer tourists, lower tourist and consumer spending, the squeeze on business profits, redundancies and lay-offs are all the result of the global recession,” Bermuda’s Cox said.

This has led to some companies leaving the Atlantic island insurance center. This week, directors of global insurance broker Willis Group Holdings approved moving its domicile from Bermuda to Ireland, citing economic factors.

But both Bermudian and Caymans business leaders felt their finance centers could weather the economic storm and prosper.

“Money is going to find the right place to be,” said Caymans Leader of Government Business Bush, who is embroiled in a dispute with the UK over the islands’ financial management.

ENDEAVOR MANTA: The ship is programmed to automatically return to its designated home port and would self-destruct if seized by another party The Endeavor Manta, Taiwan’s first military-specification uncrewed surface vehicle (USV) tailor-made to operate in the Taiwan Strait in a bid to bolster the nation’s asymmetric combat capabilities made its first appearance at Kaohsiung’s Singda Harbor yesterday. Taking inspiration from Ukraine’s navy, which is using USVs to force Russia’s Black Sea fleet to take shelter within its own ports, CSBC Taiwan (台灣國際造船) established a research and development unit on USVs last year, CSBC chairman Huang Cheng-hung (黃正弘) said. With the exception of the satellite guidance system and the outboard motors — which were purchased from foreign companies that were not affiliated with Chinese-funded

PERMIT REVOKED: The influencer at a news conference said the National Immigration Agency was infringing on human rights and persecuting Chinese spouses Chinese influencer “Yaya in Taiwan” (亞亞在台灣) yesterday evening voluntarily left Taiwan, despite saying yesterday morning that she had “no intention” of leaving after her residence permit was revoked over her comments on Taiwan being “unified” with China by military force. The Ministry of the Interior yesterday had said that it could forcibly deport the influencer at midnight, but was considering taking a more flexible approach and beginning procedures this morning. The influencer, whose given name is Liu Zhenya (劉振亞), departed on a 8:45pm flight from Taipei International Airport (Songshan airport) to Fuzhou, China. Liu held a news conference at the airport at 7pm,

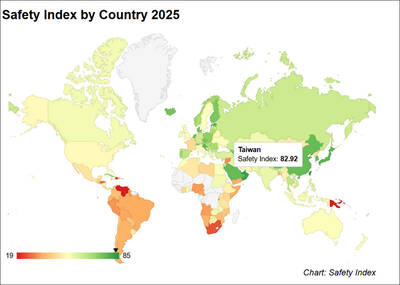

Taiwan was ranked the fourth-safest country in the world with a score of 82.9, trailing only Andorra, the United Arab Emirates and Qatar in Numbeo’s Safety Index by Country report. Taiwan’s score improved by 0.1 points compared with last year’s mid-year report, which had Taiwan fourth with a score of 82.8. However, both scores were lower than in last year’s first review, when Taiwan scored 83.3, and are a long way from when Taiwan was named the second-safest country in the world in 2021, scoring 84.8. Taiwan ranked higher than Singapore in ninth with a score of 77.4 and Japan in 10th with

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —