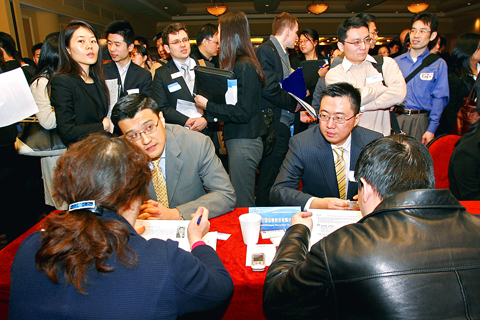

Mary Yu pitches hard to the recruiter sitting in front of her.

“I’ve got experience in risk management,” she says, naming the bank where she works and watching anxiously as the recruiter scribbles on her resume.

Yu, 43, breathes a sigh of relief when the recruiter places her resume in the review pile — she might be called back for another round of interviews.

PHOTO: NY TIMES NEWS SERVICE

Yu was just one of hundreds of jobseekers who attended a recruiting event in the ballroom of the Sheraton LaGuardia East Hotel in Flushing, Queens, where some of China’s largest financial institutions have traveled to recruit talent from abroad. The recruiters are picking from the ranks of financial sector employees who fear what the future might bring.

“I flew all the way from Charlotte [North Carolina], for this event. I’m trying to create a safety net for myself,” Yu said.

The New York event was the last of three stops made by the visiting Chinese delegation, which was made up of recruiters and representatives from more than 27 Chinese financial firms. The delegation, which held events in London and Chicago as part of its global recruiting tour, hoped to fill 170 positions by the end of its trip.

With jobs quickly disappearing from Wall Street and the boom in global finance over for the near future, China still offers opportunity, even as its own economy slows. Worldwide, thousands of financial service jobs have been erased because of the credit crisis, with London and New York suffering large losses.

Now, in a reverse miniature brain drain, Chinese financial institutions are taking advantage of the downturn and focusing on the newly unemployed to diversify and upgrade their own staffs.

“We’re looking very hard right now for experienced, senior-level talent who have knowledge of China. For our junior-level positions, we continue to recruit from our local Chinese talent pool,” said Chen Hong (陳宏), the chief executive of the Hina Group (漢能集團), a boutique global investment bank. The company specializes in cross-border mergers and acquisition advisory and has offices in Beijing and San Francisco.

In another reversal of fortune, China, because of its closed financial sector — which Washington and the West have been insisting China open — has been largely shielded from the toxic mortgage-backed securities that brought down many of the world’s banks. Capital flows in and out of China are tightly controlled and China’s capital markets are closed to foreign companies.

But China’s insular financial system has also kept it underdeveloped. Although employees of large Chinese financial institutions usually graduate from top Chinese universities, they lack practical market experience.

That lack of experience has sometimes led to poor decisions, and in some cases outright blunders. For example, the Citic Pacific Group of China (中信泰富) recently said its realized and potential losses from an attempt to hedge currency risk associated with a large purchase of Australian dollars (needed to buy iron for its steel mills in China) topped US$2.4 billion. The China Investment Corp (中國投資集團), the country’s sovereign wealth fund, which controls US$200 billion in assets, has lost money on almost all of its investments, including a loss of US$2.46 billion, or 82 percent, of the US$3 billion it invested in the Blackstone Group.

Perhaps it is not surprising then that the majority of the 27 financial institutions represented at the recruiting event, including Citic, the Bank of Shanghai (上海銀行), the Pudong Development Bank (浦東發展銀行) and the Shanghai Stock Exchange, all advertised for senior risk managers with three years to 10 years of experience with international companies in comparable positions.

More than 250 people pre-registered for the Queens event and more than 850 packed the ballroom. A long line spilled down the hallway, forcing staff members to limit interviews to three minutes. The applicants were a diverse array of nationalities.

“Institutions here are looking for people to fill senior positions overseeing risk management, compliance and derivatives. Most importantly, they’re looking for people with a global view,” said Qin Wang, 32, a banker and a member of the Chinese Finance Association, which helped organize the New York event.

In addition to formal recruiting events, many financial sector workers have sought jobs in China on their own, working through friends and informal social networks.

Tom Leggett, 30, left his investment banking job at Lazard in New York in July, ahead of expected layoffs, and moved to Beijing to search for opportunities.

“I talked things over with my parents and friends and decided to come to Beijing to canvas the scene,” he said. “I’ve been talking to both recruiters and friends in my network.”

Despite the swelling number of unemployed financial service employees, those qualified to work for Chinese firms is extremely small. Leggett’s background in Chinese — he studied Mandarin for four years as an undergraduate student at Columbia — made his move feasible. He has shocked many recruiters with his Chinese ability: “They see a tall, white guy and they’ve got low expectations. When they find out I can say a lot more than ‘hello,’ in Chinese, they begin to take me seriously.”

While most Chinese employees of financial institutions can speak English, Chinese is still a must for many recruiters.

“We’re looking for bilingual candidates because we are constantly negotiating with local Chinese companies, and those meetings are all in Chinese,” Hong said.

Despite the opportunities China can present, many candidates decide, in the end, not to move — hence the Chinese companies’ global search.

Robert Eng, 53, who used to work in the global investment division of Citigroup in New York, traveled to Hong Kong to interview for the director of private wealth position at a large Chinese financial institution. He received an offer, but turned it down, choosing to remain in the US.

“The compensation package was great, but at this point in my life it doesn’t make sense for me; my family is here. Maybe if I were 20 years younger,” Eng said.

For many ambitious overseas candidates, a matter of worry is that they are all but guaranteed to hit a glass ceiling at state-run Chinese companies. Senior management is appointed by the personnel department of the Chinese Communist Party — regardless of the votes or recommendations of shareholders or board directors.

And for many foreigners, the decision to move to China involves accepting a drastic change in lifestyle.

Brian Connors, 35, is the owner of the Bridge cafe, a popular Italian-style restaurant and cafe in the northwest of Beijing that caters to foreigners studying Mandarin and Chinese looking to practice their English.

“I’ve seen expatriates come and go — it’s a cyclical thing here. One of the major setbacks that causes foreigners to leave is health: pollution and congestion are hard on your body and lifestyle,” he said.

ENDEAVOR MANTA: The ship is programmed to automatically return to its designated home port and would self-destruct if seized by another party The Endeavor Manta, Taiwan’s first military-specification uncrewed surface vehicle (USV) tailor-made to operate in the Taiwan Strait in a bid to bolster the nation’s asymmetric combat capabilities made its first appearance at Kaohsiung’s Singda Harbor yesterday. Taking inspiration from Ukraine’s navy, which is using USVs to force Russia’s Black Sea fleet to take shelter within its own ports, CSBC Taiwan (台灣國際造船) established a research and development unit on USVs last year, CSBC chairman Huang Cheng-hung (黃正弘) said. With the exception of the satellite guidance system and the outboard motors — which were purchased from foreign companies that were not affiliated with Chinese-funded

PERMIT REVOKED: The influencer at a news conference said the National Immigration Agency was infringing on human rights and persecuting Chinese spouses Chinese influencer “Yaya in Taiwan” (亞亞在台灣) yesterday evening voluntarily left Taiwan, despite saying yesterday morning that she had “no intention” of leaving after her residence permit was revoked over her comments on Taiwan being “unified” with China by military force. The Ministry of the Interior yesterday had said that it could forcibly deport the influencer at midnight, but was considering taking a more flexible approach and beginning procedures this morning. The influencer, whose given name is Liu Zhenya (劉振亞), departed on a 8:45pm flight from Taipei International Airport (Songshan airport) to Fuzhou, China. Liu held a news conference at the airport at 7pm,

Authorities yesterday elaborated on the rules governing Employment Gold Cards after a US cardholder was barred from entering Taiwan for six years after working without a permit during a 2023 visit. American YouTuber LeLe Farley was barred after already being approved for an Employment Gold Card, he said in a video published on his channel on Saturday. Farley, who has more than 420,000 subscribers on his YouTube channel, was approved for his Gold Card last month, but was told at a check-in counter at the Los Angeles International Airport that he could not enter Taiwan. That was because he previously participated in two

SECURITY RISK: If there is a conflict between China and Taiwan, ‘there would likely be significant consequences to global economic and security interests,’ it said China remains the top military and cyber threat to the US and continues to make progress on capabilities to seize Taiwan, a report by US intelligence agencies said on Tuesday. The report provides an overview of the “collective insights” of top US intelligence agencies about the security threats to the US posed by foreign nations and criminal organizations. In its Annual Threat Assessment, the agencies divided threats facing the US into two broad categories, “nonstate transnational criminals and terrorists” and “major state actors,” with China, Russia, Iran and North Korea named. Of those countries, “China presents the most comprehensive and robust military threat