In corporate Japan, companies have long preferred to run with the pack. But some are now learning to act like lone wolves.

Take Sharp, which for decades looked like other big Japanese electronics makers, producing every device under the sun from rice cookers to semiconductors. But when the company faced collapse eight years ago, its newly installed president, Katsuhiko Machida, jettisoned unprofitable products and bet Sharp's future on a single, then-unproven new product: flat-panel TVs using a screen technology called liquid-crystal display (LCD).

The gamble paid off. Sharp now reaps record profits as a leader in the booming global market for LCD TVs.

PHOTO: NY TIMES

"Survival today means innovating and doing things that no one else does," Machida said. "This is a lesson not only for Sharp but for all of Japan."

It is a lesson that the business world here has apparently taken to heart, as a wave of corporate revamping and innovation breathes new life into Japan's long-moribund economy.

And as these lone wolves multiply, they may help Japan play a stronger role in global growth as the second-largest economy in the world.

Companies from supermarket chains to camera makers are moving away from traditional conformity. They have gotten more aggressive about containing costs after a decade of stagnant economic growth that they spent closing factories, shrinking payrolls and writing off debt.

More companies are also acting like Sharp, trying to set themselves apart from rivals with unique products and services.

The changes are rewriting the rules of Japan's business culture, where for decades after World War II companies marched in lock step to advance the nation's economy. That collectivist system broke down when Japan's economy stalled and even contracted in the 1990s after the collapse of twin bubbles in the real estate and stock markets.

"It's a new era for Japanese business," said John Beck, president of the business consulting company North Star Leadership and co-author of Japan's Business Renaissance.

Entrepreneurial

"Japan has become much more entrepreneurial and innovative. Companies are taking new risks, going into new areas, making new products," Beck said.

At Sharp, Machida said he had learned to take risks because the company had no choice.

Sharp had thrived during the postwar years with products like hand-held calculators. But when Machida took the helm in 1998, weak domestic sales and cheaper Asian competition had plunged the 94-year-old company into its worst crisis since an earthquake flattened its original factory in 1923.

As profit plummeted, Machida decided to shrink or halt production of semiconductors, computer monitors and cathode-ray tube TVs, which were major product lines where Sharp could no longer compete on price.

Machida said he decided that the only way to beat cheaper manufacturers was to stay ahead technologically. He said he chose flat-panel TVs to take advantage of LCD technology that Sharp had originally developed in the 1970s for calculator screens.

"The old way of doing things was just spreading us too thin," Machida said in an interview at Sharp's headquarters in Osaka.

While Sharp does not break out earnings by product, it said LCD TVs will account for a hefty chunk of the record profit of ¥87 billion (US$737 million) it expects in the current fiscal year, ending March 31. That is up from a profit of ¥4.6 billion in 1998, when Machida took over.

Sharp's profit margin is also higher at 5.5 percent, up from 1.5 percent over the same time period.

Demand is so strong for the TVs that the company is investing ¥350 billion to expand annual production capacity to about 20 million in two years, up from about 5 million sets now. It is also stepping up hiring, with plans to add 615 new employees next year, double the number it hired in 2003.

Economists say turnaround stories like Sharp's are fueling the current revival in Japan's US$4.6 trillion economy -- the second-largest after the US.

As companies hire more employees and build new factories, the recovery has found a firm footing in domestic consumption, unlike previous, short-lived upturns here that relied on exports.

Economic recovery

Many economists now predict that Japan will expand as much as 3.6 percent this year, rivaling and perhaps even surpassing growth in the US.

To be sure, some specialists say Japan has not changed enough. They point out that levels of productivity and earning power still tend to lag behind those in the US. The problem, they say, is that fundamental change is limited to a small numbers of companies, while most remain too timid to leave the pack.

"I don't see enough differentiating," said William Swinton, an assistant dean in the business school at the Tokyo campus of Temple University. "Some companies are using more focused strategies, but many still have a long way to go."

Still, the majority agree that change has reached even the cobweb-filled corners of Japan's domestic economy.

Aeon, Japan's largest supermarket operator, has shaken up the country's retailing industry by erecting sprawling, Wal-Mart-style supercenters even more aggressively than Wal-Mart's own local subsidiary, Seiyu. Customers are flocking to its low-cost stores, helping Aeon forecast record profit for this year.

Orix, an auto and aircraft leasing company, has gotten even more creative, seeking to turn itself into a global investment bank with acquisitions like the US$500 million purchase in October of Houlihan Lokey Howard & Zukin, the Los Angeles-based mergers and acquisition advisory firm.

Winners and losers

But nowhere are the changes in corporate behavior more apparent than in Japan's electronics industry, where companies compete in what the Japanese business press has dubbed a new "era of winners and losers." The former include Canon, the camera maker; Matsushita Electric, maker of Panasonic; and Sharp, all thriving.

Meanwhile, other well-known companies like Sanyo Electric, Pioneer and Sony have floundered.

"Everything changes much faster now than 10 years ago," said Kesanobu Yamagishi, a spokesman at Pioneer.

But this new era of competition also bears some distinctly Japanese flourishes. One is the relatively small number of layoffs, which companies still shun here for fear of ruining morale. Machida, for one, is proud of the fact Sharp did not release any of its 49,000 employees during its turnaround, instead cutting costs by dropping product lines.

He spent his first year as president making almost daily trips to Sharp offices and factory floors around Japan, exhorting employees to work extra hard to make his plan a success.

"If we don't do this, Sharp has no future," Machida repeatedly said, according to employees.

Many listened sullenly, unwilling to contradict their boss in public.

Tough sell

Machida faced a particularly tough sell at Sharp's computer-panel division, whose products he was scrapping. In town-hall-style meetings with 50 to 100 employees at a time, he said South Korean and Taiwanese manufacturers could make the same panels, and he challenged his engineers to raise the quality of LCD screens high enough to work for TVs. He set technical goals, such as tripling the contrast ratio, a way of measuring picture sharpness, within three years.

Employees said they were skeptical at first that LCDs could work, particularly for large TVs. But support quickly grew as they reached targets ahead of schedule.

Sharp gained an early lead in LCD TVs that it still strives to maintain. In October, it will open the first factory in the world to use so-called eighth-generation LCD production technology, which increases production by using glass panels as large as a king-size bed but only as thick as a postcard. Sharp now competes in the global LCD market with companies more than 10 times its size, like Sony and Samsung Electronics.

"We are constantly telling employees to push ahead," said Shigeaki Mizushima, head of Sharp's LCD division. "We can't stand still for a moment."

SECURITY: The purpose for giving Hong Kong and Macau residents more lenient paths to permanent residency no longer applies due to China’s policies, a source said The government is considering removing an optional path to citizenship for residents from Hong Kong and Macau, and lengthening the terms for permanent residence eligibility, a source said yesterday. In a bid to prevent the Chinese Communist Party (CCP) from infiltrating Taiwan through immigration from Hong Kong and Macau, the government could amend immigration laws for residents of the territories who currently receive preferential treatment, an official familiar with the matter speaking on condition of anonymity said. The move was part of “national security-related legislative reform,” they added. Under the amendments, arrivals from the Chinese territories would have to reside in Taiwan for

CRITICAL MOVE: TSMC’s plan to invest another US$100 billion in US chipmaking would boost Taiwan’s competitive edge in the global market, the premier said The government would ensure that the most advanced chipmaking technology stays in Taiwan while assisting Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in investing overseas, the Presidential Office said yesterday. The statement follows a joint announcement by the world’s largest contract chipmaker and US President Donald Trump on Monday that TSMC would invest an additional US$100 billion over the next four years to expand its semiconductor manufacturing operations in the US, which would include construction of three new chip fabrication plants, two advanced packaging facilities, and a research and development center. The government knew about the deal in advance and would assist, Presidential

‘DANGEROUS GAME’: Legislative Yuan budget cuts have already become a point of discussion for Democrats and Republicans in Washington, Elbridge Colby said Taiwan’s fall to China “would be a disaster for American interests” and Taipei must raise defense spending to deter Beijing, US President Donald Trump’s pick to lead Pentagon policy, Elbridge Colby, said on Tuesday during his US Senate confirmation hearing. The nominee for US undersecretary of defense for policy told the Armed Services Committee that Washington needs to motivate Taiwan to avoid a conflict with China and that he is “profoundly disturbed” about its perceived reluctance to raise defense spending closer to 10 percent of GDP. Colby, a China hawk who also served in the Pentagon in Trump’s first team,

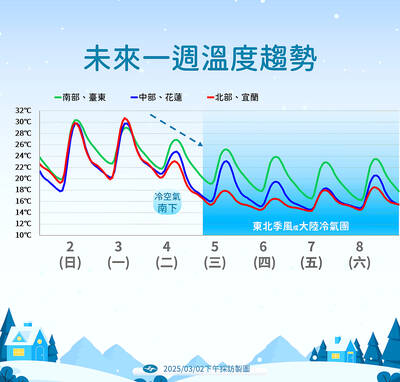

The arrival of a cold front tomorrow could plunge temperatures into the mid-teens, the Central Weather Administration (CWA) said. Temperatures yesterday rose to 28°C to 30°C in northern and eastern Taiwan, and 32°C to 33°C in central and southern Taiwan, CWA data showed. Similar but mostly cloudy weather is expected today, the CWA said. However, the arrival of a cold air mass tomorrow would cause a rapid drop in temperatures to 15°C cooler than the previous day’s highs. The cold front, which is expected to last through the weekend, would bring steady rainfall tomorrow, along with multiple waves of showers