European shares on Friday ended the week down roughly US$1.5 trillion in their worst weekly performance since the 2008 financial crisis as the rapid spread of COVID-19 outside of China saw sustained selling on fears of a recession.

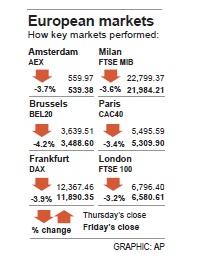

The pan-European STOXX 600 on Friday dropped 15.22 points, or 3.9 percent, to 374.24, plunging 12.6 percent from a close of 428.07 on Feb. 21 and 13.2 percent from a record high on Feb. 19.

“The move today and the week-over-week move is driven by systematic, self-enforcing flows. We have seen a significant amount of position reduction [this week],” Union Asset Management Holding AG head of investment strategy Philipp Brugger said.

All European subsectors were well in the red, with chemicals, insurance and telecom leading losses for the day, shedding more than 4 percent each.

Germany’s BASF SE was among the biggest percentage losers in the chemical subindex after it warned that earnings could drop further this year.

Travel and leisure stocks underperformed their peers by a wide margin over the week, dropping about 18 percent.

Airlines were the worst hit, with the situation intensified after British Airways owner International Consolidated Airlines Group SA said that its earnings would take a hit this year as passenger numbers tumbled.

The stock fell 8.4 percent on the day, with Easyjet PLC, Societe Air France SA and Deutsche Lufthansa AG dropping between 0.9 percent and 6.4 percent.

Milan, Italy-listed shares fell 3.6 percent. The number of people infected in Italy, Europe’s worst-hit country, surpassed 850 on Friday.

As the number of cases in Germany rose to 60, the DAX on Friday dropped 477.11 points, or 3.9 percent, to 11,890.35, plummeting 12.4 percent from 13,579.33 a week earlier.

Insurer Munich Re Group was among the worst performers for the day after its fourth-quarter profit dropped.

French publisher Lagardere SCA bottomed out the STOXX 600 after reporting lower revenue for last year. The firm also appointed former French president Nicolas Sarkozy to its advisory board.

Engine maker Rolls-Royce Holdings PLC was among the few gainers, ending up 3.2 percent after saying that it was well-placed to deal with disruptions caused by the epidemic.

While investors have ramped up expectations for a eurozone rate cut as soon as June in response to the virus, two European Central Bank (ECB) policymakers on Friday said that the bank does not need to take immediate action in response to the epidemic.

“The ECB situation has the additional challenge that they do not have so much powder left, and in general the threshold for them to move on an interest rate side is really high,” Brugger said.

The WHO warned that the virus had pandemic potential and ratings agency Moody’s Investors Service said that it would trigger a global recession in the first half of this year.

Additional reporting by staff writer

Hon Hai Precision Industry Co (鴻海精密) yesterday said that its research institute has launched its first advanced artificial intelligence (AI) large language model (LLM) using traditional Chinese, with technology assistance from Nvidia Corp. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), said the LLM, FoxBrain, is expected to improve its data analysis capabilities for smart manufacturing, and electric vehicle and smart city development. An LLM is a type of AI trained on vast amounts of text data and uses deep learning techniques, particularly neural networks, to process and generate language. They are essential for building and improving AI-powered servers. Nvidia provided assistance

GREAT SUCCESS: Republican Senator Todd Young expressed surprise at Trump’s comments and said he expects the administration to keep the program running US lawmakers who helped secure billions of dollars in subsidies for domestic semiconductor manufacturing rejected US President Donald Trump’s call to revoke the 2022 CHIPS and Science Act, signaling that any repeal effort in the US Congress would fall short. US Senate Minority Leader Chuck Schumer, who negotiated the law, on Wednesday said that Trump’s demand would fail, while a top Republican proponent, US Senator Todd Young, expressed surprise at the president’s comments and said he expects the administration to keep the program running. The CHIPS Act is “essential for America leading the world in tech, leading the world in AI [artificial

DOMESTIC SUPPLY: The probe comes as Donald Trump has called for the repeal of the US$52.7 billion CHIPS and Science Act, which the US Congress passed in 2022 The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment. The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1. Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than

Gasoline and diesel prices this week are to decrease NT$0.5 and NT$1 per liter respectively as international crude prices continued to fall last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. Effective today, gasoline prices at CPC and Formosa stations are to decrease to NT$29.2, NT$30.7 and NT$32.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, the companies said in separate statements. Global crude oil prices dropped last week after the eight OPEC+ members said they would