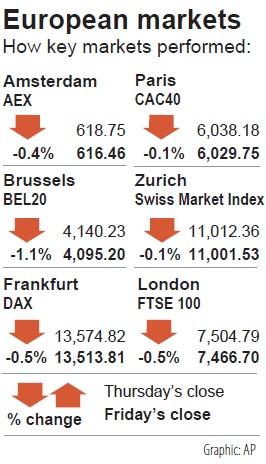

European shares slipped from all-time highs on Friday, as investor sentiment was dulled by underwhelming corporate earnings reports and the rising death toll from the 2019 novel coronavirus outbreak.

The pan-European STOXX 600 fell 0.2 percent, snapping a four-day winning streak, as the number of deaths from the outbreak climbed to 636 and several more companies suspended operations in China.

“We are probably going to see companies caution that sales have been hit as people are not going out to shops to buy and that is going to ripple through,” CMC Markets market analyst David Madden said.

British fashion brand Burberry Group PLC fell 1.8 percent after flagging a slide in demand from China and Hong Kong due to the outbreak.

China-exposed sectors, such as basic materials, luxury and auto stocks, which have seesawed over the past two weeks on virus fears, were the biggest decliners on the day.

Sentiment this week had so far been buoyed by a spate of strong earnings updates and China’s attempts to limit the economic fallout of the outbreak, helping the main index recover from a 3 percent slump last week.

Despite Friday’s declines, the STOXX 600 posted its best week since December 2016 with a 3.3 percent increase.

Swiss lender Credit Suisse Group AG slumped 3.6 percent on Friday after its chief executive officer Tidjane Thiam stepped down following a spying scandal.

Miner Norsk Hydro ASA tumbled 10 percent after missing quarterly profit estimates, while Belgian materials and recycling group Umicore SA fell after an RBC downgrade to “hold.”

Economic data from the bloc this week had raised hopes that a slowdown might be bottoming out, but latest numbers showed German industrial output registered its biggest drop in more than a decade in December last year.

“The data has raised the risk that next week’s GDP data could bring back the R-word for the German economy,” said Carsten Brzeski, Germany chief economist at ING, referring to fears of a looming recession.

Cosmetics maker L’Oreal SA and fertilizer maker Yara International ASA rose 6.7 percent and 4.9 percent respectively after posting better-than-expected quarterly profits.

Technology firm Ericsson AB topped the pan-regional index after majority owner Cevian Capital said a US interest in buying a stake would be positive, following comments from the US Attorney General on Thursday that the country should consider taking a “controlling stake” in the company.

Hon Hai Precision Industry Co (鴻海精密) yesterday said that its research institute has launched its first advanced artificial intelligence (AI) large language model (LLM) using traditional Chinese, with technology assistance from Nvidia Corp. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), said the LLM, FoxBrain, is expected to improve its data analysis capabilities for smart manufacturing, and electric vehicle and smart city development. An LLM is a type of AI trained on vast amounts of text data and uses deep learning techniques, particularly neural networks, to process and generate language. They are essential for building and improving AI-powered servers. Nvidia provided assistance

GREAT SUCCESS: Republican Senator Todd Young expressed surprise at Trump’s comments and said he expects the administration to keep the program running US lawmakers who helped secure billions of dollars in subsidies for domestic semiconductor manufacturing rejected US President Donald Trump’s call to revoke the 2022 CHIPS and Science Act, signaling that any repeal effort in the US Congress would fall short. US Senate Minority Leader Chuck Schumer, who negotiated the law, on Wednesday said that Trump’s demand would fail, while a top Republican proponent, US Senator Todd Young, expressed surprise at the president’s comments and said he expects the administration to keep the program running. The CHIPS Act is “essential for America leading the world in tech, leading the world in AI [artificial

DOMESTIC SUPPLY: The probe comes as Donald Trump has called for the repeal of the US$52.7 billion CHIPS and Science Act, which the US Congress passed in 2022 The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment. The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1. Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than

Gasoline and diesel prices this week are to decrease NT$0.5 and NT$1 per liter respectively as international crude prices continued to fall last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. Effective today, gasoline prices at CPC and Formosa stations are to decrease to NT$29.2, NT$30.7 and NT$32.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, the companies said in separate statements. Global crude oil prices dropped last week after the eight OPEC+ members said they would