As China struggles to deal with the slowdown of the world’s second-largest economy, it has embarked on a new strategy of placing financial experts in provinces to manage risks and rebuild regional economies.

Since last year, Chinese President Xi Jinping (習近平) has put 12 former executives at state-run financial institutions or regulators in top posts across the nation’s 31 provinces, regions and municipalities, including some who have grappled with banking and debt difficulties that have raised fears of a financial meltdown.

Only two top provincial officials had such financial background before the last leadership reshuffle in 2012, according to Reuters research.

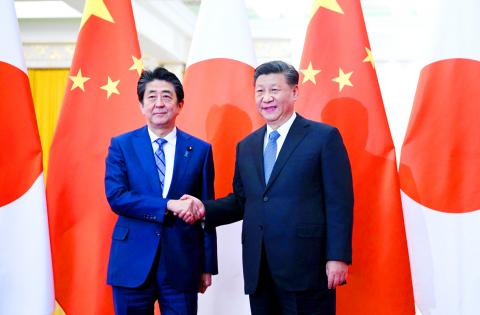

Photo: AFP

Among the experts promoted is Beijing Vice Mayor Yin Yong (應勇) a former deputy central bank governor, and Shandong Deputy Provincial Governor Liu Qiang (劉強), who rose through the nation’s biggest commercial banks, from Agricultural Bank of China (中國農業銀行) to Bank of China (中國銀行).

Another newly promoted official, Chongqing Vice Mayor Li Bo (李波), had until this year led the central bank’s monetary policy department.

The appointments — overseeing economies larger than those of small countries — would appear to put those officials in the fast lane as China prepares a personnel reshuffle in 2022, when about half of the 25 members of the Politburo could be replaced, including Chinese Vice Premier Liu He (劉鶴), who is leading economic reform while doubling as chief negotiator in trade talks with the US.

“Bankers are now in demand, as local governments are increasingly exposed to financial risks,” said Feng Chucheng, a partner at Plenum, an independent research platform in Hong Kong.

“These ex-bankers and regulators are given the task of preventing and mitigating major financial risks,” he said.

The appointments have come as economic growth has slowed to its weakest in nearly three decades, while government infrastructure investment has fallen.

Five regional banks were hit with management or liquidity problem this year, raising the prospect of devastating debt bombs lurking in unexpected corners.

“We need to be well-prepared with contingency plans,” Xinhua news agency said after a major annual economic meeting headed by Xi this month.

The economy faced “increasing downward economic pressure amid intertwined structural, institutional and cyclical problems,” it said.

With pressures mounting, local governments are expecting to take the lead in managing their financial scares and cutting the cost of rescue with local intervention, analysts said.

“Appointing financial vice governors to provinces can help better integrate financial policies into local practice, and to prevent financial risks beforehand,” said He Haifeng (何海峰), director of Institute of Financial Policy at the Chinese Academy of Social Science, a government think tank.

“Such appointments have also showcased a change of manner in official appointments,” He said.

Financial executives were long shunned for leadership positions.

Banks were nationalized after the Chinese Communist Party took power in 1949 and many bankers were purged during the Cultural Revolution.

Xi started to stress the importance of financial expertise and to elevate the status of executives in 2017.

“Political cadres, especially the senior ones, must work hard to learn financial knowledge and be familiar with financial sectors,” Xi said in a national meeting on financial affairs.

Half of the 12 former financial executives elevated to provincial leadership posts under Xi were born after 1970.

Liaoning Vice Governor Zhang Lilin ( 張酈林), 48, a veteran banker who spent two decades in the nation’s third-largest lender, Agricultural Bank of China, was appointed days after three state-controlled financial institutions announced investment in the then-troubled Bank of Jinzhou (錦州銀行).

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced