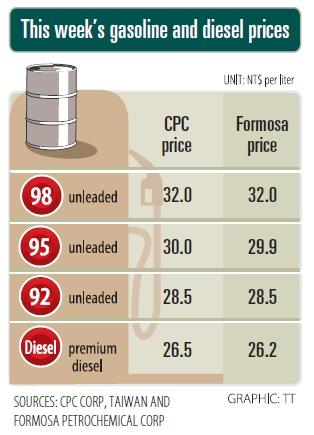

Oil refiner CPC Corp, Taiwan (CPC, 台灣中油) announced that it would today cut gasoline prices by NT$0.4 and diesel prices by NT$0.5 per liter to reflect the continued decline in international crude oil prices last week.

The second straight week of price cuts reflected the still-weak market sentiment, which is due to a supply glut after Libya resumed its crude oil exports and because the US might ease sanctions on Iranian oil exports, CPC said in a statement.

The average cost of its crude oil fell to US$71.1 per barrel last week from NT$74.31 a week earlier, the refiner said.

After taking into account the New Taiwan dollar’s depreciation of NT$0.13 against the US dollar during the week, CPC said it decided to cut wholesale prices for its fuels by 3.13 percent.

Formosa Petrochemical Corp (台塑石化) said it would match CPC’s price cuts, effective today, citing reports that Russia and other oil producers might increase their oil output and the US might release its strategic petroleum reserves, which have added to the already weak market sentiment.

In related news, CPC said that on Friday last week it signed a memorandum of understanding with Vietnam’s Sovico Holdings Co, regarding cooperation in oil exploration, oil product sales and related investments.

Sovico Holdings is a multi-sector holding company with a diversified portfolio, ranging from banking and finance to real estate, aviation, hospitality and industry.

The company has many large subsidiaries, including budget airline Vietjet Air, CPC said.

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his

Taiwan’s official purchasing managers’ index (PMI) last month rose 0.2 percentage points to 54.2, in a second consecutive month of expansion, thanks to front-loading demand intended to avoid potential US tariff hikes, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. While short-term demand appeared robust, uncertainties rose due to US President Donald Trump’s unpredictable trade policy, CIER president Lien Hsien-ming (連賢明) told a news conference in Taipei. Taiwan’s economy this year would be characterized by high-level fluctuations and the volatility would be wilder than most expect, Lien said Demand for electronics, particularly semiconductors, continues to benefit from US technology giants’ effort

ADVERSARIES: The new list includes 11 entities in China and one in Taiwan, which is a local branch of Chinese cloud computing firm Inspur Group The US added dozens of entities to a trade blacklist on Tuesday, the US Department of Commerce said, in part to disrupt Beijing’s artificial intelligence (AI) and advanced computing capabilities. The action affects 80 entities from countries including China, the United Arab Emirates and Iran, with the commerce department citing their “activities contrary to US national security and foreign policy.” Those added to the “entity list” are restricted from obtaining US items and technologies without government authorization. “We will not allow adversaries to exploit American technology to bolster their own militaries and threaten American lives,” US Secretary of Commerce Howard Lutnick said. The entities

Minister of Finance Chuang Tsui-yun (莊翠雲) yesterday told lawmakers that she “would not speculate,” but a “response plan” has been prepared in case Taiwan is targeted by US President Donald Trump’s reciprocal tariffs, which are to be announced on Wednesday next week. The Trump administration, including US Secretary of the Treasury Scott Bessent, has said that much of the proposed reciprocal tariffs would focus on the 15 countries that have the highest trade surpluses with the US. Bessent has referred to those countries as the “dirty 15,” but has not named them. Last year, Taiwan’s US$73.9 billion trade surplus with the US