CPC Corp, Taiwan (CPC, 台灣中油) and Taiwan Power Co (Taipower, 台電) are on March 21 to sign a cooperation agreement to harness geothermal energy at Renze Hot Spring (仁澤溫泉) in Yilan County, the Chinese-language Liberty Times (sister publication of the Taipei Times) reported yesterday, citing sources at the Ministry of Economic Affairs.

Under the cooperation plans, CPC would drill one or two wells near the hot spring to conduct tests, the newspaper said, adding that if the tests are successful, the state-run refiner would hand over the project to Taipower, which would be tasked with generating geothermal power.

Given the large number of hot springs in the county, the potential for geothermal energy in Yilan is huge.

CPC said it selected Renze for the tests after geological evaluation because it has greater potential to develop geothermal energy than other areas in Taiwan.

Moreover, the plots of land on the site in Renze belong to the Forestry Bureau, making the process less costly and time-consuming than if the company were to lease land from private owners, the newspaper said.

CPC has ample experience drilling geothermal wells and in 1981 helped set up a geothermal power plant in the county’s Cingshuei (清水) area, which was shut down in 1993 as its generators became less efficient.

Taipower is interested in developing geothermal energy and is simultaneously engaged in a geothermal development project on Green Island (綠島) this year.

The state-run utility has carried out well tests and is on track to build a small geothermal power station capable of generating 200kW of electricity on the island by next year, the Liberty Times said, adding that Taipower plans to build a larger geothermal power plant there capable of generating 40 megawatts of electricity by 2020.

The Bureau of Energy has said that the government’s target is to install 200 megawatts of geothermal generation capacity by 2025, as part of the Democratic Progressive Party administration’s pledge to establish a “nuclear-free homeland” by that year.

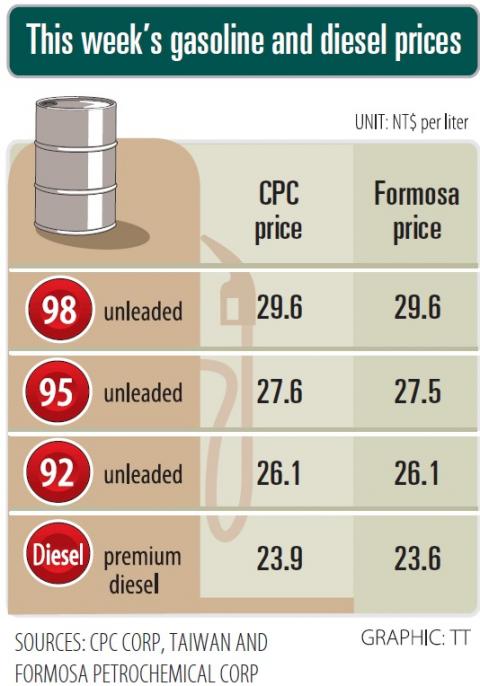

Separately, CPC yesterday announced that it would lower fuel prices this week, as crude oil prices dropped last week after Saudi Arabia lowered its prices for Arab Light sold to Asia and amid a continued increase in US crude oil inventories.

CPC said in a statement that its average crude oil cost fell by US$1.11 per barrel to US$62.41.

That means it is to cut gasoline and diesel prices by NT$0.2 per liter starting today after factoring in the New Taiwan dollar’s depreciation of NT$0.011 against the US dollar, the refiner said.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors